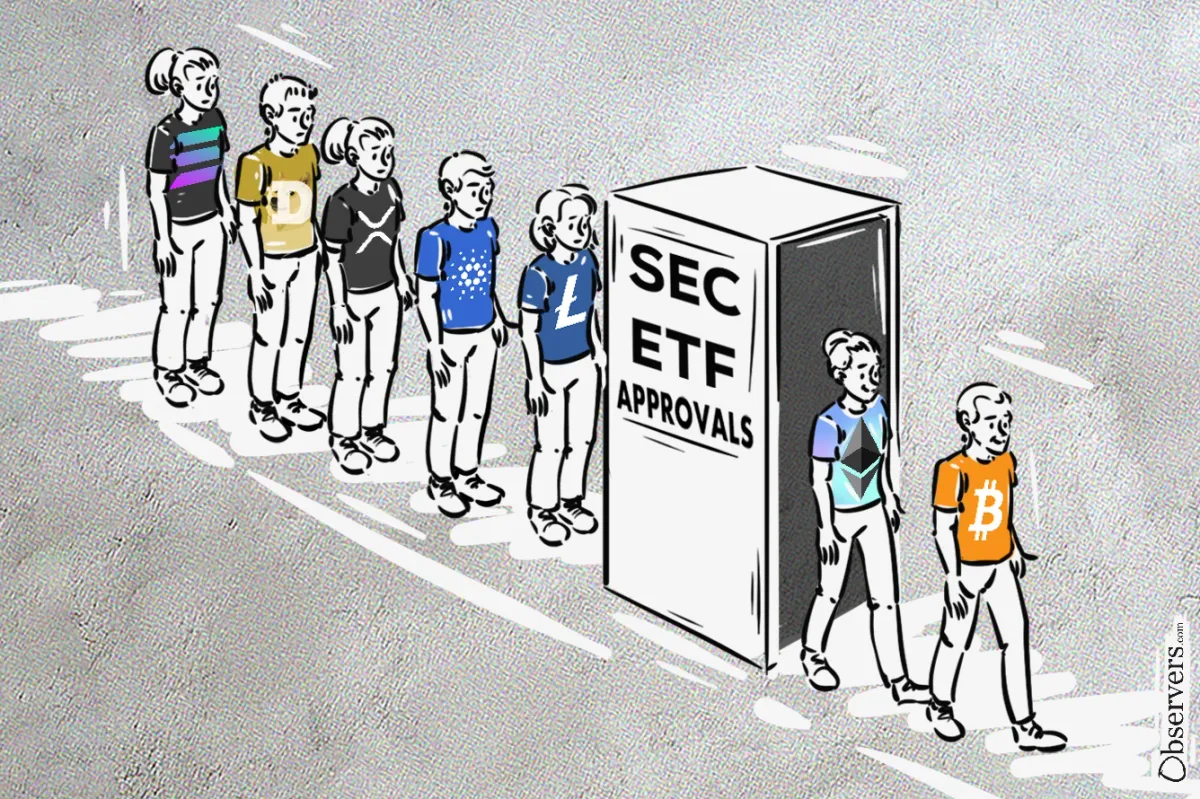

The Next Crypto ETF

Trump administration sparked a surge in crypto ETF filings. Asset managers have rushed to file ETF applications for various altcoins. Analysts expect that many of these applications will be approved in 2025.

Trump administration sparked a surge in crypto ETF filings. Asset managers have rushed to file ETF applications for various altcoins. Analysts expect that many of these applications will be approved in 2025.

Donald Trump’s pro-crypto administration has sparked a surge in filings for crypto exchange-traded funds (ETFs). After the approval of Bitcoin and Ethereum ETFs, it seems only a matter of time before other major altcoin projects receive approval for their ETFs.

Multiple applications have been filed for large altcoins, including Ripple (XRP), Solana (SOL), Cardano (ADA), Litecoin (LTC), Dogecoin (DOGE), Polkadot (DOT), Hedera (NBAR), SUI (SUI), and others.

Currently, the market anticipates that most ETF applications will be approved in the last quarter of 2025.

Ripple is among the top projects with the highest number of ETF filings in the United States.

Issuer | Product Name | Date |

Bitwise XRP ETF | October 2, 2024 | |

Canary XRP ETF | October 8, 2024 | |

21Shares Core XRP Trust ETF | November 1, 2024 | |

WisdomTree XRP Fund | December 2, 2024 | |

ProShares XRP ETF ProShares Short XRP ETF Pro Shares Ultra XRP ETF ProShares UltraShort XRP ETF | January 17, 2025 | |

REX-Osprey XRP ETF | January 21, 2025 | |

CoinShares XRP ETF | January 25, 2025 | |

Tuttle Capital 2X Long XRP Daily Target ETF | January 27, 2025 | |

Grayscale XRP Trust (Conversion) | January 30, 2025 | |

Volatility Shares XRP ETF Volatilish Shares 2x XRP ETF Volatilish Shares -1x XRP ETF | March 7, 2025 | |

Franklin Templeton XRP ETF | March 11, 2025 |

Ripple CEO Brad Garlinghouse announced on March 19 that the SEC would drop its long-running lawsuit against the XRP issuer. As a result, the ads for XRP ETFs have risen significantly.

According to Polymarket, the odds of XRP ETFs getting approved in 2025 are around 85%, which signals that investors are almost certain of ETF approval. Garlinghouse has also mentioned that he expects ETF approval in the second half of 2025.

Bloomberg analyst James Seyffart thinks that there is at least a 65% chance of XRP ETF approval in 2025. However, his estimates were made before Ripple’s resolution with the SEC was announced.

Solana is another hot asset targeted by asset managers, with multiple ETF filings.

Issuer | Product Name | Date |

VanEck Solana Trust | June 27, 2024 | |

21Shares Core Solana ETF | June 28, 2024 | |

Canary Solana ETF | October 30, 2024 | |

Bitwise Solana ETF | November 21, 2024 | |

Solana Volatility Shares Trust | December 27, 2024 | |

ProShares SOL ETF ProShares Short SOL ETF Pro Shares Ultra SOL ETF ProShares UltraShort SOL ETF | January 17, 2025 | |

REX-Osprey SOL ETF | January 21, 2025 | |

Grayscale Solana Trust (Conversion) | February 6, 2025 | |

Franklin Solana ETF | March 12, 2025 | |

Fidelity Solana Fund | March 25, 2025 |

Similarly to Ripple, Solana also has a high chance of ETF approval this year. James Seyffart gives it a 70% chance of approval, while Polymarket users think there is an 84% chance that the Solana ETF will be approved this year.

Given that Fidelity, one of the largest asset managers in the world, has joined the Solana ETF race, it is quite reasonable to expect approval by the end of this year.

Issuer | Product Name | Date |

Canary Litecoin ETF | October 15, 2024 | |

Grayscale Litecoin Trust (Conversion) | January 24, 2025 | |

CoinShares Litecoin ETF | January 24, 2025 |

While Litecoin has notably fewer applications than other cryptocurrencies, according to Bloomberg Intelligence analysts James Seyffart and Eric Balchunas, it has a higher chance of ETF approval. Analysts estimate its odds of approval are at least 90%.

Unlike tokens like SOL and XRP, the SEC has not previously labeled LTC as a security, whereas SOL and XRP were deemed securities in several SEC lawsuits. Therefore, it has a good chance of going through the approval process with fewer issues than other crypto assets that have had problems with the SEC before.

Polymarket users also think that the odds of a Litecoin ETF being approved in 2025 are quite high, at around 73%.

Issuer | Product Name | Date |

REX-Osprey Doge ETF | January 21, 2025 | |

Bitwise Dogecoin ETF | January 28, 2025 | |

Grayscale Dogecoin Trust (Conversion) | January 31, 2025 |

Similar to Litecoin, Dogecoin has a lower number of ETF applications, but because it was never labeled as a security, it has a relatively high chance of receiving approval. James Seyffart and Eric Balchunas give it a 75% chance.

Notably, there is no Polymarket market for the ETF approval of a Dogecoin ETF.

Polkadot ($DOT) | ||

Issuer | Product Name | Date |

21Shares Polkadot Trust | January 31, 2025 | |

Grayscale Polkadot Trust | February 24, 2025 | |

Hedera($HBAR) | ||

Issuer | Product Name | Date |

Canary HBAR ETF | February 21, 2025 | |

Grayscale Hedera Trust | February 28, 2025 | |

Cardano ($ADA) | ||

Grayscale Cardano Trust | February 24, 2025 | |

Other relatively big altcoins have fewer filings as of now. However, there should definitely be more filings for projects like Cardano in the future. Given its market cap, the probability of an ADA ETF receiving approval should also be quite high. However, Polymarket users currently value it at only 59%.

For assets like Hedera and Polkadot, the chances remain uncertain. Their ETF listing probabilities will likely become clearer as more established projects receive approval for their ETF applications.

In addition to the above applications, asset managers have also filed ETF applications for coins like TRUMP, MELANIA, BONK, LINK, and other altcoins. However, their chances of getting listed look quite slim this year. However, this does not mean they won't be listed in the longer term.

Despite the rush into crypto ETFs and analysts expecting many to obtain U.S. regulatory approval in 2025, the demand for these assets will likely depend on overall market conditions.

If the market remains as bumpy as it is now, the demand will likely be much smaller than for Bitcoin and Ethereum ETFs.

While it is exciting to anticipate altcoin ETFs, they will likely not be game-changers for the approved projects.