Latest Articles

7 Articles

Understand Genesis' role in crypto lending and trading, shaping the digital finance landscape with innovative financial products.

Understand Genesis' role in crypto lending and trading, shaping the digital finance landscape with innovative financial products.

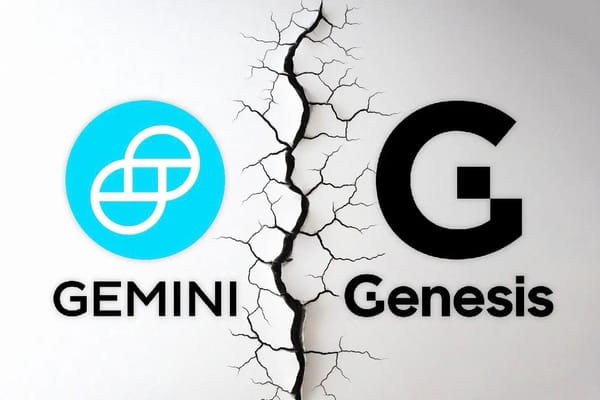

The two companies came to an agreement that should see the almost full repayment of DCG's loans by April 2024.

The now-bankrupt сrypto lender claims that the cryptocurrency exchange withdrew approximately $689,302,000 during the 90-day period prior to the bankruptcy, benefitting at the expense of other creditors.

One Bitcoin for one Bitcoin: Gemini and Genisis are returning digital assets to the users of the failed lending platform in kind.

Eva Senzaj Pauram

One Bitcoin for one Bitcoin: Gemini and Genisis are returning digital assets to the users of the failed lending platform in kind.

Eva Senzaj Pauram

The two companies came to an agreement that should see the almost full repayment of DCG's loans by April 2024.

Sasha Markevich

The now-bankrupt сrypto lender claims that the cryptocurrency exchange withdrew approximately $689,302,000 during the 90-day period prior to the bankruptcy, benefitting at the expense of other creditors.

Sasha Markevich

Digital asset firm Genesis, owned by DCG, has announced that it will cease derivatives and spot trading through GGC International, which means that Genesis no longer offers any trading services at all. This marks yet another straw in the growing pile of troubles for DCG.

Sasha Markevich

The CEO of Bitcoin Magazine has published documents on X (formerly Twitter) suggesting that DCG borrowed approximately $500 million from the now-bankrupt lender, Genesis. Bailey asserts that these funds were used to “manipulate and prop up the price of GBTC.”

Alexander Mardar

Genesis Trading lays off 30% of its workforce in attempt to avoid a bankruptcy filing.

Sasha Markevich

Genesis Global Capital has suffered from the FTX collapse. This can be a bad sign for the whole Digital Currency Group.

Sasha Markevich