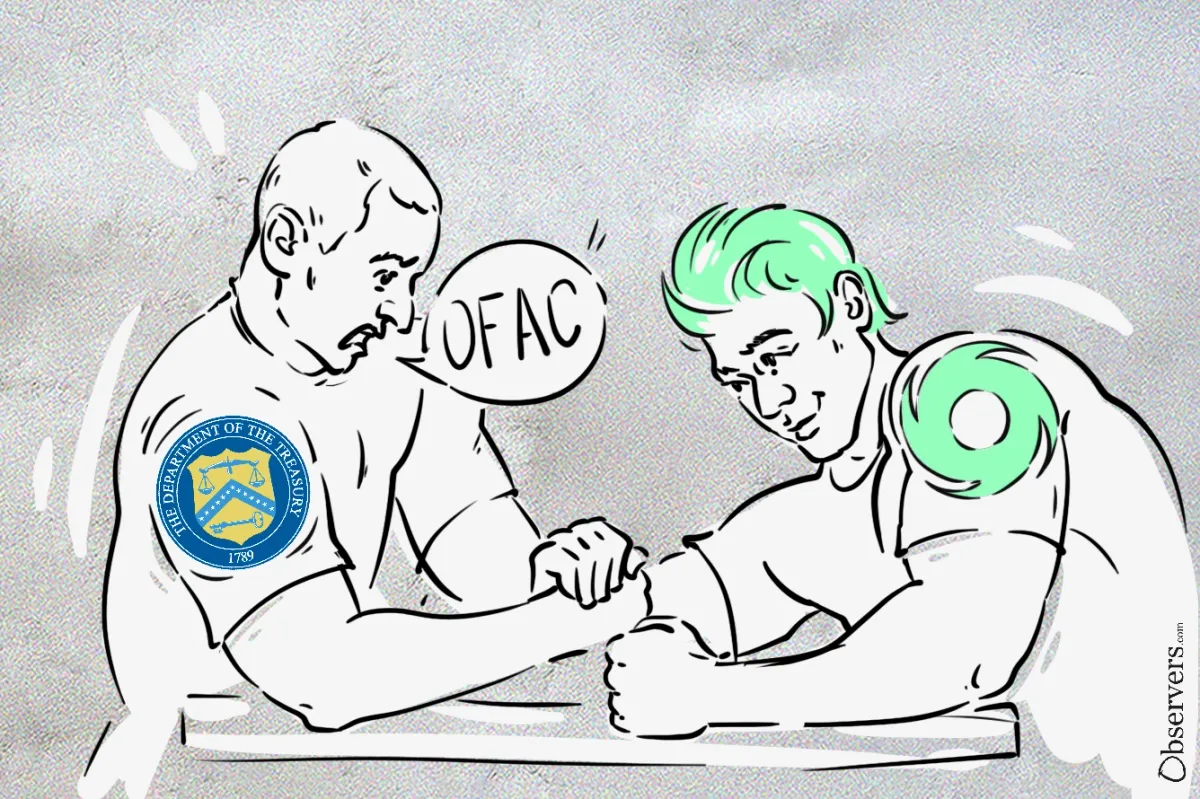

Under current legislation, OFAC sanctioning Tornado Cash's immutable smart contracts was a pointless overstep.

The ruling, decided by a judge on the United States Court of Appeals for the Fifth Circuit on November 26, is being heralded by the crypto community as a major win for decentralized technology.

"Immutable smart contracts just beat the treasury department in court," Uniswap Labs CEO Hayden Adams crowed on X.

While the privacy-preserving crypto mixer will now be removed from the OFAC sanction list, its creators are still fighting courts in the U.S. and the Netherlands to prove their innocence over a series of money laundering allegations.

Roman Storm, whose trial has been postponed to April 14, said: "My fight is not over yet, and I still lack resources."

The Verdict

The lawsuit on which the Fifth Circuit ruled on Tuesday had been filed by six Tornado Cash users, headed by Joseph Van Loon and backed financially by Coinbase a few weeks after the Treasury Department's Office of Foreign Assets Control (OFAC) sanctioned Tornado Cash for violating the International Emergency Economic Powers Act on August 2022.

The plaintiffs claimed that, contrary to OFAC's claims, the smart contracts weren't the property of any foreign national entity.

As such, the office was overstepping its authority.

The Fifth Circuit judge determined that because the contracts that execute the mixing service of Tornado Cash pools are immutable (meaning that nobody can stop them or exert control over them), nobody can exclude somebody else from using them.

"Tornado Cash cannot "unplug" the immutable smart contracts. Even if Tornado Cash did not want North Korea, the Lazarus Group, or anyone else, for that matter, using the immutable smart contracts that the Tornado Cash developers created, Tornado Cash—let alone the Department—would be powerless to stop them."

OFAC sanctions, the judge concluded, were incapable of stopping North Korean hackers from using Tornado Cash.

Furthermore, smart contracts aren't actually contracts, in the sense that there are two parties in agreement about something, and anyone can send funds through them for a crypto address without requiring the receiver's permission.

By putting the crypto-mixer on the list of Specially Designated National and Blocked Persons (SDN), OFAC then created unnecessary liabilities for any user with a crypto address, who authorities might identify for breaking the IEEPA and other legislation without them ever even interacting with Tornado Cash.

"No one wants criminals to use crypto protocols, but blocking open source technology entirely because a small portion of users are bad actors is not what Congress authorized. These sanctions stretched Treasury's authority beyond recognition, and the Fifth Circuit agreed," said the Chief Legal Officer of Coinbase, Paul Grewal.

The Game Isn't Over

While the Fifth Circuit agreed that the government overreached when it sanctioned the decentralised privacy tool, it also recognised that the current legal status has "blind spots" and that it causes "disruptive effects."

"We readily recognize the real-world downsides of certain uncontrollable technology falling outside of OFAC's sanctioning authority," the decision filed reads. It adds: Unlike the smart contracts in question, the law is a mutable affair.

In recognizing that the current legal body isn't adequate to stop the threats arising through present-day technology, the Fifth Circuit has low-key asked Congress to update the law.