Tether has been basking in the glow of some box office profits — it made a record-breaking $4.52 billion in the first three months of 2024 alone — and now, it's looking to splash some of this cash.

The company, best known for issuing the world's biggest stablecoin USDT, has now invested $18.75 million in XREX Group, which describes itself as a "blockchain-enabled financial institution."

Beyond the cash injection, the most headline-grabbing announcement relates to how XREX now plans to facilitate "compliant, USDT-based cross-border B2B payments in emerging markets."

The prospect of near-instantaneous transactions at minimal cost — in an asset pegged to the U.S. dollar — could prove appealing to businesses dealing with razor-thin profit margins. International transactions often command fees of 4% or more, with funds taking several working days to arrive. Uncompetitive exchange rates from one fiat currency to another often add another layer of pain.

Tether CEO Paolo Ardoino said the XREX investment reflects an "unwavering commitment to fostering financial inclusion," adding:

"This latest investment aligns with Tether’s long-term vision of building a resilient infrastructure that extends beyond the confines of the crypto market, as demonstrated by our diversified investments in various industry sectors."

The Unitized Stablecoin Overcollaterized by Gold

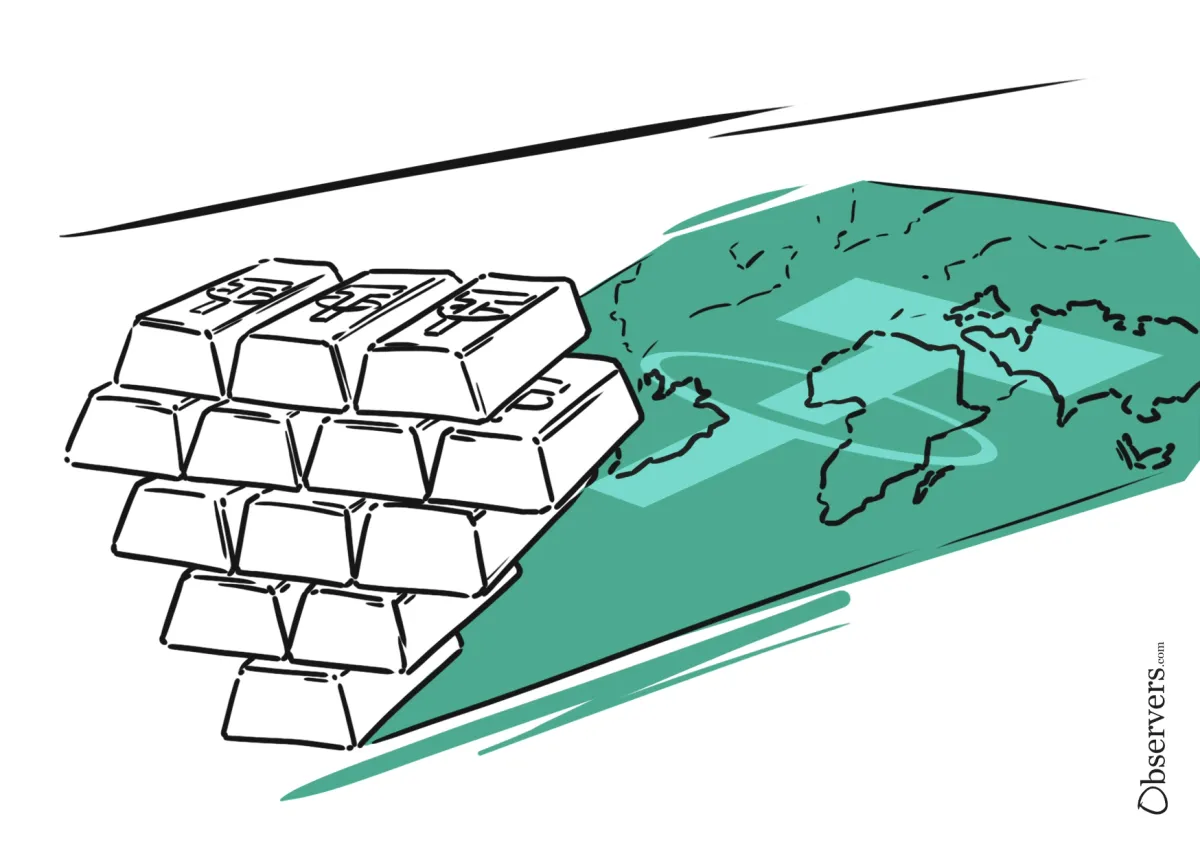

In an announcement, Tether also said that XREX will be collaborating with the Unitas Foundation to launch a new stablecoin called XAU1. This would be overcollateralized with Tether Gold, known as XAUt, and would aim to provide consumers with "a hedge against inflation" by mirroring the precious metal's current value.

Unitas has previously set out an ambition to offer localized stablecoins based on smaller currencies such as the Indian rupee and UAE dirham. The project aims to develop a special Unitas protocol that will translate (“unitize”) a USD stablecoin into different local currency units. The project website claims that it will be done using the official exchange rate, but it does not detail how the protocol works in cases where the official rate differs significantly from the real one.

As regulators around the world develop laws preventing foreign currency pegged stablecoins, the localization or "unitization" of the stablecoins might provide a workaround for the issuers.

Many of other Tether's investments have been eclectic to say the least. The company has repeatedly given funding to Georgia-based CityPay.io, which allows consumers in the transcontinental country — straddling Europe and Asia — to make crypto payments at a slew of leading brands. Expansion into other Eastern European nations is now on the cards.

A newly established ventures division has also been placing bets outside of the crypto markets. Back in April, a $200 million investment made Tether a majority stakeholder in Blackrock Neurotech, which aims to allow people to operate robotic limbs, surf the web, type and even drive cars solely with their thoughts.

Tether's stablecoin now has a market capitalization of $112 billion — three times more than its nearest rival USDC. The company's immense profitability recently relates to the interest earned on the dollars it holds in reserve, as yield is not passed on USDT holders.