On May 4th, the Federal Reserve raised the official U.S. interest rate by half a percentage point to 1%. It was a decisive step to get a grip on accelerating inflation against the background of a fragile international political situation.

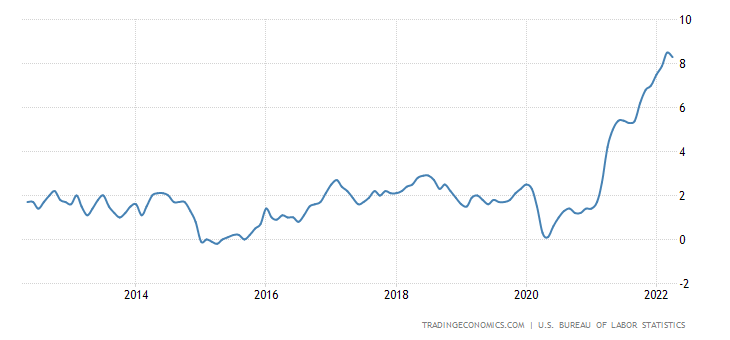

Recently, inflation in the US has been shooting up at a pace not seen for 40 years. The Fed’s updated quarterly projectionsshow they expect inflation to average at 4.3% this year, much higher than its annual target of 2%. An interest rate hike is a common tool to get inflation under control. It helps to cool down the demand by increasing the cost of all kinds of credit, from auto loans to home mortgages.

Inflation in the U.S., tradingeconomics.com

Yet, some forecasters believe the Fed’s raising of rates is a sign of a looming recession (which is also expected in Europeany day now). Some seemingly strong suits like low unemployment are said to jeopardize the economy. The tight labour market is pushing up wages, and that may result in inflation even further above the Fed’s target of 2%.

Matthew Luzzetti, Chief US Economist at Deutsche Bank, believes the Federal Reserve will have to crack down hard, with significantly higher interest rates. Those aggressive rate hikes, in his view, will push the economy into a mild recession by late next year.

In this context, it is worth paying attention to the market’s reaction to this news. At around 2:30 p.m., after the announcement, markets got caught up in the turbulence. Bitcoin, Nasdaq 100, S&P 500, and gold went up; the 10-year yield and the U.S. dollar went down. The next day, these moves returned to former levels as if nothing had ever happened.

Some analysts explain this by a belated discovery of the importance of high inflation, which brought back the markets from positive assessments. Another explanation is that this move is the handiwork of trading firms that react to news faster than anyone. And finally, the market might be acting just like a “drama queen” overreacting to any newsflash before figuring out what’s going on. Anyway, it is curious that Bitcoin is in sync with major market quotations.

Fed Chairman Jerome Powell warned on Thursday that getting inflation under control could cause some economic pain. He noted that he and his colleagues would actively consider two additional half-point rate increases in the near future. Let’s see what markets will think about this next time.