The market surged yesterday following news World Liberty Financial (WLF), a DeFi platform led by Donald Trump's family, increased its holdings in Ethereum (ETH), Aave (AAVE), and Chainlink (LINK).

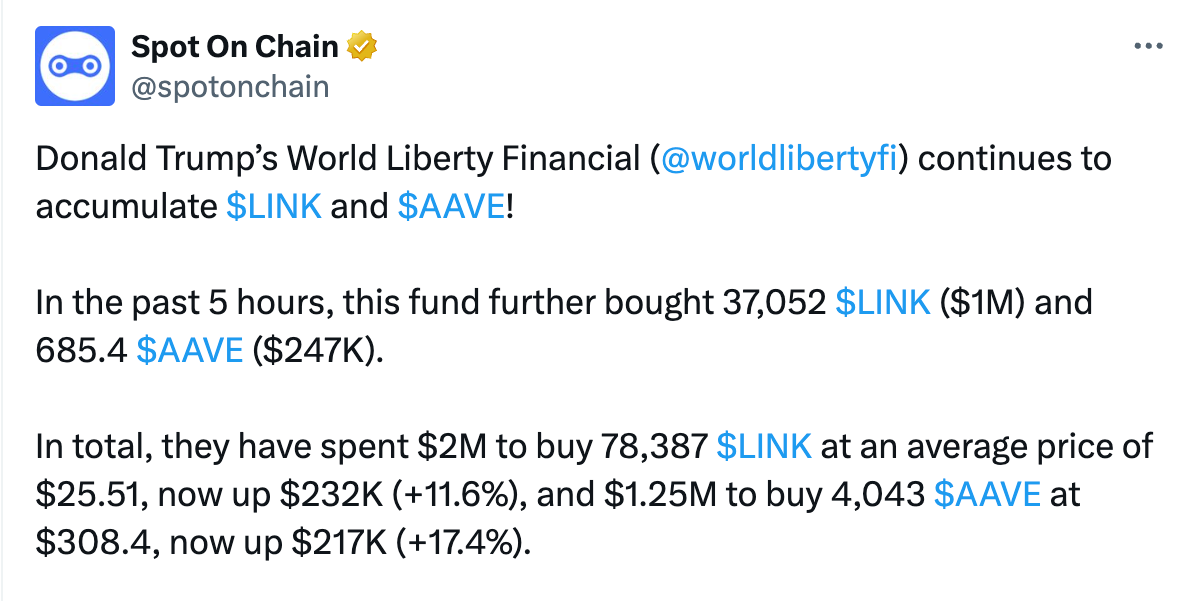

The $12 million spending spree broke down like this: $10 million for 2,631 units of ETH, and around $1 million each for substantial quantities of AAVE and LINK. Not long after the news broke, AAVE soared roughly 31% in the past 24 hours, and LINK rose by about 23.5%.

Spot on Chain also revealed additional purchases amounting to $30 million in ETH. This kind of confident market buy-in suggests WLF's bullish outlook on these assets and hints at potential upcoming announcements that could further influence the DeFi and broader crypto landscape.

Strategic Partnerships Enhance DeFi Capabilities

The news follows WLF's confirmation of the adoption of the Chainlink standard to enhance its DeFi operations. In a press release last month, they said they "will leverage Chainlink as the standard for onchain data and cross-chain interoperability” to secure its protocol ecosystem.

The press release went on to describe Chainlink as “the most secure solution for solving critical security, interoperability, and onchain data problems” while noting that this would “kick off the next wave of DeFi mass adoption” for WLFI.

"World Liberty Financial's partnership with Chainlink marks a huge step forward. Never before have we been more bullish on crypto or the overall future of DeFi technology," stated Eric Trump, Web3 Ambassador at World Liberty Financial.

In addition to Chainlink, WLF has also proposed significant integration with Aave. This includes a plan submitted to the Aave governance forum detailing how WLF intends to utilize the Aave platform for its crypto operations.

Trump & WLF's Impact on DeFi and Crypto Regulations

During a visit to the New York Stock Exchange yesterday, where he rang the opening bell, Donald Trump made yet more bullish remarks about the cryptocurrency sector. When asked directly about integrating Bitcoin into the U.S. strategic reserves, Trump offered a vague answer, promising broad support for the industry.

Trump's election win has already bolstered markets. We've already seen a euphoric post-election rally, the announcement of a crypto-friendly SEC chair, and the fizzling out of some of the SEC's more high-profile lawsuits.

This new round of investment by WLF positions the platform to potentially lead a transformative wave in how DeFi services are integrated and utilized across the financial sector. As regulatory landscapes gain more clarity under Trump, WLF's efforts could help influence the future trajectory of DeFi's adoption and its integration into mainstream financial services.