Another U.S. company has announced it's betting big on Bitcoin, and adopting the cryptocurrency as its primary treasury reserve asset.

Semler Scientific, which makes medical devices to treat chronic diseases, has acquired 581 BTC for $40 million.

While this might seem like a drop in the bucket compared with MicroStrategy's huge crypto war chest, it's significant nonetheless. Why? Because this amounts to almost two-thirds of the cash reserves that the company had in the first quarter of this year. The company's chairman, Eric Semler, explained:

"Bitcoin is now a major asset class with more than $1 trillion of market value. We believe it has unique characteristics as a scarce and finite asset that can serve as a reasonable inflation hedge and safe haven amid global instability."

Semler went on to argue that Bitcoin was a superior safe haven to gold — and given the precious metal has a market cap that's 10 times higher than the world's biggest cryptocurrency, BTC "has the potential to generate outsize returns."

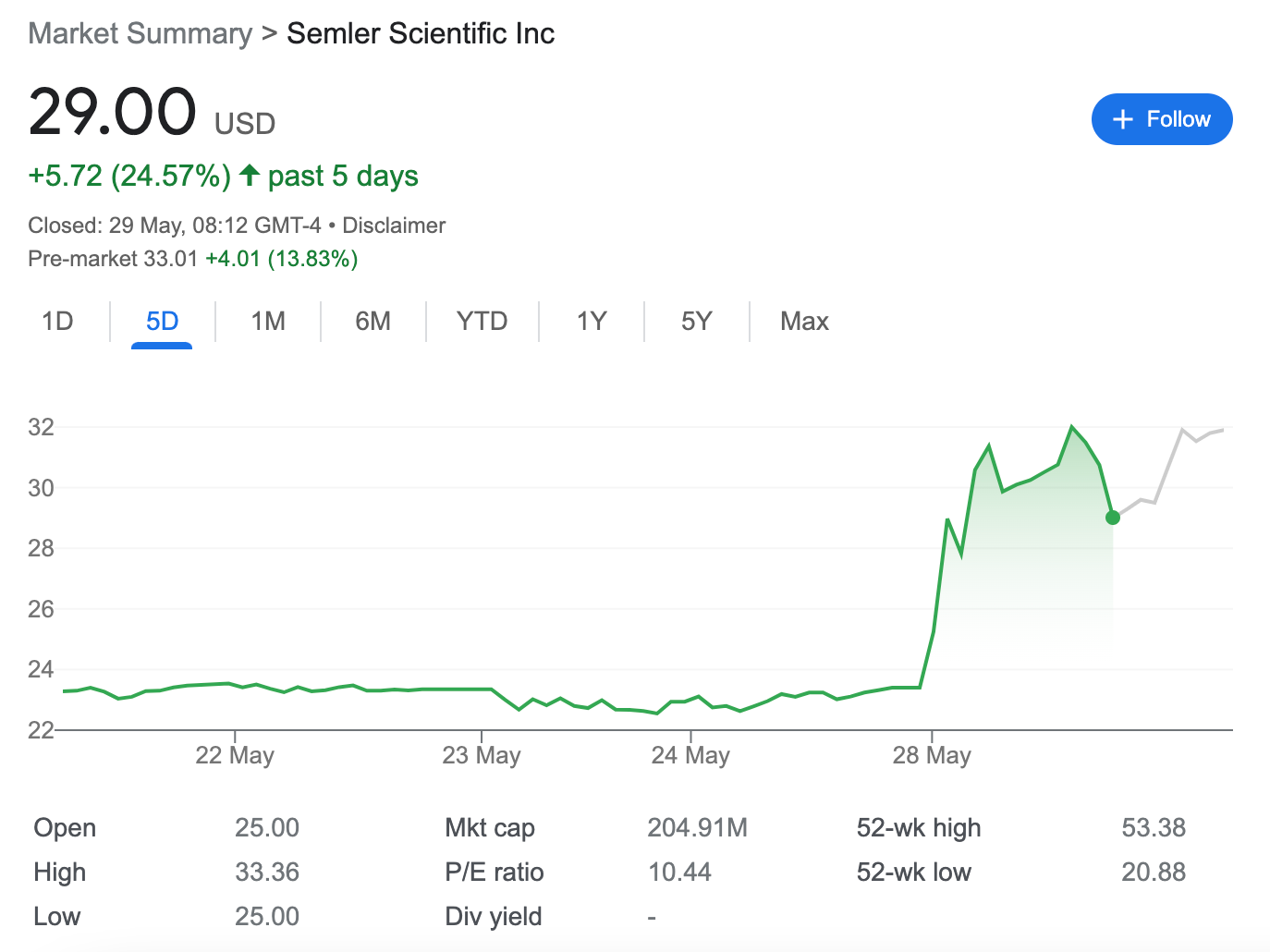

Traders on the Nasdaq reacted warmly to the news. See if you can spot on this chart when Semler made its announcement:

Embracing Bitcoin so aggressively — and accruing 1% of total supply since August 2020 — has proven to be hugely lucrative for MicroStrategy's shareholders. The stock has surged by 460% over the past 12 months and 1,160% in five years, rallying hard when BTC's price appreciates. MSTR is now being added to MSCI's prestigious ACWI Index, which is closely tracked by a number of funds.

Investing in MSTR has been regarded as a way of gaining exposure to this digital asset without owning it directly — but now exchange-traded funds based on Bitcoin's spot price have launched, you could argue that the stock no longer needs this role.

It didn't take long for BTC to dominate MicroStrategy's operations, with few in the crypto space realizing it actually specializes in offering business intelligence software. Michael Saylor ended up taking a step back as the firm's CEO, becoming its executive chairman, so he could focus on advocating for wider Bitcoin adoption.

For its part, Semler Scientific has vowed to remain focused on specializing in medical products and services. Its CEO Doug Murphy-Chutorian said:

"We remain dedicated to our customers and our goal of operating a growing and profitable healthcare company."

Despite Bitcoin's impressive performance over the past five years, few publicly listed companies have opted to add this cryptocurrency to their balance sheet. While Tesla did for a while, the electric vehicle manufacturer ended up offloading a substantial chunk of its investment. Regulatory compliance and accounting headaches are likely to blame, as well as concerns over volatility.

Undeterred, MicroStrategy holds an annual event called Bitcoin For Corporations, where Saylor attempts to persuade executives about the benefits of moving away from cash. During his most recent presentation earlier this month, he pointed to figures that show BTC has far outperformed the S&P 500, Nasdaq, gold, silver and bonds over the past four years.