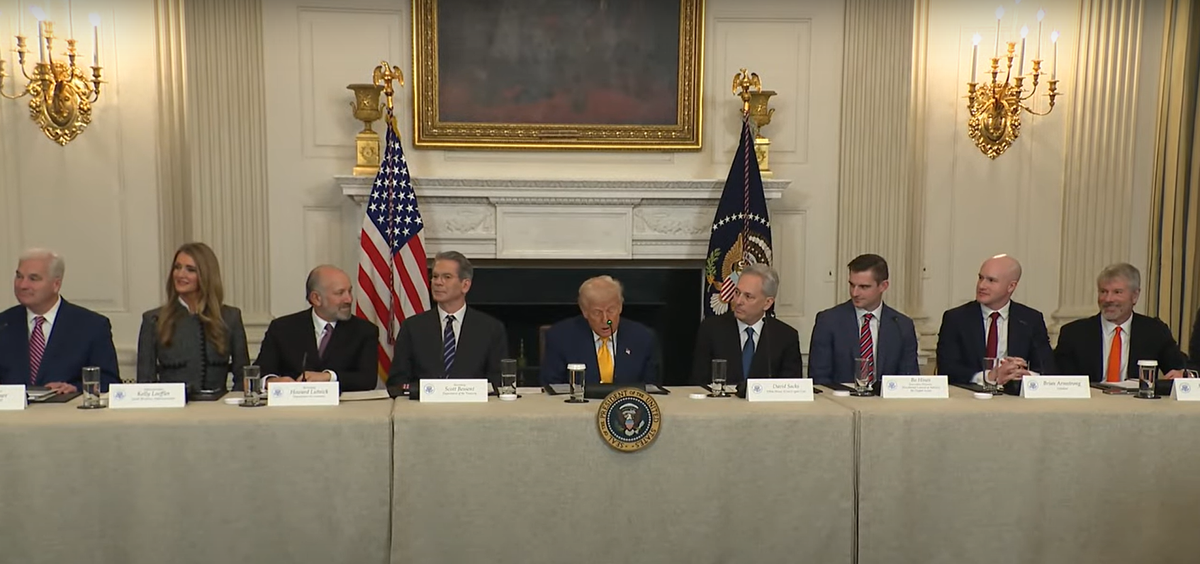

The White House Digital Asset Summit took place on March 7, 2025, from 1:30 p.m. to 5:30 p.m., lasting a total of four hours. Hosted by U.S. President Donald Trump, the summit hosted key administration and government staff and industry representatives.

"Welcome to the first-ever White House Digital Asset Summit. Last year, I promised to make America the Bitcoin superpower of the world, AND WE'RE TAKING HISTORIC ACTION TO DELIVER ON THAT PROMISE." –President Donald J. Trump 🇺🇸 pic.twitter.com/nqUrHQ1xLl

— President Donald J. Trump (@POTUS) March 8, 2025

U.S. Bitcoin Reserve and Digital Asset Stockpile

Days before, White House Crypto Czar David Sacks announced an executive order to create a Bitcoin Reserve out of seized BTC, along with a Digital Asset Stockpile also sourced from forfeiture proceedings in other cryptocurrencies.

The executive order also authorized the Secretaries of Treasury and Commerce to develop strategies for acquiring additional bitcoin, provided these strategies are budget neutral and impose no incremental costs on American taxpayers. The government, however, does not plan to acquire other cryptocurrencies for the Digital Asset Stockpile beyond those obtained through similar means.

Industry representatives such as Coinbase CEO Brian Armstrong and Ripple CEO Brad Garlinghouse lauded the administration's recognition of cryptocurrencies. Armstrong described the move as a "historic moment for Bitcoin and crypto," suggesting that other nations might follow suit. Garlinghouse welcomed the acknowledgment that the world of cryptocurrencies extended beyond just Bitcoin.

Michael Saylor, co-founder and executive chairman of MicroStrategy, now rebranded as Strategy, advocated for the United States to acquire 5% to 25% of the total bitcoin supply by 2035. He predicted it could unlock up to $100 trillion in economic value over the next decade, offering a substantial solution for national debt reduction by 2045.

Crypto Regulation in the U.S.

The regulations were the second most significant expectation from the summit. Although no groundbreaking announcements were made, speeches by agency representatives reaffirmed the current administration's generally positive stance toward the industry.

The Office of the Comptroller of the Currency removed the requirement for banks to seek permission for engaging in common crypto activities, marking an end to "Operation Chokepoint 2.0." This move is intended to facilitate greater integration of cryptocurrencies into mainstream finance.

The Securities and Exchange Commission (SEC) represented by Commissioner Hester Peirce emphasized the agency's shift from enforcement actions to policy development through public processes, highlighting an upcoming public roundtable on crypto asset regulation scheduled for March 21.

The SEC's new direction under Commissioner Peirce includes clarifying regulatory stances and discontinuing multiple court cases against crypto companies initiated during the previous administration.

The heads of Coinbase, Crypto.com, and Binance, leading crypto trading platforms, spoke about the growing adoption of cryptocurrencies in everyday transactions and the importance of security and compliance in building consumer trust.

Co-founders of Gemini, the Winklevoss twins also underscored the evolution of cryptocurrency exchanges and the significance of regulatory compliance in gaining mainstream acceptance.

The only woman attendee, Kelly Loeffler, the head of the Small Business Administration, praised the administration's swift actions in the tech sector, noting, "You're moving at the speed of tech for sure."

Stablecoin Discussions at the White House Crypto Summit

Although stablecoins received significant attention in President Donald Trump's first executive order, effectively replacing the digital dollar, they were only briefly discussed during the summit.

Treasury Secretary Scott Bessent highlighted the potential of stablecoins to maintain the U.S. dollar's status as the dominant global reserve currency, recognizing their role in facilitating transactions valued at approximately $6 trillion annually.

In a rather surprising turn, FIFA President Gianni Infantino attended to discuss the intersection of digital assets and global sports. During the event, Infantino unveiled a new trophy design for the 2026 FIFA World Cup, the event that was on President Trump's agenda a day before the summit.

Seizing the opportunity to be among such distinguished company, Infantino expressed FIFA's interest in developing a cryptocurrency under the organization's authority, aiming 'to conquer the 5 billion soccer fans in the world.'

Overall, crypto enthusiasts had mixed reactions to the White House Crypto Summit, with institutional players viewing it more positively than retail traders and BTC maximalists.

Some saw the move as a simple trade-off for the crypto community's support during the election and an example of Trump's transactional nature. Trump saw it differently, hailing the event as just the beginning. “We feel like pioneers,” he said.

After the summit, Bitcoin was down, trading at around $86,000, and ETFs saw $370 million in outflows.