Stablecoin Tether continues to get rid of commercial securities, following its plan. And Maker DAO redistributes the reserves of the stable Dai coin, which may affect its own profits.

After the collapse of Terra, stablecoins became the focus of attention. Many of them also lost their connection to the dollar and experienced working difficulties. These events have forced everyone to pay more attention to ensuring the stability of coins and the volume of reserves.

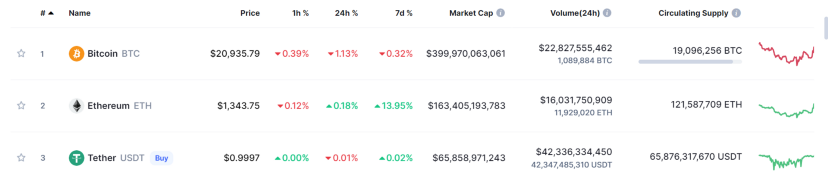

Even before the crisis began, Tether announced its plans to reduce commercial securities used as reserves. Perhaps this step was one of the reasons why the company managed to maintain stability during the general chaos in the cryptocurrency market. At the time of writing, stablecoin USDT is in third place in the ranking of cryptocurrencies by market capitalization from CoinMarketCap. Tether appeared on the market in 2014, in March 2015, the market capitalization of Tether was $25,1600.00, and in March 2022 it was already $81,958,643,217.

In March, the company owned commercial securities worth approximately US$20.1 billion. In addition, Tether published quarterly reports, according to which the number of commercial securities providing a reserve decreased by 17% compared to the previous quarter. In the May report, Paolo Ardoino, Tether CTO, spoke about the results of work on reducing the share of commercial securities for April of this year:

«In fact, since April 1 2022, Tether has seen a further reduction of 20% in commercial paper which we will reflect in the Q2 2022 report. As Tether’s growth in the market continues to validate the business, we are pleased to share attestations now, and in the future, as part of our ongoing commitment to transparency.”

In our opinion, it is very important that the company’s management understands that the reduction of commercial securities in reserves is very important for the company’s reputation. Indeed, this makes the work of Tether more open and transparent for investors. It’s agreed that when you know exactly what amounts and which assets are a guarantee of security for your investments, you are more willing to bring money to the company.

Furthermore, on June 15, in an address to the community, the company stated that the current portfolio of commercial securities is $11 billion, which is almost half as much as at the end of the first quarter. In the same message, Tether announced its intention to reduce this amount to 8.4 billion by the end of June. The company has really managed to achieve these results. The company also announced its intention to reduce the number of commercial securities to zero by the end of 2022. Let’s hope that this time everything will go according to plan, despite the difficult market conditions and instability.

The market crisis has provoked new difficulties and not all stablecoins can cope with them. The future of the Dai stablecoin is currently being discussed online . As of today, it is occupying at 11th place in the rating of cryptocurrencies from CoinMarketCup. Dai was launched in November 2019, in November 2020 its market capitalization was $1,053,445,327, and today it is $7,173,209,753.

The community was forced to doubt its reliability by the tweet of financial analyst John Paul Koning, who shared his observations about possible problems of Dai.

As onlookers’, we can see that MakerDAO is diversifying reserve assets to support Dai by adding other stablecoins to the repository. Among them are stable coins from Circle and Paxos companies . For the use of $4 billion in these stablecoins, an interest rate of 1.7 percent was offered, which will allow these companies to earn $68 million. This fact raises concerns among the analyst.

In another tweet, the expert drew attention to the fact that if MakerDAO did not pay this amount for using stable coins, then its projected annual profit could be ten times more.

The instability of the market forces many companies to make changes on how they work and carefully monitor the provision of their coins, and we will observe how this happens.