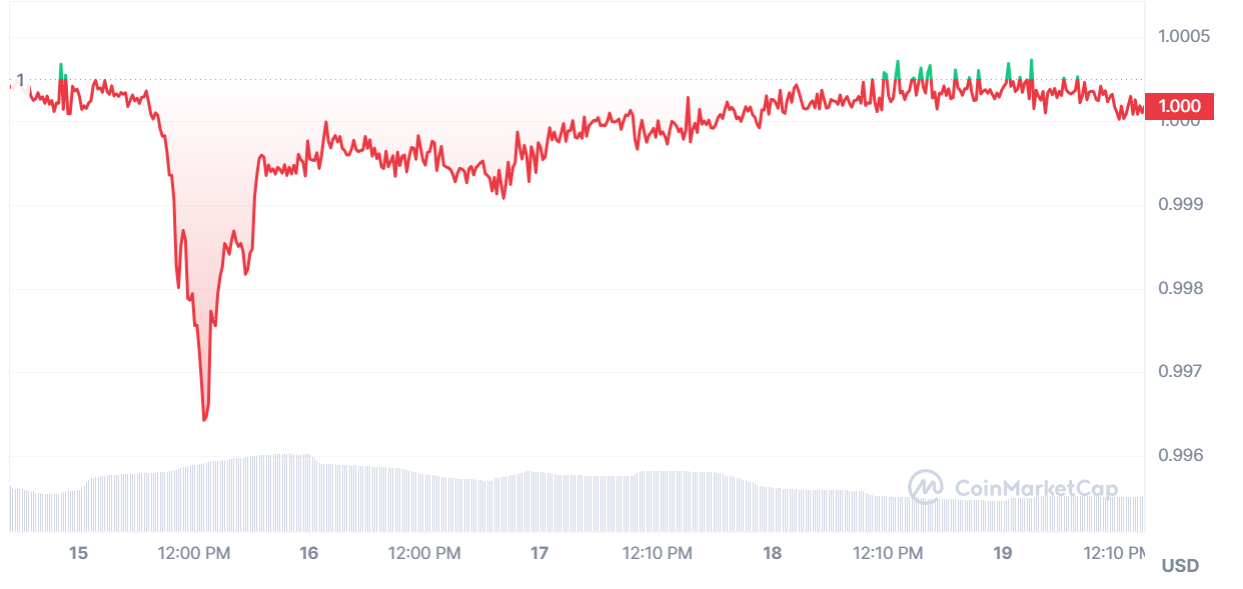

On June 15, USDT, the largest stablecoin in terms of market cap, lost its 1:1 peg to the U.S. dollar, dropping briefly to a price of $0.996. For comparison, the most recent major depeg of USDT was in November 2022, during the FTX crisis when the token fell to $0.96.

The key market trigger influencing the fall in USDT price occurred in Curve's trilateral '3Pool'. On that day, the balance in the pool was disrupted – USDT was oversold to almost 70% of the pool value against the the other two componenets, USDC and DAI. The abnormal volume caused the stablecoin's depeg. But what made users actively sell the stablecoin?

Some suggest that the USDT depeg could have occurred due to an information attack on Tether.

The turbulence in the market coincided with CoinDesk's publication of Tether's old reserve reports. The reports were submitted by Tether to the New York Attorney General (NYAG) as part of a settlement in a previous litigation, and CoinDesk got access to them under New York's Freedom of Information Law (FOIL). The documents presented in the media highlighted facts that had little relevance to the current situation of the stablecoin's reserves but were perhaps enough to create fear, uncertainty and doubt (FUD).

According to comments from Tether, the attack on the markets may have had a direct connection with the publication.

“We find it suspicious that today’s attack on USD₮ via both DeFi and centralized exchanges occurred on the day that materials were handed over to CoinDesk. This timing raises questions.”

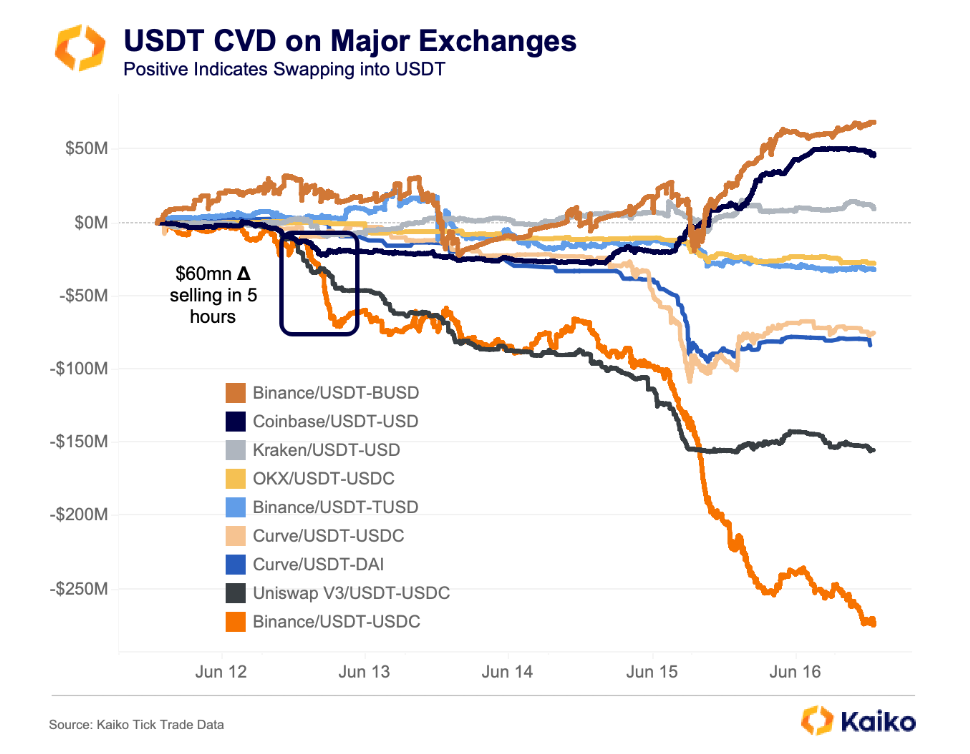

Kaiko experts analyzed USDT's Cumulative Volume Delta (CVD), an indicator of buy vs. sell pressure on the market, and found interesting patterns for the period around the depeg. Selling started three days before the publication, on June 12 when around $60 million negative USDT-USDC delta was registered on Uniswap and Binance. The total negative CVD from June 12 to June 16 on these two exchanges reached $250 million.

Kaiko experts commented in their report:

“While the facts remain blurry, the selling started a few days before USDT dipped to as low as $.995 on both centralized and decentralized exchanges, suggesting some holders may have had advanced warning of the release.”

Following the depeg, Coinbase and Kraken showed a positive CVD of USDT with fiat dollar. The same happened with the USDT-BUSD pair on Binance. Possibly a sign that traders with prior knowledge of the release were cashing in their profits.

So what was in this scandalous publication? CoinDesk's article disclosed documents detailing the reserves of Tether and their custodians. One of the key points mentioned in the article was that in 2021 Tether had commercial securities from Chinese banks in its reserves. As Observers has reported, that particular issue has not been true since the end of 2022.

At the end of the article, the Coindesk journalists added that their publication could not have influenced the USDT depeg, since it occurred five hours before that:

In fact, the stablecoin briefly lost its peg prior to 07:00 UTC (3:00 a.m. ET) on June 15, at least five hours before the NYAG FOIL officer shared the documents with CoinDesk’s attorneys.

Nevertheless, CoinDesk admitted that its editorial board became aware that the documents would be received on June 12.

“CoinDesk learned from our lawyers on June 12 that we would finally receive the documents after a long court dispute in which Tether tried to block their disclosure. We did not share the news of our win with anyone outside our editorial staff until after we received the documents on the morning of June 15 in New York, hours after USDT lost its peg. CoinDesk stands by the integrity of our reporting,” - said Marc Hochstein, Executive Editor of CoinDesk.

Tether responded with an official statement on the website, in which it explained its position on FOIL requests. The company revealed that it had long resisted issuing documents to journalists, which could contribute to disclosing confidential official and client information.

“Ultimately Bloomberg, CoinDesk or any other media outlet’s decision to present this information to its readers was likely done in haste with little attention to current events or facts. We do not condone this behavior but our priorities lie with our customers and our ongoing support of the greater crypto community.”

It is also worth noting that CoinDesk is owned by Digital Currency Group (DCG), a behemoth holding company in crypto industry. In the investment portfolio of DCG, you can find not only major players in the crypto market but also Tether's main competitor – Circle. Despite CoinDesk's ethics page, which states that DCG can't pressure the publication to pump its own interests, there have been previous conflicts of interest reported.

The situation shows us that even stablecoin giants like Tether can be exposed to media FUD risk. Tether has been a target of previous attacks by the press, but hadn't thus far lost its dollar peg. We will continue our Observations and pass on any news.