This week, the largest stablecoin issuer Tether published its regular Consolidated Reserves Report (CRR) for the quarter ending 30 September 2023. The company has been publishing data on its reserves since 2021, as part of its declared path to transparency. However, the private company is not part of any state or industry regulatory regime, so it can choose the extent and the content of its reports.

Tether has not chosen to publish its financial reports in accordance with any standard. Instead, it began to publish the most important information that users seek for any custodial stablecoin - the balance and breakdown of its reserve assets. Such a report is far from being comprehensive, because it omits important information about revenues, cash flows and other disclosures, and gives only a snapshot of the reserves at the end of the quarter.

The auditor hasn't changed either. BDO, the firm that audits the CRR, is not one of the Big4 (KPMG, PWC, EY and Deloitte) audit firms, but it is fifth on the list. Also worth noting is that the member firm that did the report, BDO Italia, is based in Milan, the hometown of Giancarlo Devasini, Chief Financial Officer of Bitfinex and Tether.

Nevertheless, as with the previous report, we base our review on the provided information:

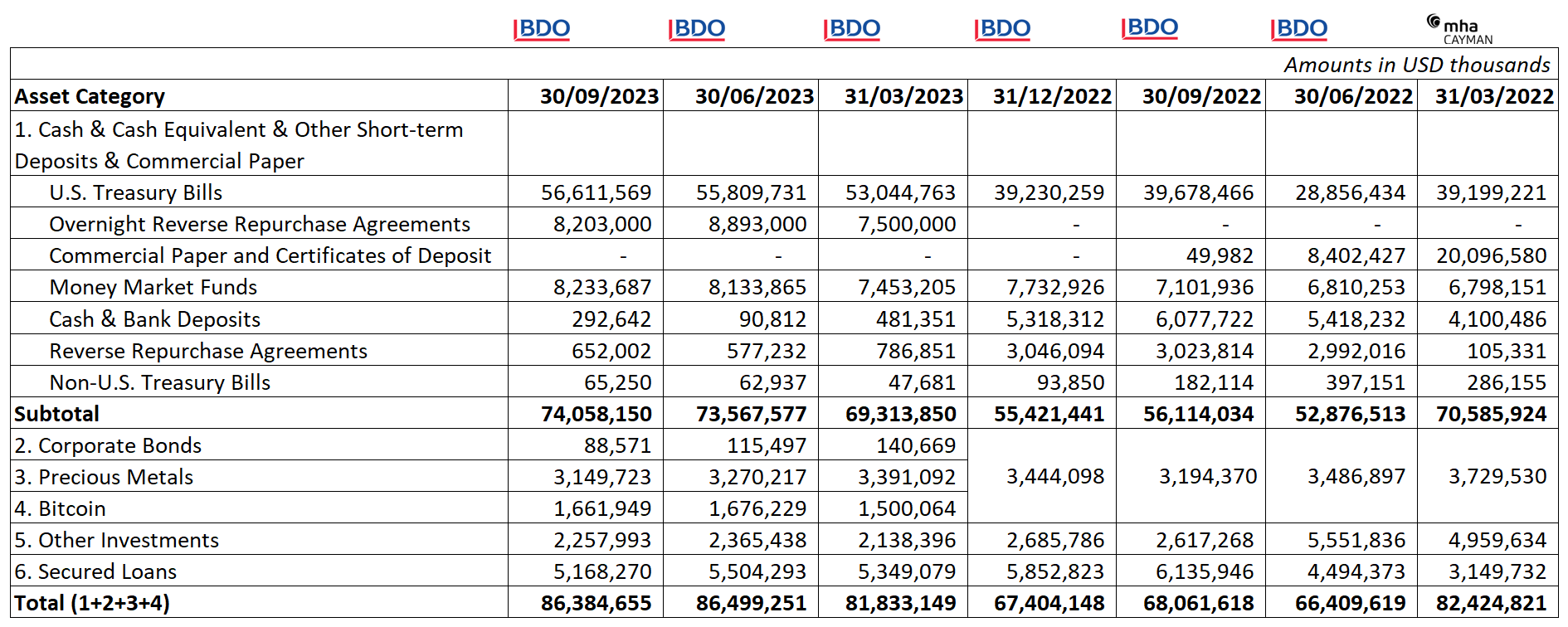

Tether reported almost exactly the same amount of reserves as last quarter, with negligible redistribution between categories. The number of issued tokens is also almost unchanged. In its cover post (unaudited), Tether proudly reports nearly $1 billion profit from operations. Unlike the previous quarter, however, the profits were withdrawn and invested elsewhere.

If Tether's profit is correct, then it is comparable with such FinTech giants as PayPal, which has consistently reported around $1.5 billion in quarterly profits this year. PayPal's profits largely come from commission revenues, while Tether earns interest on its reserves and, presumably, on trading.

In its post, Tether proudly notes the reduction in the category of Secured Loans, which includes funds lent directly in Tether coins. However, the decrease is only 6%, still leaving a balance of above $5 billion. The category is clearly of some concern, because Tether goes further by comparing the excess reserves of $3.2 billion with the outstanding balance, declaring that this leaves only $2 billion at risk.

Stablecoins referencing a single currency are currently facing headwinds with regulators set to limit their circulation. Listless DeFi markets add yet another concern for the issuers. Tether's closest rival, USDC, announced this week that it will close minting accounts for retail customers, focusing only on institutional brokers. However, overall, Tether's report is typical of a product with a strong return in a slow-growth market - a 'cash cow'.