There's a flurry of legislative activity designed to regulate stablecoins right now.

In the same week as the U.K. declared it wants to give issuers clear rules of the road to follow, a bipartisan bill in the U.S. intends to follow suit.

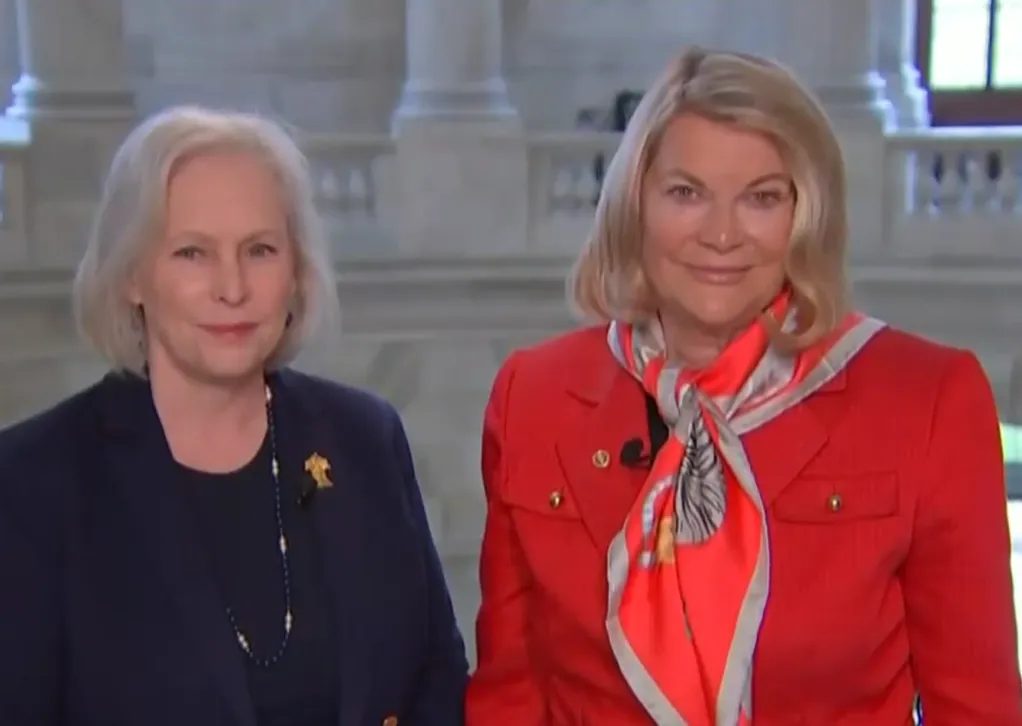

Republican Senator Cynthia Lummis and her Democratic counterpart Kirsten Gillibrand — pro-crypto politicians who have teamed up before — are joining forces once again with the Payment Stablecoin Act.

They both argue that action is needed to preserve the dollar's dominance, with China streets ahead of major economies through its rollout of the digital yuan. Explaining how it would work, Gillibrand said:

"It protects consumers by mandating one-to-one reserves, prohibiting algorithmic stablecoins, and requiring stablecoin issuers to comply with U.S. anti-money laundering and sanctions rules."

If approved, this would address two major pain points that exist with stablecoins right now. Algorithmic digital assets — which use code to maintain a peg to the dollar rather than real-world reserves — suffered a fatal reputational blow following the collapse of Terraform Labs. And when it comes to issuers that do claim to match every coin with $1 held in a bank, such a law would mean they have to prove their working.

There would also be a significant advantage for the consumers who currently use stablecoins. Lummis and Gillibrand say their proposed bill would mean issuers can join the FDIC's program, which means consumers would receive funds back if a company enters insolvency. As unlucky UST investors found out after a $40 billion market rout in May 2022, everything can be lost.

The bill also acknowledges that legacy financial systems fail to offer the immediacy that's expected in an online world. While cross-border payments via wire transfer can take up to 10 days to process, both politicians say stablecoins drive down fees and settlement times — all while enabling entrepreneurs to build apps that give consumers greater control over their money.

It's also positioned as a matter for national security — amid fears that offshore and unregulated stablecoins are being used as a source of funds for Hamas, Hezbollah, and North Korean hackers.

Just like the U.K. — which faces political uncertainty as an election looms — Washington is likely to grind to a standstill as the presidential battle heats up.

But there's little doubt that the nuanced, technologically literate legislation will be welcome among crypto businesses reeling from the heavy-handed approach from the U.S. Securities and Exchange Commission.