As the bull market rages on, the fear of missing out, coupled with an excess of information consumption, is making users exceedingly vulnerable to attacks that exploit users' (already depleted) trust in something or someone else.

Influencers and key opinion leaders (KOL) are at the center of these hacks.

Fake accounts mimicking original ones are everywhere, and social media accounts with a large following are hacked almost daily now.

While some influencers are also victims, others, ignoring existing laws, purposely mislead their followers for their own personal gain.

Influencers As Bait

Twitter Hacks

Elon Musk's X is the main square of the crypto community, and like most main squares around the world, it has a fair share of pickpockets (or "pick-handles" in this case?)

Just this week, two high-profile accounts were hacked into.

On Wednesday, hackers got into the X account of the UpOnly from the crypto apostles Cobie and Ledger, posting a fake brand token and altering the account's handle, making the original one up for grabs.

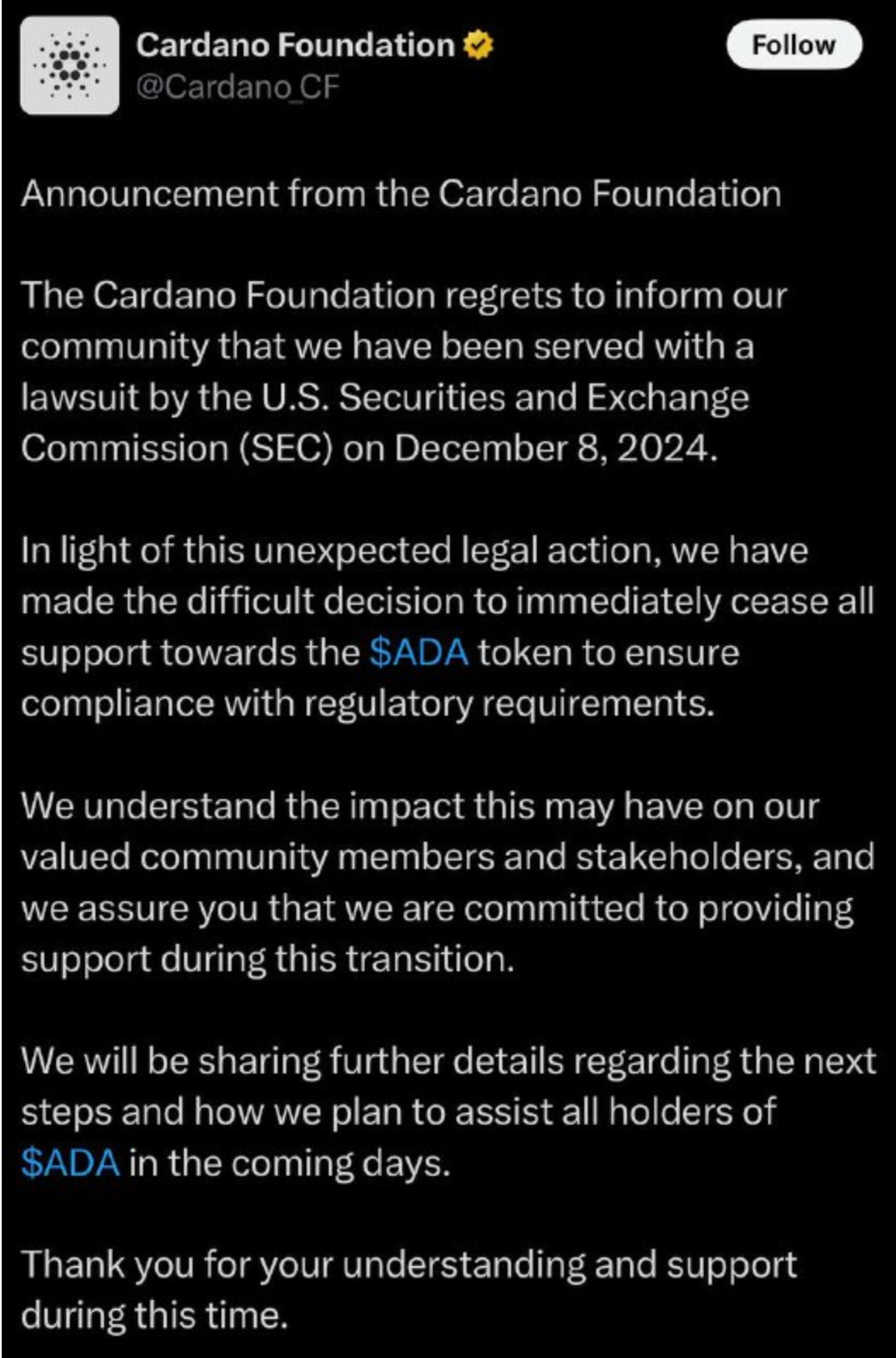

On Sunday, the Cardano Foundation's X account was hacked to (again) promote a fictitious token, ADAsol. Later, the scammers published a claim falsely stating that the organization would cease support for the ADA token after being served a lawsuit by the United States Securities and Exchange Commission.

Twitter Impersonators

Earlier this week, both a Web3 security project scam sniffer and a crypto sleuth Cos issued a warning regarding a new "Telegram Safeguard" scam. The air of legitimacy with this scam has been proven to be an efficient bait to dozens of users.

Attackers impersonate crypto influencers on social media to lead their followers towards Telegram channels where they promise to share exclusive investment advice, but once users join in, they are asked to verify their identity through fake Safeguard bots that immediately inject malicious code into their clipboards.

If they execute the bot's suggested commands, their systems become compromised.

Similar malware has been able to scan devices for wallet data, collect sensitive information, including private keys and passwords, and send it to hackers.

Influencers Gone Rogue

Three United States researchers went through the tweets of the 180 most prominent crypto influencers earlier this year and concluded that: "Crypto-influencers' tweets are initially associated with positive returns. However, these tweets are followed by significant negative long-horizon returns, suggesting they generate minimal long-term investment value."

The study showed that the price of promoted tokens rises in the first twenty-four hours following an influencer's mention and then starts to crash.

Users' losses are larger when they follow the alpha of self-entitled "experts" (a vague title that most often bears no accreditation): "Their advice appears to be the least profitable," the paper read.

Fartcoin currently has a market cap larger than 38% of U.S. public-traded companies, meaning that not only is the crypto market extremely volatile, but it is also extremely unpredictable.

Given the market characteristics, it is hard to get it right all the time or even most of the time, which is why users are strongly advised to do their own research before committing funds to a project.

Yet, despite giving the benefit of the doubt, it is impossible to ignore the large number of influencers who advise followers about hot tokens, when the only merit to the advice is that those very tokens are in their own portfolio sitting & waiting until the price is high enough to sell.

With the rise of meme coins,which can be created in minutes on websites such as Pump.fun, rug pulls have become even more prevalent, and it isn't only unknown internet juggernauts who feel confident enough to do them.

In one of the most recent flashy cases in the industry, last week, Haliey Welch, mostly known as the "hawk tuah girl" from an Instagram video that catapulted her to online fame, and her team launched a meme coin and rugged it all on the same evening.

Like several of its kind, the scam catered to people outside of crypto who don't have the background to understand the fee structure or the token economics of projects but are lured into buying due to Welch's popularity.

While the rate at which these scams are happening is unprecedented and the technicalities of some of the scams are also new, the social behavior of users - who tend to maintain their trust once they have positioned it - and of hackers - who exploit this very human laziness (or efficiency) for their own gain.