Tether has released its Consolidated Reserves Report (CRR) for the first quarter of 2023. Let's Observe it in more detail.

The reviews of earlier reports can be found in our articles:

- Tether Attestation of Reserves For The Last Quarter of 2022. What's New?

- Tether New Attestation of Reserves

As with previous reports, the assurance was provided by BDO Italia auditors and the released information covered only reserves without showing a full set of financial statements.

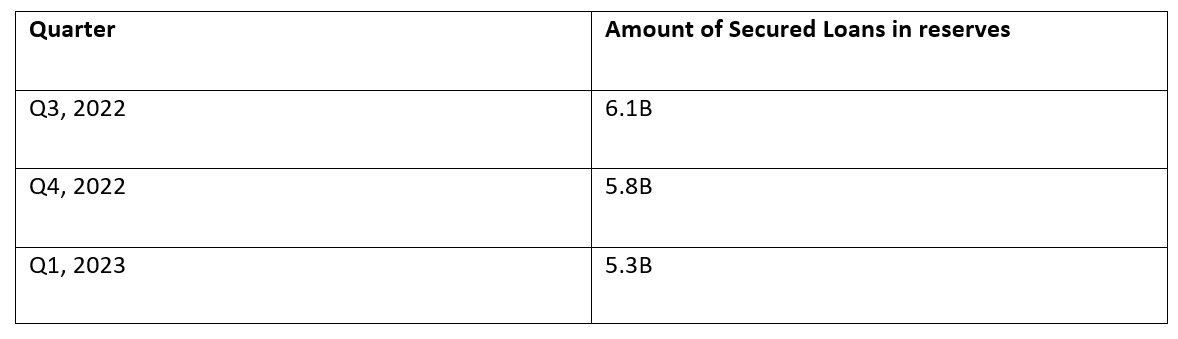

Reduction of Tether's Secured Loans

After a Wall Street Journal article criticizing Tether for having secured loans in reserves, the issuer of the most popular stablecoin announced its intention to get rid of secured loans in 2023 entirely. The current report shows a reduction of around $500 million over the previous quarter, marking a decrease of roughly 10%.

Tether's Assets Exceed Liabilities

As always, Tether was proud to announce that its assets in reserves of about $81.8 billion, exceeded its liabilities (issued coins) of around $79.3 billion. The excess reserves amount to approximately $2.44 billion, which may seem like a reasonable cushion. However, there is little information given about the methods used to value the assets, except that they were valued at "fair value" according to IFRS 9. Valuation of assets is a complicated process, which, especially in turbulent times, can lead to significant discrepancies.

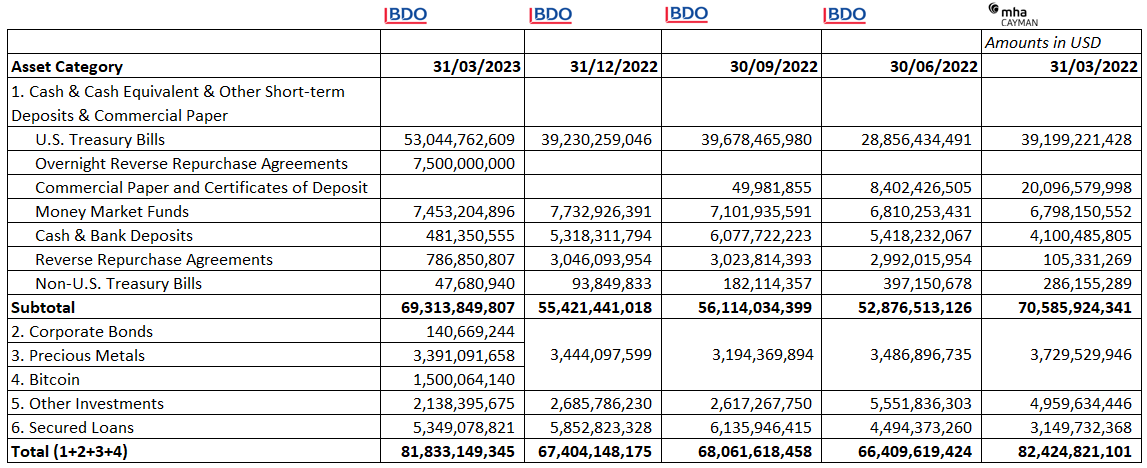

The distribution of the company's assets, according to the financial statements, is as follows.

There is a large balance of U.S. Treasury Bills, a category of asset that was considered to be bullet-proof until the recent US banking crisis. We could not find details about the maturity and valuation of these instruments.

A new category of "Overnight RePo" was introduced that indicates better management and more sophisticated investment practices for the reserve funds.

For the first time, Tether has broken down the 'Corporate Bonds, Precious Metals and Funds' to show the corresponding balances separately. The largest holdings turned out to be physical gold ($3.4 billion) and bitcoin ($1.5 billion).

The physical gold balance is much larger than the company's gold-referenced token XAUT which has a market cap of around $0.5 billion. This might be another reason for the company's recent push for Tether Gold.

Tether's Profit

In the first quarter of 2023 Tether reported $1.48 billion in net profit, twice the company's net profit of 2022 Q4. The profits are in the range typical for large banks.

No information about the taxes paid from those profits or distribution to shareholders was provided by the company. Still, this report is a good step towards improved transparency for this key player in the crypto world.

We will continue our Observations and inform you of any further developments.