Latest Articles

8 Articles

Decentralized lending and borrowing redefine financial services, offering users access to loans and credit without traditional intermediaries, through blockchain technology.

Decentralized lending and borrowing redefine financial services, offering users access to loans and credit without traditional intermediaries, through blockchain technology.

This remarkable surge in TVL owes much to Pendle’s strategic integrations with Eigenlayer and Ethena, both of which have garnered immense popularity in the last quarter.

The new protocol will function partly off-chain and draws inspiration from traditional banking models. Although it has sparked excitement within the ecosystem, there are also concerns about whether it might be considered an unlicensed lending product.

A relatively small segment of decentralized finance aims to replicate the processes and workflows of traditional financial institutions in the digital asset realm.

Alexander Mardar

A relatively small segment of decentralized finance aims to replicate the processes and workflows of traditional financial institutions in the digital asset realm.

Alexander Mardar

This remarkable surge in TVL owes much to Pendle’s strategic integrations with Eigenlayer and Ethena, both of which have garnered immense popularity in the last quarter.

Alexander Mardar

The new protocol will function partly off-chain and draws inspiration from traditional banking models. Although it has sparked excitement within the ecosystem, there are also concerns about whether it might be considered an unlicensed lending product.

Alexander Mardar

The merger unites Osmosis’s deep liquidity with UX Chain’s lending functionality, fostering innovative DeFi solutions in the Cosmos ecosystem.

Alexander Mardar

MakerDAO's recent launch, the Spark Protocol, offers enticing yields, drawing significant attention in the DeFi space. But with big players like Aave and Compound around, it's got to work hard to stand out and stay ahead.

Alexander Mardar

A number of high-profile crypto figures have stepped in to buy Curve.fi founder Michael Egorov’s CRV tokens at a discount, to avoid the potential liquidation of $100 million worth of DeFi loans secured against them.

Jack Martin

Another DeFi lending protocol has become the victim of hackers as Sturdy Finance lost more than $760,000 worth of users' assets. Is something broken in DeFi lending?

Alex Harutunian

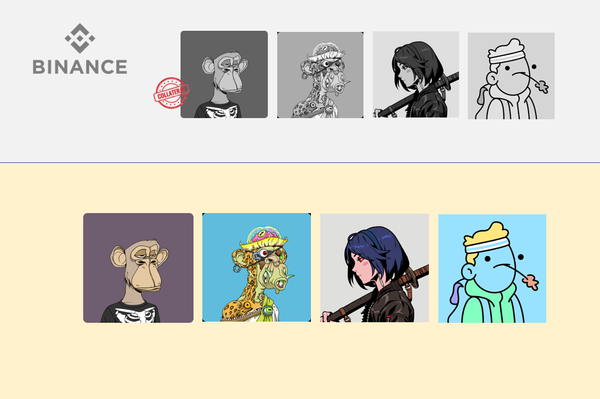

The exchange will initially support ETH loans using NFTs from a selection of four collections as collateral, with a Loan-to-Value ratio of up to 60%.

Jack Martin