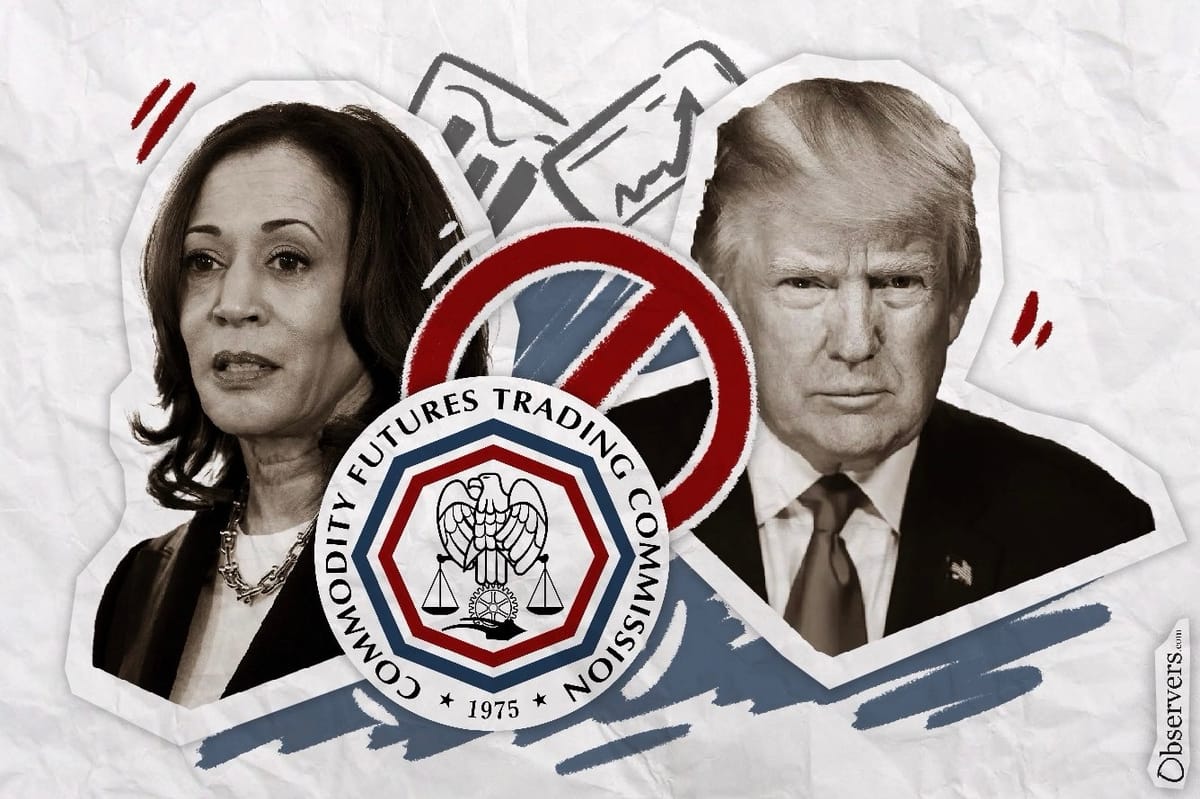

Last night's face-off between presidential candidates Kamala Harris and Donald Trump on the debate stage in Philadelphia was worth watching for several reasons.

Pop icon Taylor Swift, like many other U.S. nationals, saw it as an opportunity to gain insight into making an informed decision about whom to vote for in the November elections.

Several other viewers, however, watched it for money.

Because, whenever a presidential race is underway, bets on its outcome surge.

This time around, thanks to the crypto betting platform Polymarket, traders can bet not only on the election results but also on the behaviors, speech topics, and other micro-events that take place during the presidential race.

While the market is promising in many aspects, the country's regulators are not pleased with elements of it, and have continuously tried to shut down initiatives to list political events for betting.

Why doesn't the CFTC Likes Election Bets?

Election bets are a form of prediction contract, similar to future contracts, but for speculation on future events rather than asset prices.

The Commodities Futures Trading Commission (CFTC) prohibits events contracts that touch on topics such as "terrorism, assassination, war, gaming," as well as any contracts that might be contrary to the public interest.

The CFTC has long considered political bets as one of the latter, claiming that betting on who might win an election might lead traders to cast their vote based on who makes them more money on contracts and also due to their similarity to gambling.

Proponents of political trading contracts disagree. John Aristotle Phillips, an entrepreneur behind one of the few online prediction markets in the U.S., argues that election bets collect information "for the benefit of both participants and non-participants."

Similarly, Ethereum co-founder Vitalik Buterin has called political prediction markets a "social epistemic tool" through which "the public gets a view of how important certain events are and what kinds of things are likely to happen."

In sports, bets are more accurate than predictions by individual experts, and they lead to more informed and active viewers.

Political bets are also a much cheaper and faster mechanism to get a pulse on what is going on compared to the more scientific method of poling, which is the prevalent method for predicting political outcomes used by traditional media.

Election Bets In The U.S.

As one of the oldest democracies in the world, with a sizable population and a tendency for spectacle in everything, including politics, the U.S. has a long tradition of election betting.

This tradition started around the 1860s and peaked at President Woodrow Wilson's re-election in 1916.

World War II, a legal crackdown on sports bets, and the rise of scientific polling led to election bets falling out of practice, re-emerging only in 1993 through an academic project called Iowa Electronic Markets, which accepts election bets from students and faculty members of the University of Iowa.

In 2014, PredictIt, an originally New Zealand project adopted by the Victoria University of Wellington, opened, allowing trading by the general public. Eight years later, the CFTC withdrew the No Action Letter under which the exchange could operate, effectively forcing it to cease operations.

The University responded, and the case is currently waiting for trial.

The CFTC's giving and taking happened again with Kalshi Inc., which got the go-ahead to operate soon after PreditIt lost its in 2022.

The agency reversed its decision in September 2023. Following a year of back-and-forth lawsuits, a federal judge overturned the CFTC's order last Friday.

Crypto events trading exchange Polymarket began listing in the U.S. from its headquarters in New York in 2020.

Two years later, it was ordered to pay a $1.4 million penalty for "operating an illegal unregistered or non-designated facility for event-based binary options online trading contracts."

There are also platforms such as FiveThirtyEight and the New York Times election pool that keep the tradition of election betting alive but without the financial incentive.

The British Controversy, And All That Can Go Wrong With Election Bets

This June, the newspaper Guardian broke the story of an aide to former prime minister Rishi Sunak who placed a bet about an early July election three days before Sunak took the country by surprise by announcing just that—a general election on July.

Betting is about asymmetry of information, which makes the activity prone to cheating by those with insider knowledge of a topic.

Take this example. Last night, Kamala Harris and Donald Trump faced each other for the first time in a debate. On Polymarket, users deposited around $1.5 million on what they believe the Republican candidate will say, such as "Border Czar," "Comrade Kamala," or repeat the word "Alien" more than five times.

On the words and expressions the Democrat nominee might use, "Democracy", "Not Going Back", and "Liar," traders bet $1.3 million.

A script writer for one of the candidates can, without breaking any law, participate in these bets and make substantial money from them.

Other things can also go wrong.

A trader of PredictIt known as Domer told The New Yorker that Trump brings an element of unpredictability to the market. Trump supporters are known to bet on outcomes in which the candidate will come out on top, even when it is extremely unlikely to happen.

Should The CFTC Bet On Political Bets?

While the national election bet exchanges are few and legally troubled, U.S. nationals can and do bet on offshore exchanges: the 2020 presidential election generated around £1.7 billion (around $2.24 billion at the time) on the British-based platform Betfair.

At present, U.S. nationals are placing most of their bets in Polymarket, an unregulated crypto exchange.

It is known that in the U.S., regulation moves slowly and tends to be punitive toward industries it still doesn't know how to control.

Polymarket has recently secured $70 million in venture funding, meaning it is not the one losing here. The question is, who is - and are they worth protecting?