The State of Stablecoins 2025

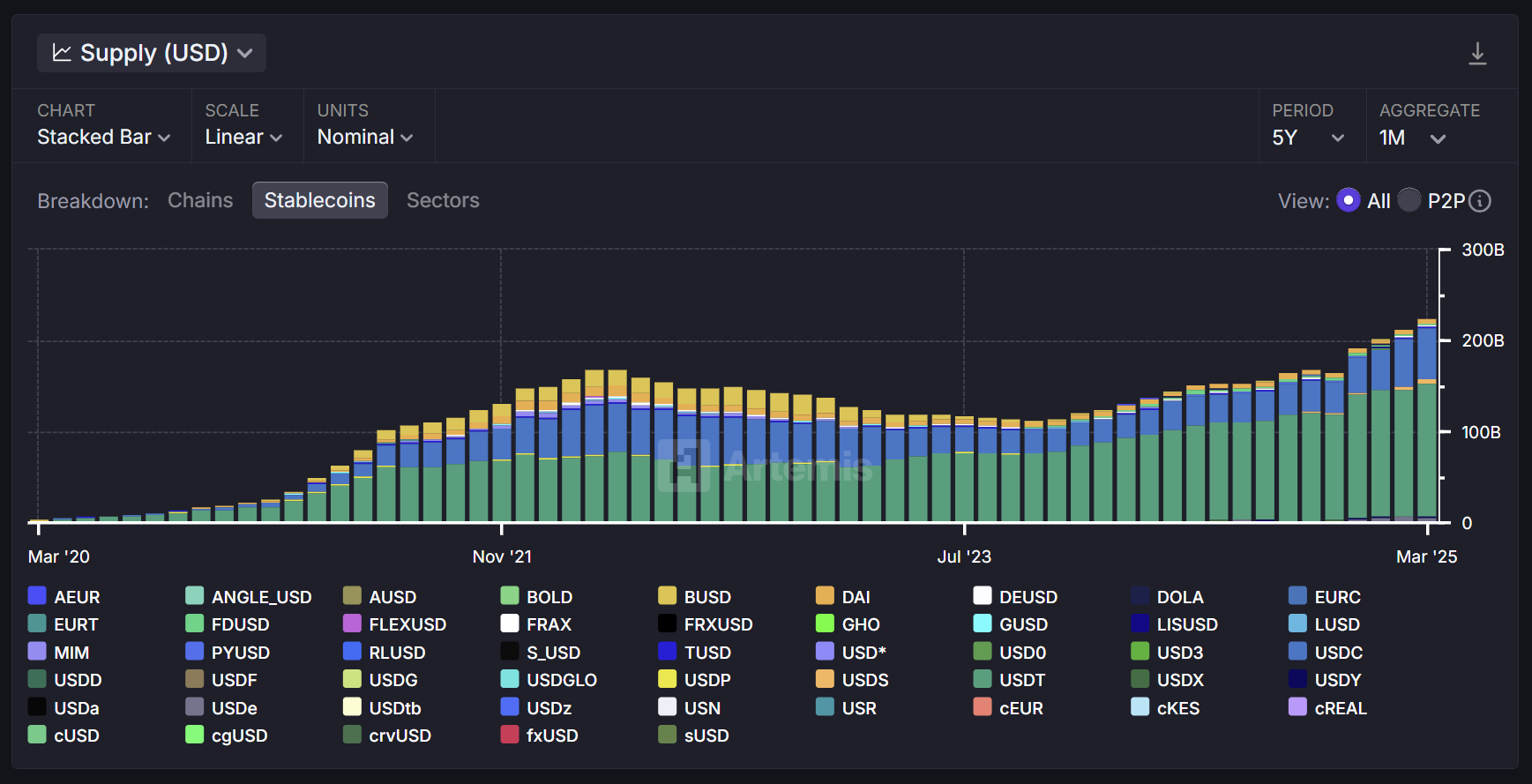

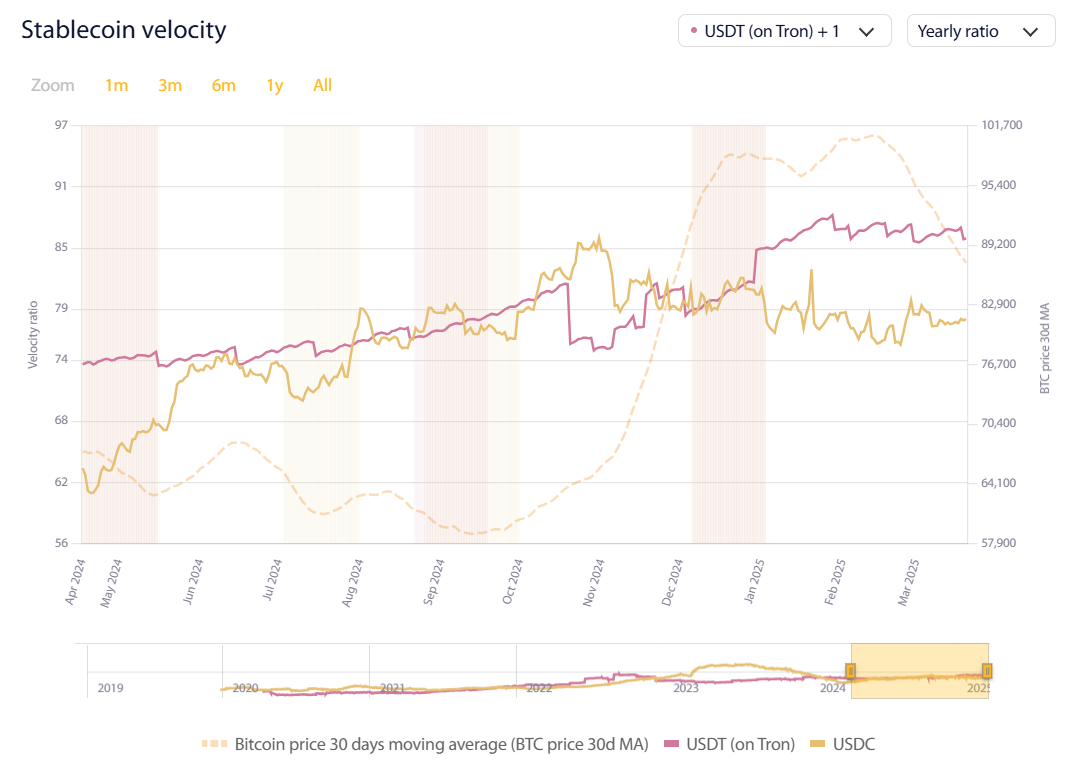

Stablecoins remain one of the top use cases in crypto, with the market showing tremendous growth year over year. USDC market share climbs to 25% taking 4% from USDT. The velocity measure for USDT of Tron and USDC is almost equal, while USDT on Ethereum moves two times slower.