Circle Internet Financial has announced the launch of a fully reserved stable coin EUROC, which is pegged to the euro.

Today, interest in stablecoins has grown significantly. Some people are monitoring them after the collapse of Terra and evaluating their reliability, while others actively use them as a means of payment or store their savings in them.

It is not surprising that Circle Internet Financial decided to release a stablecoin that is tied specifically to the euro. After all, according to the Bank for International Settlements (BIS), the euro is the second largest fiat currency in the world in terms of its turnover.

According to the idea from the developers, the EUROC stablecoin will provide enterprises with wide access to liquidity in euros. The stablecoin can be used for payments, trading, lending and borrowing. Initially, EUROC will be launched on the Ethereum blockchain as an ERC-20 standard token.

Circle Internet Financial clarified that the EUROC is a fully reserved stablecoin. The token is backed by reserves denominated in euros, which are stored in financial institutions “included in the regulatory perimeter of the United States.” It is worth noting that the company did not specify what the software consists of. It may consist exclusively of currency, or it may include bonds and securities. The initial custodian of the stable coin is Silvergate Bank.

The start of EUROC trading is scheduled to begin on June 30. According to a press release, it will be added to the listing of such cryptocurrency exchanges as BinanceUS, Bitstamp, FTX and Huobi. The DeFi protocols, Compound, Curve, Uniswap and other services will also allow interaction with the stablecoin.

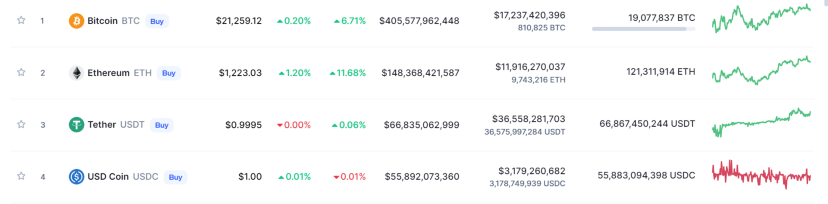

It can be assumed that the token will be very popular with market participants, since another stable coin from Circle, USD Coin, ranks 4th in the top crypto tokens by market capitalization.

The company Tether, which has one of the most popular stablecoins pegged to the dollar (USD), also has its own token pegged to the euro (EURT). According to Coinmarketcap, the capitalization of USD is $66,812,833,325, and the capitalization of EURT is $41,242,563. We have noticed that the capitalization of the token pegged to the dollar is about 38% higher. From this we can conclude that a stablecoin pegged to the dollar is the most attractive for market players.

How successful will the EUROC launch be? How will it be able to establish itself in the foreign exchange market and bypass the popularity of USD Coin? We will observe.