Since 1962 Cuba has been under an economic embargo imposed by the United States, which prevents American companies from doing business with Cuba. Financial services, as well as payment systems, are no exception.

The first push to use crypto was in 2020 when the Trump administration banned Western Union from Cuba, and people looked for new ways to send money to their families.

“When Western Union ceased to exist, there was a big rise in remittances via cryptocurrencies,” said Erich García, founder of BitRemesas.com, a company that now processes crypto remittances.

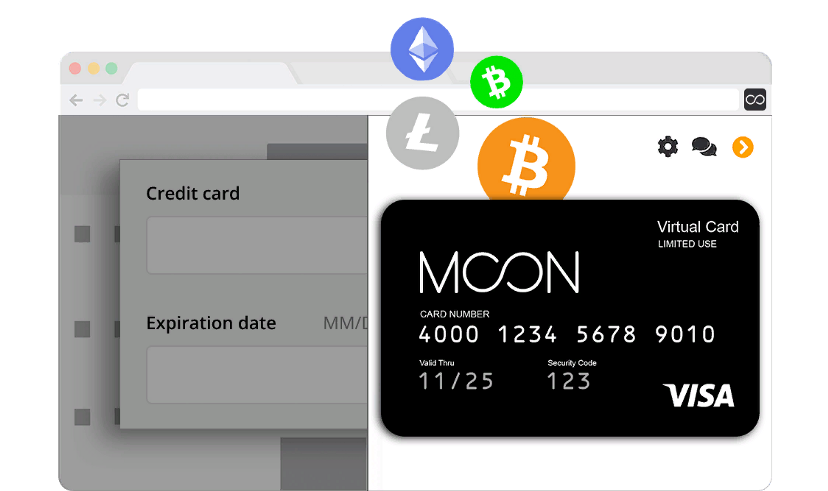

To substitute international payment systems like PayPal and Visa, Cubans download PayWithMoon, which allows funding a prepaid virtual card with bitcoin (BTC).

PayWithMoon card from paywithmoon.com

Large crypto exchanges like Coinbase, Binance, and OpenNode also instantly block Cuban crypto users to comply with the embargo. The only way to obtain crypto in Cuba is through WhatsApp or Telegram groups. Sadly, scams through these platforms are common, and buyers often receive nothing.

Fortunately, the island recently issued new regulations for the use of cryptocurrencies; the Central Bank will begin issuing licenses to virtual asset service providers. President Miguel Díaz-Canel has said that the country is “evaluating the advisability” of using cryptocurrencies.

As of now, Cuban stores must have a personal wallet to accept bitcoin payments because they provide customers with a QR code to receive transactions. If bitcoin payment automation platforms such as OpenNode were available in this country, local businesses could automate payments both online and in person. But, due to the embargo, that has not happened so far.

Still, with more than 5 million Cubans using mobile internet, informal estimates put the number of Cubans using currencies like Bitcoin, Ethereum, and Avalanche at between 100,000 and 200,000.

The 1 to 2 percent of the island’s population that uses cryptocurrencies is far lower than half of the population in El Salvador who reportedly have cryptocurrency apps. However, we should bear in mind that 60% do not use the app after spending a welcome bonus; and those who stay active in the app use it rather for dollar operations, not for crypto, a recent study says.

Anyway, it will be interesting to compare how cryptocurrency will settle down in the two countries with different motives: Salvadorian innovations were imposed from above, whereas for the Cuban population Bitcoin is a means of getting around global sanctions in their everyday lives.