Tether, the issuer of the leading USD-pegged stablecoin, has released its recent communication with U.S. lawmakers in response to accusations of the former’s involvement in illicit finance activities. In two letters dated November 16th and December 15th, the crypto firm pledges to adhere to the highest standards of anti-money laundering (AML), terrorism and other illicit activity funding, and sanctions compliance. The tone and language of the letters, as well as the follow-up measures initiated by Tether, seem to show that they have taken the warning with utmost seriousness.

A previous letter, written by U.S. Senator Cynthia Lummis and Representative French Hill, had urged the U.S. Department of Justice (DoJ) to investigate and take action against Binance and Tether, due to their implied involvement in facilitating the financial operations of Hamas, Palestinian Jihad and Hezbollah. As we previously reported, these accusations resulted in significant charges and cardinal structural changes for Binance.

Tether’s first letter in response detailed existing client identification, Know-Your-Customer (KYC) measures, and other compliance policies, monitoring tools and examples of law enforcement cooperation. In the second letter, Tether further updates the law-makers on the implementation of, “a wallet-freezing policy designed to significantly enhance the tools available for law enforcement agencies seeking to combat illicit use of stablecoin.” It also highlights the alignment of the company’s policies to the requirements of the Office of Foreign Assets Control (OFAC), the U.S. agency responsible for enforcing sanction compliance and maintaining the list of Specifically Designated Nationals.

Previously, Tether has displayed a much more relaxed approach to compliance risks. In response to the sanctioning of Tornado Cash by OFAC, it refused to block the crypto mixer's addresses and called out the corresponding adherence by its peer Circle (issuer of USDC) as premature.

With most of their reserves in U.S. Treasury bills, the stablecoin issuers are becoming extremely closely linked to the economic and political agenda of the United States. Tether, once blamed for risky reserve investment policies, has been steadily increasing the share of U.S. securities in its reserves, reaching as high as 65% according to its latest report.

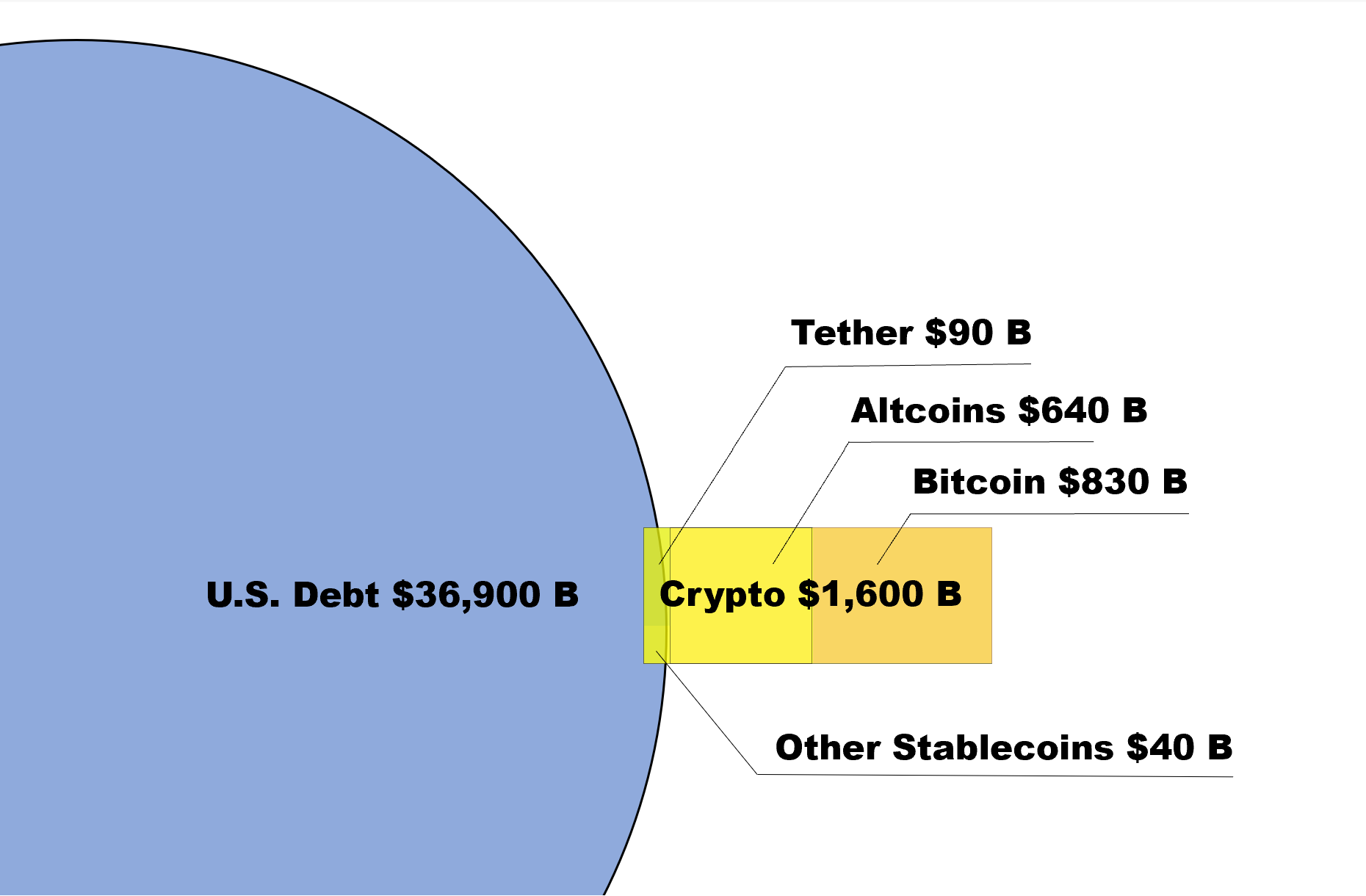

Tether is becoming a visible player in the financial world. The capitalization of its flagship coin, USDT, broke the $90 billion level at the beginning of the month. USDT is one of the most widely accepted digital currencies in the world, and the most common crypto on/off-ramp and bridge between different tokens and blockchains.

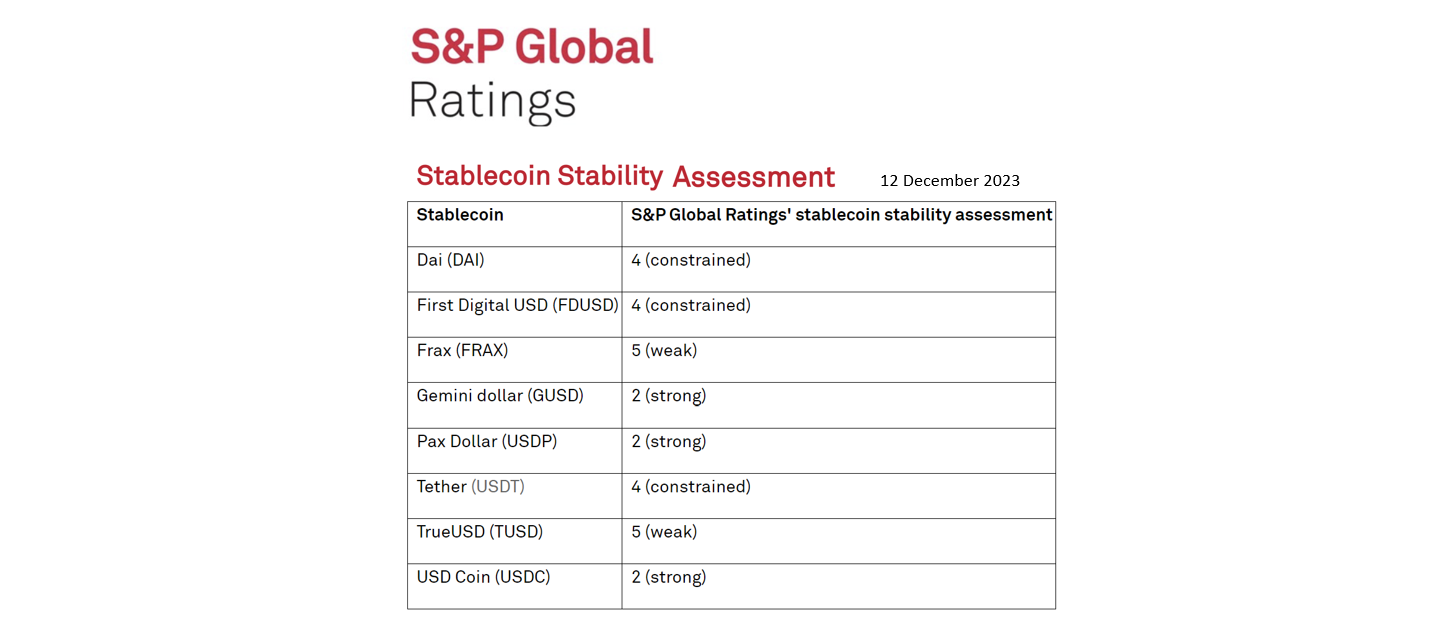

Despite this, in a recent rating of stablecoins, S&P assessed Tether’s stability as ‘constrained’ compared to its fully U.S. Treasury-backed peers.

With such a fortune at stake, we will probably Observe a further increase in U.S. debt as a proportion of Tether’s reserves and see more dependency on its economic and foreign policies.