Marc Andreessen’s account of how the United States government has been ordering banks to close the accounts of crypto founders has triggered a #MeToo movement of the debanked within the crypto sector.

The CEO of the venture capitalist firm a16z went on the Joe Rogan Experience podcast on November 26 for a three-hour conversation in which he discussed politics, AI, crypto, and even philosophy.

Several of Andreessen's insights caught the public's attention, but nothing had as big an impact as his comments on debanked crypto founders.

"We have had 30 founders in the last 4 years debanked,” the billionaire said, blaming the situation on the Biden administration and as an explanation for why he voted for Donald Trump.

Choke Point Operations

In many industries in the United States, banks closing accounts without prior notice or explanation isn’t uncommon.

It all started in 2013, when a secret operation of the Department of Justice, without providing evidence or court orders, began to order banks to shut down the accounts of clients associated with drug trafficking, arms deals, the sex industry, and other sectors considered problematic.

The operation was frowned upon not only by those affected but also by banking industry professionals, who wrote publicly about how the practice was way out of control.

A VICE report on the topic noted, “Bankers are just as pissed as porn stars.”

This targeted effort, called Choke Point Operation, was meant to shut down as many as 30 separate industries by making it impossible for them to access banking services.

It was officially shut down in 2017.

On the Joe Rogan Experience, Andreessen discusses how, instead of ending operations, the operation began to deploy its tactics on other industries.

While the a16z CEO made a point of blaming Joe Biden's policies for cutting crypto founders off the banking system, testimonies surging on social media in the last couple of days trace the unjustified unbanking acts back to 2017.

The same year Choke Point 1.0 ended, Choke Point 2.0 seems to have started.

Much More Than Thirty Cases

Soon after the podcast aired and clips began to pop up online, founders and crypto users came out, revealing similar experiences.

Roman Storm, the co-founder of Tornado Cash, shared how he had just been debanked (again).

Storm’s account freeze comes on the day following the Fifth Circuit’s announcement of its decision to remove Tornado Cash from the U.S. sanction list and ruling that the Department of Justice’s OFAC overstepped when it sanctioned the crypto mixer in 2022.

Caitlin Long, co-founder of Custodia Bank, shared that she has been through the same. Custodia Bank filed a lawsuit, which it lost and is currently appealing, accusing the Kansas Federal Reserve of illegally rejecting its bid for a master’s account (a type of bank account that grants banks access to the FED’s payment networks).

Tyler Winklevoss, co-founder of crypto-exchange Gemini, shared how he and his firm were both de-banked. He said, “The number is probably much larger than 30; that's just in the a16z portfolio alone.”

Here are other testimonies of similar situations:

- From Jake Brukham, CEO of CoinFund:

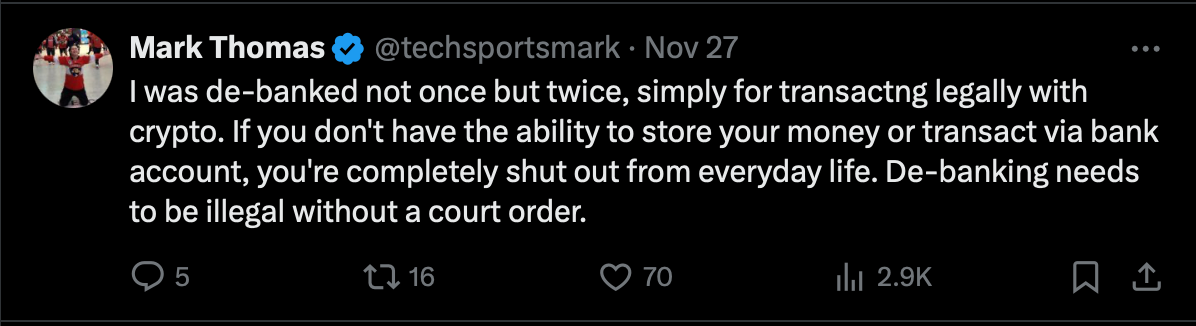

- From Mark Thomas, a tech entrepreneur investing in several crypto and blockchain ventures:

- From Zooko Wilcox, founder and former CEO Electric Coin Co:

- From Isabel Foxen Duke, founder and CEO of Bitcoin Communications: