Latest Articles

137 Articles

Learn about DeFi (Decentralized Finance) and its impact on traditional financial systems. Discover the opportunities and challenges it presents.

Learn about DeFi (Decentralized Finance) and its impact on traditional financial systems. Discover the opportunities and challenges it presents.

The project’s team introduces a fundamentally new approach to decentralized trading and liquidity provision, addressing inefficiencies in existing protocols.

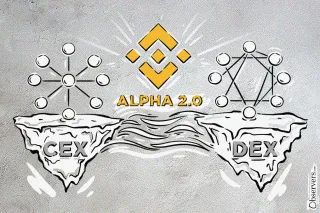

Binance has introduced a new product that brings decentralized exchange (DEX) functionality directly to users of its centralized platform. This move could mark the beginning of a more integrated trading experience across both models.

Superseed is an Ethereum Layer 2 with a built-in CDP lending platform. What sets it apart is that 100% of its on-chain profits are used to repay loans for users who provide its native token as collateral. The big question is: Will this bold bet on tokenomics pay off?

Alexander Mardar

Superseed is an Ethereum Layer 2 with a built-in CDP lending platform. What sets it apart is that 100% of its on-chain profits are used to repay loans for users who provide its native token as collateral. The big question is: Will this bold bet on tokenomics pay off?

Alexander Mardar

The project’s team introduces a fundamentally new approach to decentralized trading and liquidity provision, addressing inefficiencies in existing protocols.

Alexander Mardar

Binance has introduced a new product that brings decentralized exchange (DEX) functionality directly to users of its centralized platform. This move could mark the beginning of a more integrated trading experience across both models.

Alexander Mardar

A DeFi app named 'DeFi App' has quickly gained traction. With its unique technology and user-centric approach, it surpassed $1.8 billion in transaction volume and attracted over 20,000 weekly active users within just seven weeks of launch.

Alexander Mardar

Despite a major security breach in 2023, Euler lending protocol successfully regained users' trust. The project’s TVL grew by over 5x in the first few months of 2025 and shows no signs of slowing down anytime soon.

Alexander Mardar

With a monthly trading volume of around $190 billion, the exchange is the first to offer genuine competition to centralized exchanges in the space.

Alexander Mardar

The token buyback program hopes to strengthen network security and enhance the utility of its native token, DYDX.

Rebecca Denton

Berachain has extended its Proof-of-Liquidity system to include third-party decentralized applications, which can now apply for emissions. At present, all approved vaults are tied to decentralized exchange liquidity pools, though additional use cases are anticipated in the near future.

Rebecca Denton