Emerging from the dark of the 2022-2023 crypto winter, the crypto landscape has bounced firmly back thanks in part to institutional investment and a pro-crypto U.S. President-elect.

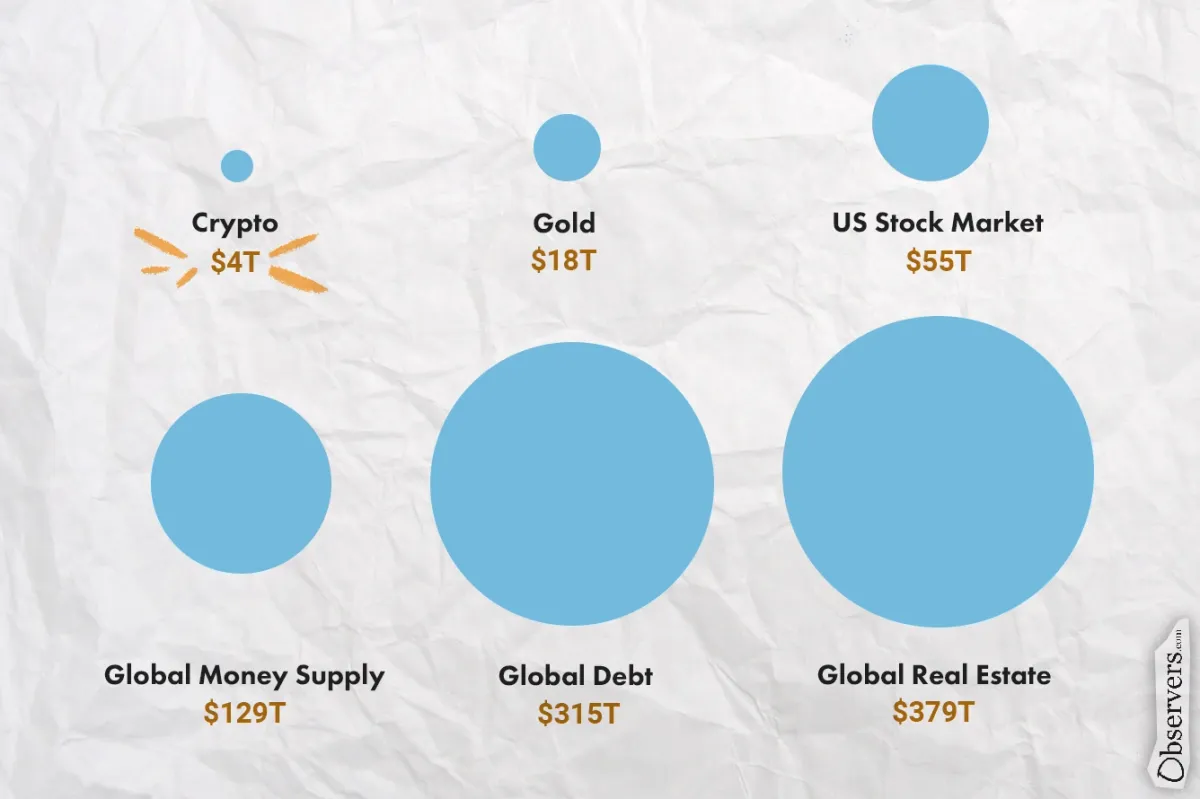

The revival has not only propelled Bitcoin to soar past $106,000 but also significantly broadened the market's scope and depth. As 2024 closes, the global cryptocurrency market cap is approaching a staggering $4 trillion.

2024 Notable Winners

Bitcoin

Bitcoin leads the way with a 53% market share and a just over $2 trillion market cap. The market-wide surge was fuelled by the re-election of a now crypto-friendly President, Donald Trump, who has promised big things for the industry under his term (and even hinted at a U.S. Bitcoin reserve).

Institutional investors like Morgan Stanley and Goldman Sachs supported the rise by buying up Bitcoin ETFs. And, while Michael Saylor might have failed in his bid to get Microsoft to buy Bitcoin, there was no shortage of companies and governments investing heavily in 2024.

Solana

Solana reached a high of $263 in November, marking an almost 230% rise this year. The company’s fast, low-cost blockchain has attracted major DeFi projects and is now the epicenter of the ever-expanding meme-coin market.

Solana is also attracting a record number of developers, taking some notable deflections from its biggest rival, Ethereum.

Ethereum

Ethereum has continued to assert its dominance as a leading blockchain platform within the DeFi and NFT sectors. While its transition to a proof-of-stake consensus mechanism boosted scalability, some have questioned its massively fragmented ecosystem.

Still, Ethereum rose to $3,910 this year, and some analysts predict that strong growth will continue well into 2025.

Dogecoin

The (probably heavily) Musk-backed crowd favorite saw a massive rise of over 400% in 2024, boosted in part by Musk and other celebrity endorsements along with big social media hype.

After Donald Trump’s victory and his announcement that he would appoint Musk as head of a government efficiency department called DOGE, the meme-coin grew to a market cap of almost $60 billion, surpassing Ford Motors in value.

XRP

With the SEC's shifting regulatory environment, Ripple will be hoping that the lawsuits holding it back for the last few years will completely fizzle out in 2025.

Currently trading at around $2.30, XRP has ballooned by 338% this year, gaining traction not only among retail investors but also attracting the attention of financial institutions. Just last week, Ripple received final approval from NYDFS for its RLUSD stablecoin, a significant regulatory milestone.

Stablecoins

Tether continues its world domination, this year partnering with Telegram's TON and leveraging that reach to secure a 75% market share in the almost $211 billion stablecoin market.

But, there are roadblocks ahead. The new MiCA rules mean Tether will be delisted from many exchanges in the EU in the coming weeks.

Circle's USDC, on the other hand, has its EU licenses, and with its newly announced Binance partnership, it will be interesting to see where these two market leaders sit by the end of 2025.

And Those Left Behind?

NFTs

While the cryptocurrency market has shown incredible resilience and recovery amid fluctuations, the NFT market continues to struggle. The market's peak in 2021 was $41 billion until it was wiped out by the market collapse in 2022. One analyst claimed that by mid-2024, 96% of all NFTs were dead.

But there is hope. NFTs have found a home in gaming, loyalty programs, and bridging the real world with the digital one. They have been repositioned away from assets or status symbols; instead, NFTs now have utility and long-term value. You can read more from our NFT observer here.

2025 and Beyond

2025 is poised to be a big year with expected regulatory evolutions and global shifts towards digital currencies.

With increasing adoption—from retail to government investments—and rocketing prices sending traditional investors into a FOMO frenzy, market growth seems unstoppable.

On the other hand, there are clearly still challenges around regulation, and plenty of countries are lagging behind in their acceptance of digital currency, with ongoing fears about the undermining of fiat currencies. There are still many question marks around consumer protections, and the industry is still dogged by scams and rug-pulls.

However, the market continues its march towards and beyond that $4 trillion market cap, with more than 16,000 coins tracked on CoinGecko and many more being launched daily.

If 2024 was the year crypto went mainstream, 2025 should see that momentum continue, but hopefully, with added clarity for developers, investors, and users.