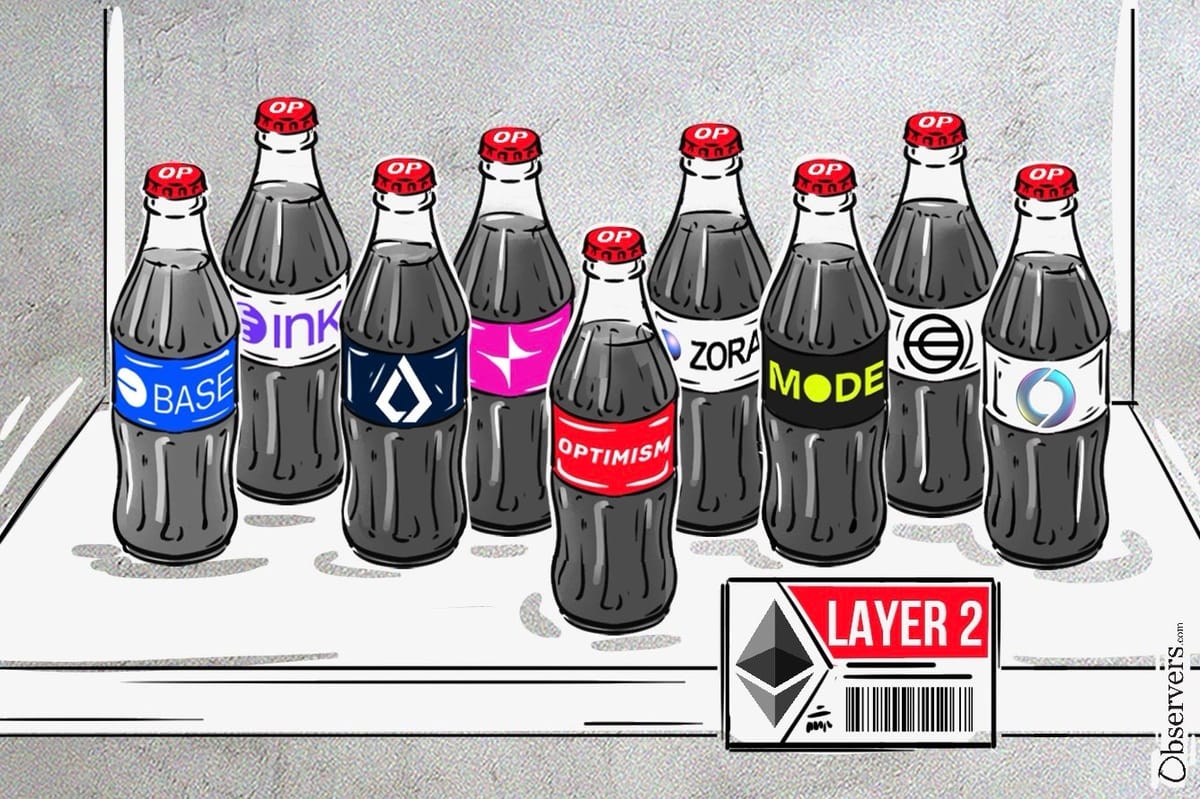

Recently, several major crypto projects have launched their own Layer 2 networks on Ethereum. Among the most notable are Kraken and Uniswap, alongside many others. What’s particularly interesting is that instead of developing their own chains, these projects have opted to utilize the OP Stack and the Optimism Superchain.

The Optimism Superchain now includes over 50 Layer 2 networks and handles 44.6% of all Layer 2 transactions. Currently, some of the largest Layer 2 networks are built on the Optimism Superchain.

It appears that a long-awaited consolidation is taking place in the L2 space, with major Ethereum players leaning towards this single solution.

Why are Projects Choosing the Superchain?

One of the key reasons projects choose this route is to avoid starting from scratch. The OP Stack significantly simplifies the process of creating L2 blockchains.

However, Optimism is not the only player in this space offering ready-made solutions for projects looking to launch their own L2 networks. Projects like Arbitrum and Polygon also provide similar services.

What appears to be a game-changer for Optimism is the Superchain’s resolution of Ethereum’s interoperability problem. All the chains built with Superchain technology are easily interoperable with one another. This means that users can seamlessly transfer and trade various assets between these chains without relying on cumbersome bridges or other third-party applications.

This interoperability is especially appealing when projects like Uniswap, Ethereum’s largest decentralized exchange, are part of your ecosystem, making other L2s naturally drawn to your solution. With more chains joining the network, this interoperability creates strong network effects, establishing Optimism as a preferred choice for L2 technology.

Competitors like Arbitrum have also found success, drawing projects to their L3 solutions. We've recently looked closely at ApeChain, Arbitrum's Layer 3 offering. However, Optimism has successfully attracted larger players with ample resources and extensive ecosystems to continue building.

Some analysts believe Arbitrum made a strategic error by pushing for their own L3 instead of focusing on L2, like Optimism. The [L1 - L2 - L3] triple-governance structure can introduce friction, whereas Optimism's emphasis on Layer 2 allows for greater independence and flexibility for projects.

Optimism Superchain Revenue and Governance

The Optimism Superchain is governed by the Optimism Collective, a coalition of companies, communities, and individuals working together to support public goods and create a sustainable future for Ethereum.

Within the Superchain, each OP Chain operates under a standardized revenue-sharing model that ensures equitable contributions across the network. Every chain commits a portion of its revenue back to the Optimism Collective through a fee split, which is calculated as the greater of either 2.5% of the chain revenue or 15% of the on-chain profit (defined as fee revenue minus L1 gas fees).

To date, the Optimism Collective has generated over 15,800 ETH (~$40 million) in revenue, and this figure continues to grow alongside the expanding Superchain. The generated revenue is reinvested into developing and enhancing the Optimism Stack and ecosystem, benefiting all chains within the ecosystem.

Largest Chains in the Optimism Ecosystem

While some might have assumed that the Optimism Chain is the largest chain within the Optimism Superchain, that is not actually the case. Recently, the Base chain, also built on top of the OP Stack, has been gaining significant traction. With a TVL of over $7.7 billion, it is now the largest chain in the ecosystem. For instance, just recently, Base processed over $18.1 billion in stablecoin transactions, accounting for over 30% of all stablecoin crypto transaction volume on that day.

As the chart below shows, Base significantly outpaces other chains in the ecosystem in terms of transaction numbers.

While Optimism’s own Layer 2 follows in second place, it lags considerably. It is also worth noting that the success of the Optimism Superchain doesn’t directly translate to success for the $OP token, which saw only about a 15% increase over the past year.

Revenue generated is primarily funneled into further developing the Superchain’s technology, with Optimism L2 being one of many chains in that ecosystem rather than the dominant one.

Governance of this collective network will still utilize the $OP token. However, the “governance utility” has not sparked much excitement among users, which likely explains the relatively poor performance of the token despite overall ecosystem success.