U.S. Senator Cynthia Lummis introduced a controversial bill to mandate the U.S. Treasury to purchase 1,000,000 bitcoins, around $60 billion at current prices, over a five-year period.

“As families across Wyoming struggle to keep up with soaring inflation rates and our national debt reaches new and unprecedented heights, it is time for us to take bold steps to create a brighter future for generations to come by creating a strategic Bitcoin reserve,” - said Lummis when introducing the BITCOIN bill in the U.S. Senate on July 31.

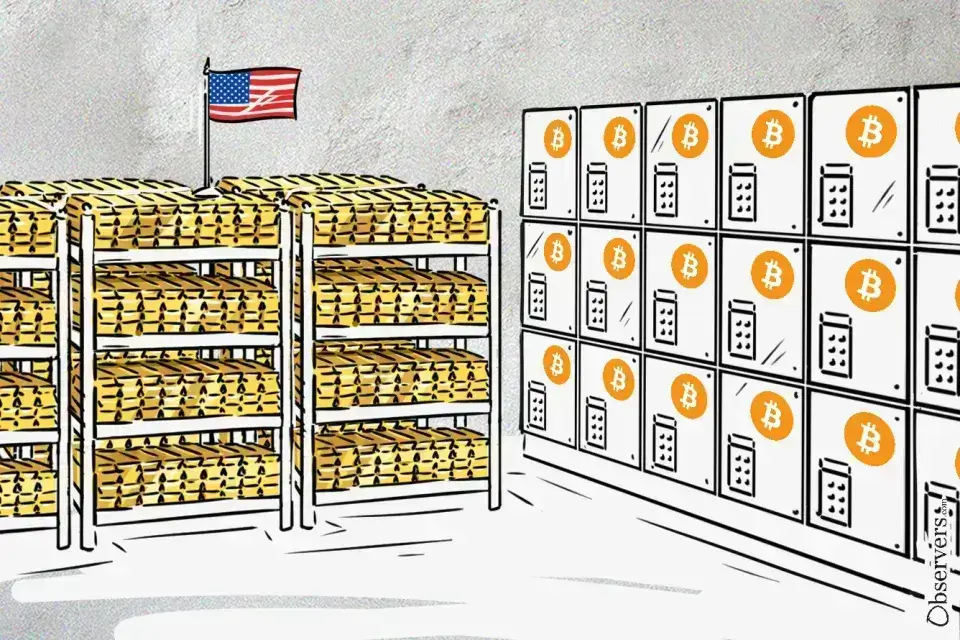

The bill directs the Treasury to create a Bitcoin reserve, "mirroring the size and scope of the nation's gold reserves" (estimated at 20% of all gold globally). The target is impressive: the one million bitcoins suggested by Lummis adds up to about 5% of the total Bitcoin supply. The assets should be held for at least 20 years and stored in a decentralized network of secure Bitcoin vaults operated by the U.S. Department of Treasury.

The bill, titled "Boosting Innovation, Technology and Competitiveness through Optimized Investment Nationwide," to be spelled as the BITCOIN Act, could be another PR paper circulated by the pro-crypto senator. Yet, one part of the bill—the source of funds suggested by the authors—is worth a second look.

Since voters are sensitive about where taxpayers' money is spent, Senator Lummis suggested using the "excess" funds at the Federal Reserve banks to offset the expenses. Let's review them as best we can understand:

- The first is the surplus fund of the Federal Reserve Banks. The existing cap on the aggregate amount of these surplus funds is $6.825 billion. The bill suggests reducing the cap to $2.4 billion and using the freed $4.425 billion for the Bitcoin Purchase Plan. This is not a recurring amount, but one-time-only draw on the accumulated funds, so they still need to find another $55 billion.

- The next source also comes from the Federal Reserve Banks, this time via the earnings that are normally remitted to the Treasury. The bill proposes that for the fiscal years of 2025-2029, the first $6 billion of these payments be directed towards funding the Bitcoin Purchase Program before repayment of any previous financial obligations. This option isn't always available, though, since, for example, in 2023, Federal Reserve banks' operations resulted in a combined loss of $114 billion, due to high interest rates.

- The major funding source for the Bitcoin Purchase Plan is highly controversial: the revaluation of the gold reserves. The U.S. Federal government owns the gold and holds it as security for around $11 billion in gold certificates issued, in book-entry form, to the Federal Reserve Banks. The Treasury backs these certificates by holding an equivalent amount of gold at the statutory exchange rate of $42.22 per troy ounce of gold. Revaluating these holdings to the current market price of $2,513 per troy ounce of gold would result in a windfall accounting gain of around $600 billion for the Federal Reserve Banks. Senator Lummis proposes that Federal Reserve banks transfer the cash amount of the realized gain to the Treasury for the Bitcoin Purchase Plan.

Most of the commentaries from the banking experts are negative, and they doubt that the plan is viable because of the lack of the Fed's "excess reserves".

According to George Selgin's observation, it will worsen the financial position of the Fed. The Federal Bank would need to pay more interest on the increased bank reserves.

Some also expressed their discontent with the fact that foreign and domestic Bitcoin owners will benefit on the account of the U.S. taxpayers, even calling the bill "a pump scheme for current Bitcoin holders."

Finally, if Congress considered this, other cryptocurrencies and interest groups would likely push to be included in the Government purchase plan too. This could lead to pressure on the Government and potentially distort the market.

The crypto community's first reaction towards the bill was positive, but later, we observed several concerns, including the possibility that the government's vested interest in Bitcoin would distort the crypto market and harm innovation and altcoins. On top of which, the U.S. government owning 5% of total supply will have excessive power over the Bitcoin market.

Nevertheless, the topic is popular in the U.S. Robert F. Kennedy Jr., an independent candidate for president who recently suspended his campaign, also suggested creating a strategic reserve of four million Bitcoins. Further, Donald Trump, has publicly promised to create a U.S. strategic national Bitcoin stockpile during the Bitcoin 2024 conference. He proposed holding rather than selling bitcoins seized by the authorities from various malefactors. According to some on-chain intelligence reporters, the U.S. government holds $12 billion in such bitcoins.

The only other country that publicly holds Bitcoin in its treasury reserves is El Salvador. Following President Nayib Bukele's vision, the country has been accumulating BTC since 2021 and now holds 5,829 bitcoin in its portfolio.

It is not yet clear when the bill's next hearing will be. After its introduction, the bill was assigned to the Committee on Banking, Housing, and Urban Affairs for study. After the committee releases it, the bill will be put on a calendar to be voted on, debated, or amended. We will observe and report on this.