Trump has been officially sworn in as the 47th president of the United States of America.

In the days before the president’s inauguration, the launch of his and his wife Melania Trump's meme coins, as well as the million-dollar purchases of Trump’s crypto project World Liberty Financial, sent the crypto space into total disarray.

The Memecoins

The announcement of the launch of Donald Trump's official meme coin $TRUMP on Friday on Solana was received frantically by his crowd of supporters who immediately bought the token, leading its market capitalization to soar from around 0 to $15 billion in a matter of hours.

The “to the moon trajectory” lasted until Sunday when the release of Melania Trump’s meme coin killed her husband's token. Seven hours after its launch, $MELANIA had more than $1 billion in the market, reached an all-time high of $13, but cost $TRUMP 1/3rd of its market cap. $TRUMP has not fully recovered since then, and the sentiment around these two tokens now seems to be aligned.

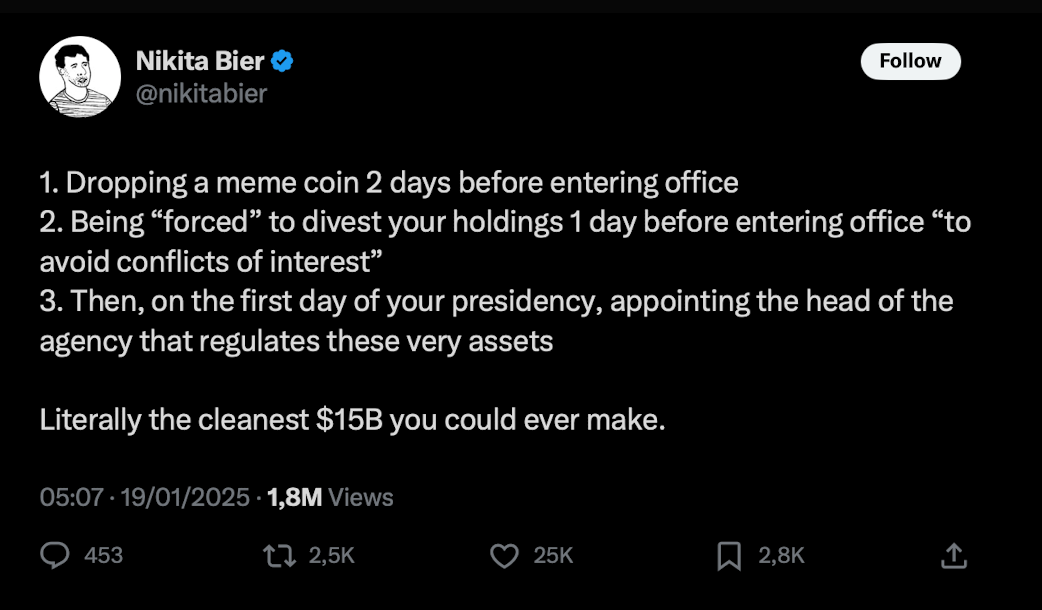

The price movements and timing of the launch of the presidential couple’s meme coins sparked intense criticism and frustration online.

Users who rushed to buy cryptocurrencies for the first time so that they could buy the tokens were outraged when their values began to decline.

Accusations of Trump rug-pulling his supporters and calls for Gary Gensler, considered crypto's number one enemy until very recently, to come back began to spread like wildfire.

Analysts, on the other hand, pointed to how illegal the whole affair would have been if it had been done by anyone else or even by the President himself at any other time than not the long weekend that preceded the inauguration: the U.S. Constitution prohibits presidents of profiting from the presidency - meaning that the launch could not happen after the inauguration - and, even if securities laws were broken by the launches during the weekend, Trump is now protected from being held accountable due to presidential immunity.

“Trump family has extracted more money in 2 days from the trenches / hot ball of money than any app or bot has all year combined,” shared with its 300 thousand followers the cryptocurrency trader Moon on X.

WLF Actively Buying Crypto and ENS Domains

Trump’s family crypto project, World Liberty Financial, has aggressively bought millions in crypto during the past few days, with the latest purchase happening already after the President’s Inauguration.

According to data from Arkham Intelligence, “the instant he [Donald Trump] was sworn in, Trump’s project World Liberty Fi bought $4.7 million of Bitcoin.”

The platform spent over $103 million in tokens such a TRX, Aave and LINK, and its recent purchases of ETH bring its total holdings of Ethereum’s token to more than 47,000 ETH.

Further, on January 20, on-chain data showed that wallets related to WLF acquired ENS domain names.

All-Time Highs And Record Levels Of Users

Unsurprisingly, Bitcoin hit an all-time high of $108,786 on the first hours of Monday.

Solana, where the presidential family meme coins were launched, also reached an all-time high of $293,31 on Sunday.

Solana’s meme-coin marketplace Moonshot, one of the first to allow trading of the $TRUMP meme-coin, reported over 1 million active users.

The spike in usage, also witnessed by several other apps on Solana, led to congestion issues and transaction delays.

While decentralized platforms solved their issues swiftly, centralized exchanges took longer and were much more heavily criticized for being unable to fulfill requests.

Coinbase’s CEO Brian Armstrong apologized to users on X due to issues in processing transactions with Solana.

One user woke the FTX ghost to ask Coinbase for proof of solvency and reserves upon noticing that his SOL transaction would take more than nine hours to complete.

With U.S. number one crypto exchange unable to rise to the occasion, Binance, while it also reported some issues, ended up being the exchange that processed most of the transactions during the last three days.

According to market analyst ltrd, the Binance listing was the catalyst that led to the price of Trump’s meme-coin skyrocketing.

“TRUMP’s turnover on Binance alone caught up with the total turnover of all US equities for the entire month of January,” ltrd wrote in a post on X.

What’s next?

In the short term, a week of high volatility is expected.

In the medium term, industry leaders are confident that the new administration will move pro-crypto moves. Circle CEO Jeremy Allaire believes executive orders regarding the sector are imminent, and the developments of recent weeks make his belief highly likely.

Despite the pace at which Trump-associated accounts bought, sold, and created cryptocurrencies in the last few days, the President has let down crypto users who were expecting a mention of the sector during the inaugural speech and those executive orders Trump promised to sign on his first day in office.

NO ROSS PARDON, NO LEGALIZATION OF PERPETUAL SWAPS AND NO CRYPTO EXECUTIVE ORDER

— Flood (@ThinkingUSD) January 21, 2025

HAVE WE BEEN BAMBOOZLED BY THE TRUMP CRIME FAMILY?

Instead, when Trump was asked if he would continue to create financial products that benefit him personally, his response was, "I don't much about it," before joking that several billion "...is peanuts for these guys".