Latest Articles

12 Articles

Stay updated on Grayscale's contributions to cryptocurrency investment products, guiding investors in the digital asset space.

Stay updated on Grayscale's contributions to cryptocurrency investment products, guiding investors in the digital asset space.

Grayscale introduces the Bitcoin Mini Trust, aiming to combat investor departures and high fees. This new fund could potentially allow investors to bypass tax penalties while exploring lower-cost ETF alternatives.

Spot Bitcoin ETFs have drawn in more than $1.5 billion within the first month. As the market adjusts and major investors conclude their due diligence, we may expect a fresh surge in capital flowing into these products.

As investor interest in Sui grows, driven by influencers and new investment vehicles, the pressure mounts for it to demonstrate practical utility and user engagement.

Alexander Mardar

As investor interest in Sui grows, driven by influencers and new investment vehicles, the pressure mounts for it to demonstrate practical utility and user engagement.

Alexander Mardar

Grayscale introduces the Bitcoin Mini Trust, aiming to combat investor departures and high fees. This new fund could potentially allow investors to bypass tax penalties while exploring lower-cost ETF alternatives.

Alexander Mardar

Spot Bitcoin ETFs have drawn in more than $1.5 billion within the first month. As the market adjusts and major investors conclude their due diligence, we may expect a fresh surge in capital flowing into these products.

Alexander Mardar

The ETF filings of HashDex and Grayscale have been postponed until next year, although the SEC might now be cornered into approving spot BTC ETFs.

Mathilde Adam

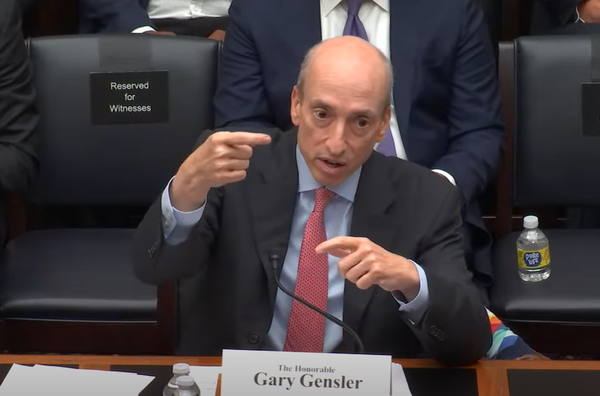

The SEC, headed by Gary Gensler, is poised to potentially approve multiple Bitcoin ETFs, while scrutiny of Gensler's shifting stance on digital asset regulation is growing.

Mathilde Adam

The deadline for the SEC to appeal against the court’s ruling on the Grayscale Bitcoin ETF application passed without event yesterday. Last week its appeal against the preliminary Ripple judgement was denied. Could the regulator finally be accepting defeat in its war on crypto?

Jack Martin

Gary Gensler is under fire from Members of Congress, who have had enough of the SEC’s digital assets enforcement strategy.

Eva Senzaj Pauram

Digital asset firm Genesis, owned by DCG, has announced that it will cease derivatives and spot trading through GGC International, which means that Genesis no longer offers any trading services at all. This marks yet another straw in the growing pile of troubles for DCG.

Sasha Markevich