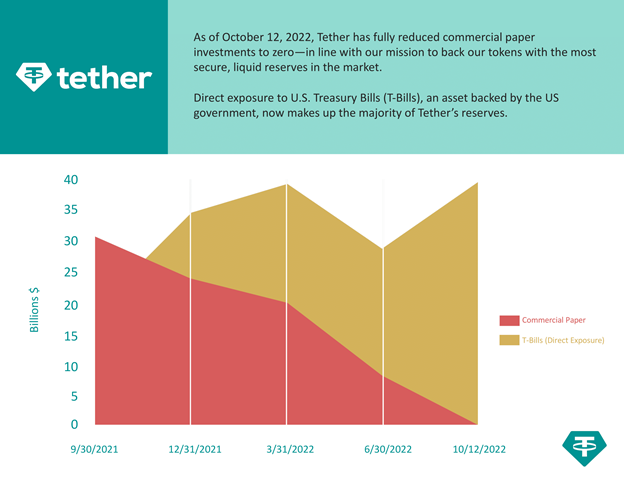

Tether has completely gotten rid of commercial papers, replacing them with U.S. Treasury Bills (T-Bills).

As we wrote earlier, Tether has long been on course to get rid of commercial securities as part of its reserves. Following its plan, the company managed to reduce the number of commercial securities to zero by October 12, 2022.

For example, in March of this year, the company owned commercial papers worth approximately $20.1 billion US dollars. But even then, the team was actively reducing the number of commercial papers in its reserves and by June 15, the company's portfolio of commercial papers was estimated to be $11 billion. But the company was not going to stop there, so by July 1, the amount had decreased to $3.5 billion, and at the end of September, commercial papers were estimated at only $50 million. By the end of 2022, Tether intended to reduce its reserves in commercial papers to zero. And this goal was achieved before time!

BREAKING: Tether is proud to announce that we have completely eliminated commercial paper from our reserves. This is evidence of our commitment to back our tokens with the most secure, liquid reserves in the market. (1/3)https://t.co/zBa9jRe7so

— Tether (@Tether_to) October 13, 2022

From the message on the official website of the company, it was revealed that all commercial papers were replaced by U.S. Treasury Bills (T-Bills) on October 12, 2022.

In its message to the Tether team, Tether stressed that with this step it is able to increase the level of trust not only in the company, but also in stablecoins in general.

This is a step towards even greater transparency and trust, not only for Tether but for the entire stablecoin industry. - the message says.

One of the obstacles in dampening customer confidence was commercial papers, which occupied a significant share of reserves. Agreed, it is difficult to entrust your money to a company if you are not sure of the reliability of its reserves. Now this issue has been resolved, but Tether is still working to increase the level of trust, so it actively shares its reports with users, involving international organizations in creating reports. For example, BDO Italy was tasked to produce a report in August of this year.

According to our observations, Tether is an active member of the crypto community, and is working on keeping the crypto industry healthy, and doing so with its actions.

Not so long ago, Binance suspended its network due to a hacker attack. Many members of the crypto community helped the exchange to figure out the attackers, including Tether which blocked the hackers' wallet.

#Tether added potential hacker's address to Blacklist

— Colito·~·~·~ (@MicaMontecalvo) October 13, 2022

USDT blacklisted 0x489a8756c18c0b8b24ec2a2b9ff3d4d447f79bechttps://t.co/FD3Ffgcmie pic.twitter.com/CtSQCynnji

Also on October 11, it was revealed that Tether had frozen three addresses on which a total of $8.25 million was blocked. This became known thanks to the Whale Alert Twitter account, which publishes data on the largest transactions in the blockchain.

Earlier, Tether reported that they cooperate with law enforcement agencies and contribute to investigations by blocking the accounts of alleged criminals. However, when OFAC imposed sanctions against Tornado Cash in August, Tether did not block these addresses. While Circle blocked 44 addresses with assets in USDC and Ether.

It's great that during the instability in the crypto market, Tether has achieved its goals and taken care of the industry as a whole. We will continue our observations and be sure to share the news with you.