Today, the anticipated World Liberty Financial token (WLFI) went on sale for whitelisted customers. The sale went live at 8:00 a.m. Eastern time with over 344 million tokens sold in the first hour to around 3,000 unique wallets, according to blockchain data analyzed by Coindesk. Apparently, one wallet connected to the token holds nearly $4 million worth of ether (ETH), $1.2 million of tether (USDT) plus around $250,000 USD Coin (USDC) tokens.

In a live Spaces chat yesterday, the head of operations at WLF, Zak Folkman, shared more information on the token, explaining that WLFI would be an Ethereum-based ERC-20 token and it would function as the governance asset of the decentralized finance (DeFi) platform.

.@WorldLibertyFi Token Sale goes live on Tuesday morning, October 15th! This is YOUR chance to help shape the future of finance. Be there on Monday, October 14th at 8 AM EST for an Exclusive Spaces to learn more. Join the whitelist today and be ready for Tuesday:…

— Donald J. Trump (@realDonaldTrump) October 12, 2024

According to a leaked white paper last month, the WLFI token will be nontransferable for 12 months from distribution, though holders can obviously use it immediately to participate in governance votes.

For now, the platform is open only to accredited U.S. investors who meet the Securities and Exchange Commission’s criteria. Investors must earn over $200,000 annually or possess more than $1 million in assets to participate. WLFI aims to raise $300 million from token sales, placing its valuation at around $1.5 billion. According to the team, 63% of the tokens will be sold to the public, 17% will be reserved for rewards, and 20% will be allocated to the team.

None of the limitations seemed to dampen Folkman's and the rest of the WLF executive team's excitement. On the 80-minute Spaces chat, they boasted of the 100k in whitelist sign-ups and reiterated points made in their Oct. 11 blog post. They say the platform will allow users to borrow and lend crypto, create and interact with liquidity pools, and transact with stablecoins.

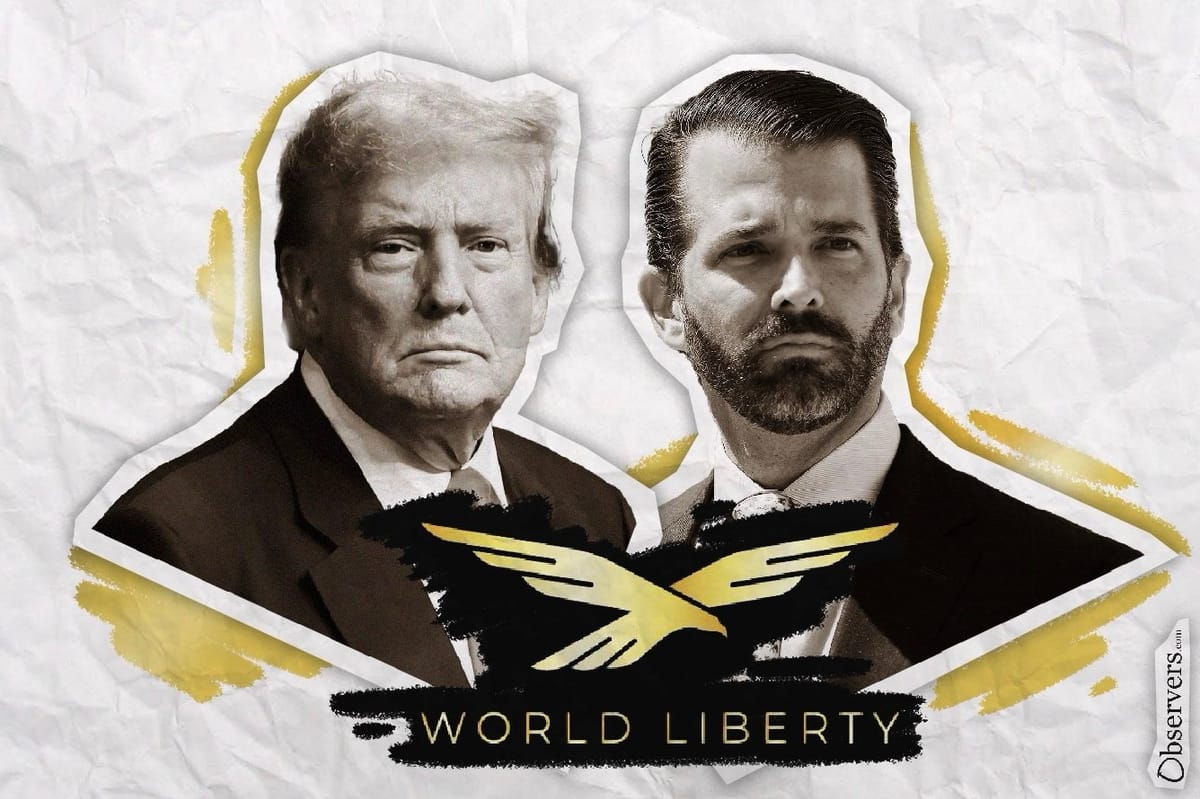

Donald Trump Jr. showed up between his tough schedule of "saving the free world," using the opportunity to promote his Father's election campaign.

"I'd pay good money to see Kamala Harris explain the blockchain," Trump Jr. said, ramming home his Father's commitment to the crypto community. "From the political side, in 23 days, you've got to vote... Kamala is pro-crypto when she has to be. Just don't fall for it."

Trump Jr. explained that WLF's vision was to address the banking system's "imbalances, inequities, and inefficiencies," which he said had become politically charged and was now just a "giant Ponzi scheme." Trump Jr. described the lack of loan approval for his family as a rude awakening. "This is not a fair market," he said, comparing his family's struggles to the everyday American. Unfortunately, the call dropped out a few times as Trump Jr. was en route to take a flight on his private jet.

Aave's CEO, Stani Kulechov, also made a short appearance on the call. He expressed his excitement about WLF integrating Aave’s borrowing and lending protocols and was seemingly thrilled that Aave would be part of the platform’s core DeFi functionalities.

There is no doubt that WLF is a somewhat self-serving move from a family that has found themselves in serious legal and financial trouble of late. As president, Trump declared bitcoin “not money” and criticized it as “highly volatile and based on thin air."

Still, needs must. Right now, Trump needs the crypto community, and they need him.