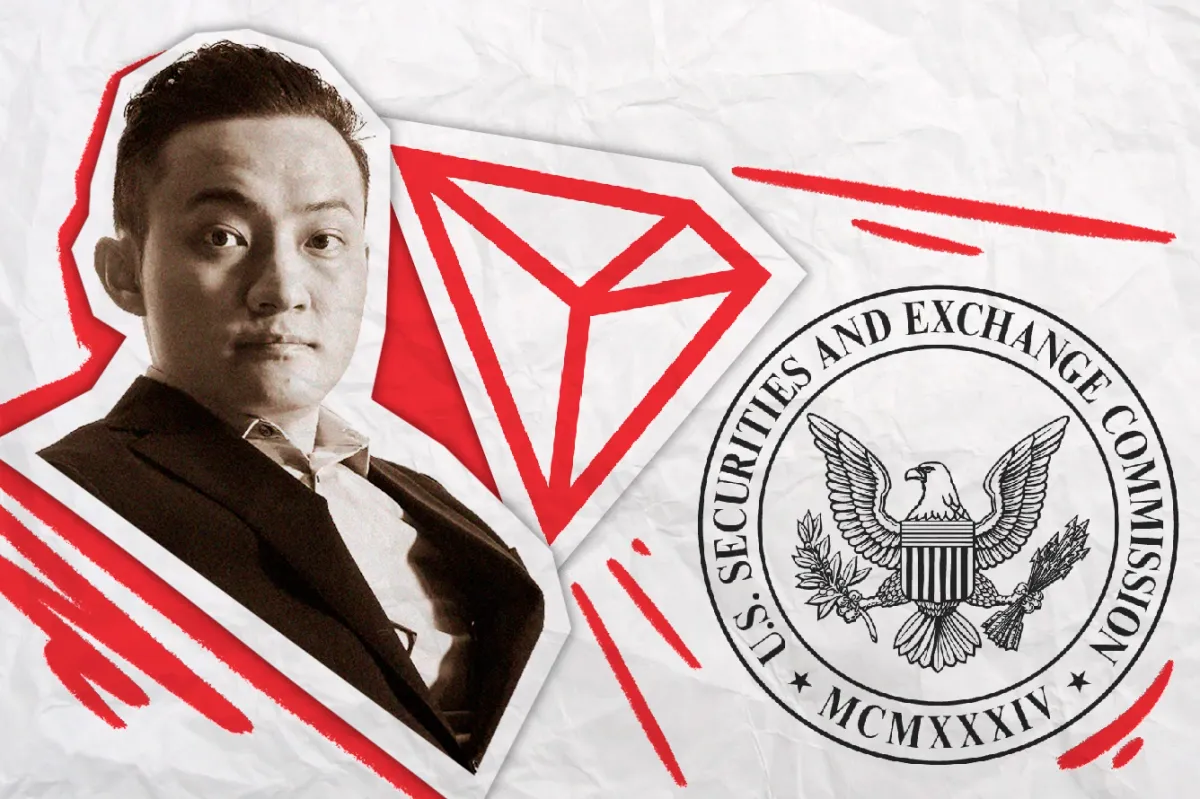

The Tron Foundation, which oversees the TRON blockchain network, along with Justin Sun, BitTorrent Foundation, and Rainberry submitted a renewed pre-motion letter on May 2, to Judge Edgardo Ramos, outlining a proposed schedule for moving to dismiss the U.S. Securities and Exchange Commission's (SEC) amended complaint.

They argue that the SEC's amendments do not "cure the deficiencies" previously identified, hence their decision to pursue a renewed motion to dismiss on substantially the same grounds as their original motion.

The document reveals that the defendants and the SEC have agreed on a briefing schedule without the need for a second pre-motion conference unless deemed necessary by the court. According to the proposed schedule:

- The defendants will file their omnibus motion to dismiss by May 30, accompanied by a 50-page supporting brief.

- The SEC will then have until June 28, to file any opposition brief, also limited to 50 pages.

- The defendants can file a reply brief by July 26, with a 25-page limit.

New focus on Sun's U.S. trips and live stream

The SEC's recent amendment to its complaint, filed on April 18, expanded on the initial accusations of unregistered securities offerings and market manipulation related to TRON (TRX) and BitTorrent (BTT) tokens.

The updated complaint focuses on Justin Sun's extensive travel and promotional activities in the U.S. from 2017 to 2019, arguing that these actions establish sufficient jurisdiction for the U.S. courts over the case. The SEC cited a livestream conducted by Sun from his San Francisco office as evidence of this. During the livestream, Sun directly promoted the TRX token and announced that existing TRX holders would receive an airdrop of BTT tokens, effectively linking the two communities and offering a direct benefit to TRX holders within the U.S.

The SEC argues that this livestream, along with Sun's other activities targeting U.S. investors, demonstrates that his actions fall under the purview of U.S. securities laws.

Tron filed a Motion to Dismiss

On March 28, the Tron Foundation and Sun filed a motion in a New York court to dismiss their ongoing lawsuit with the U.S. Securities and Exchange Commission (SEC). They argue that the SEC is overstepping its authority by trying to regulate a global offering primarily involving foreign participants.

In March 2023, the SEC filed a lawsuit against Tron Foundation, Justin Sun, and affiliated entities, alleging unregistered securities offerings and market manipulation. The SEC alleges that Tron's 2017 Initial Coin Offering (ICO) was, in fact, an unregistered securities offering. The regulator claimed the firm raised over $90 million by selling TRX tokens, which the SEC considers securities. Tron Foundation claims that the ICO was not targeted at U.S. investors and that the tokens were simply operational ones used within their network. Both sides have engaged in the usual pre-trial dance since last year, requesting extensions and other procedural steps to prepare for the main event.

According to court filings, Justin Sun's trial for fraud and market manipulation related to TRX and BTT tokens was postponed for the third time in January. Sun's legal team also requested time extensions in September and December.

The SEC alleges Sun and celebrities SouljaBoy and Austin Mahone accepted undisclosed payments to promote these tokens. While Mahone settled the case and SouljaBoy lost by default, Sun is contesting the charges. He previously sought a delay in his initial court appearance for three reasons: to re-establish the TRON Foundation in Singapore (previously dissolved), await the outcome of the SEC v. Ripple Labs case (potentially relevant precedent), and explore settling with the SEC.

Observing moneytech and cryptoObservers

Observing moneytech and cryptoObservers

California-registered Rainberry, the fourth defendant, contests the lawsuit on separate grounds, arguing that the SEC's claims are unfair and overreaching, creating new rules to target Tron without explicit Congressional authorization. Rainberry also claims they didn't receive fair notice of the alleged violations.

The motion cited the major questions doctrine – a legal principle requiring clear Congressional authorization for agencies taking actions with significant economic or political consequences – to contest the SEC's premature action. Other crypto firms, including Kraken and Coinbase, have employed this strategy in their legal battles with the SEC.

According to court filings, the defendants said that "even if it could be shown that the exercise of personal jurisdiction over the foreign defendants is appropriate here, the claims still fail for a myriad of equally powerful reasons."

Tron could set a precedent for ICOs

The lawsuit can potentially trigger a ripple effect across the crypto industry. A win for Tron could limit the SEC's ability to regulate ICOs targeting international audiences, even if U.S. dollars are involved. This could potentially create uncertainty for future ICOs and lead companies to operate them through offshore entities to avoid regulatory scrutiny.

The Tron vs. SEC suit might cause companies to delay or even cancel ICO plans due to the lack of stability the case established. It could also seriously hinder fundraising and project development. A geographically based regulatory approach might lead to fragmentation in crypto laws across different countries, making it more complex for companies to conduct business internationally. Furthermore, stricter SEC regulations could provide greater investor protection but stifle innovation in the crypto space.

Tron and Justin Sun's lawsuit is just the tip of the iceberg. According to Cornerstone Research, the SEC filed a staggering 46 enforcement actions against crypto firms in 2023 alone, 53% more than in 2022. A U.S. court rejected Coinbase's own dismissal request on March 27.

The Tron case has the potential to become a landmark decision, shaping how the SEC classifies crypto assets and how far its regulatory reach extends. A win for the SEC could usher in a period of stricter oversight, while a win for Tron could bring more freedom to the industry.