A report released last week by the U.S. Treasury pays a lot of attention to the stablecoin market and its impact on the traditional financial system. Although digital assets “do not seem to have cannibalized” demand for Treasuries and other financial assets yet, their use cases, and specifically those of stablecoins, continue to evolve, which might change the game in the future.

One of the main findings is that the growth in stablecoins has resulted in an increase in demand for the T-bills as short-dated treasuries are often used as collateral on the DeFi market. The Treasury estimates that $120 billion worth of T-bills were purchased to hedge stablecoins’ risks. For example, T-bills represent almost 70% ($81 billion) of Tether’s total backing. The hedging demand for treasuries is expected to grow further alongside the expansion of stablecoins and institutional crypto adoption.

Although the authors expect the regulators to encourage this trend and recommend the issuance of T-bills in higher proportion, this might expose eventually the treasuries market to an increased risk of fire sales and financial instability.

Another trend outlined in the research is that both the private and public sectors are now studying opportunities to leverage blockchain and DLT to improve legacy financial systems and tokenize the financial market infrastructure. According to the research, tokenizing Treasuries, which could bridge digital and ‘native’ markets, has several benefits, including faster, safer, and more transparent transactions. It could enable “atomic settlement,” meaning all parts of a transaction clear at once, reducing failure risk. Smart contracts improve collateral management, while real-time blockchain transparency helps investors and regulators monitor activities. The technology also opens the door to wider investor access and potentially increases trading hours.

Apart from the proverbial ‘instability risk’ and other typical concerns, the authors mention that an ill-conceived design might create liquidity and maturity mismatches between tokens and the underlying assets and that in case tokenized short-dated Treasuries happen to replace bank deposits, the banking system will be disrupted.

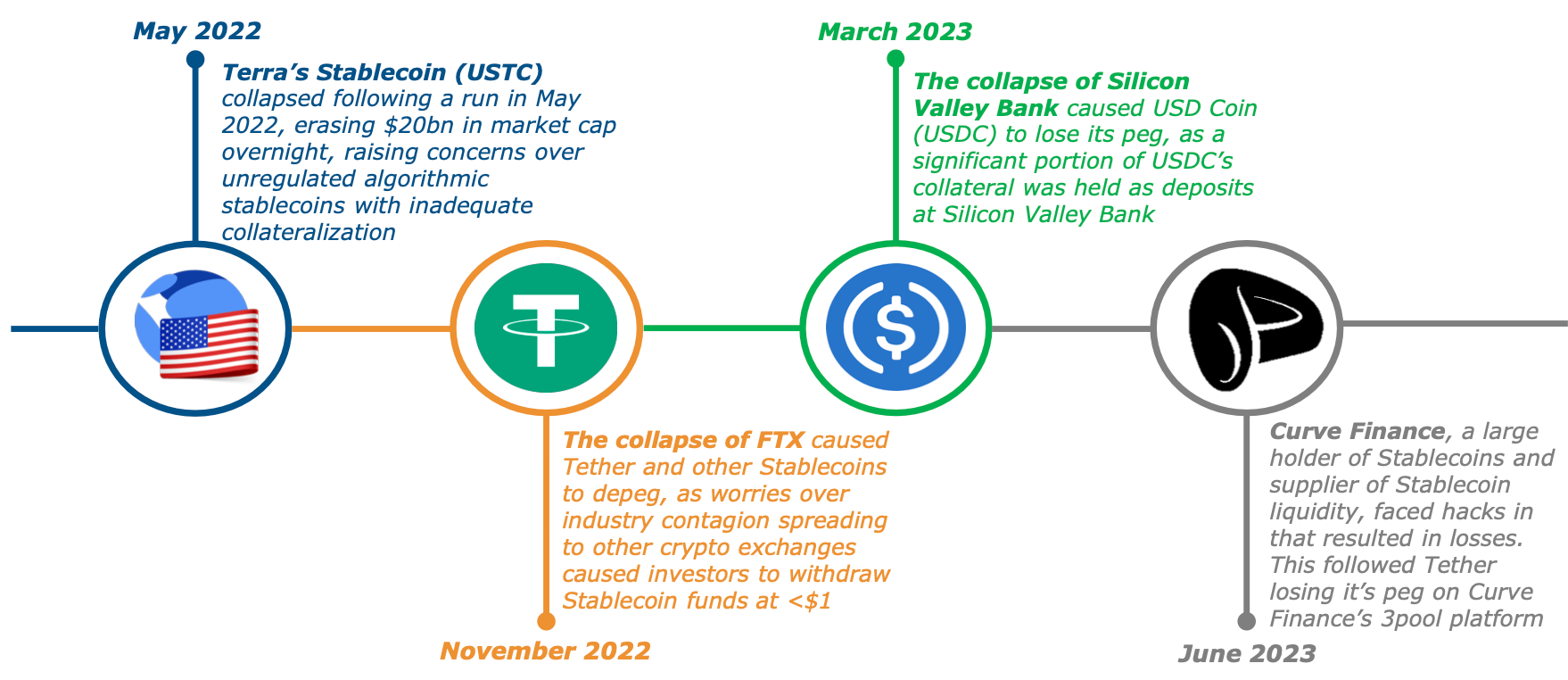

The Treasury admits that the tokenization requires some monetary unit that “denominates transactions, accompanies the means of payment, and is accepted without question by market participants.” Still, the Treasury Department doesn’t believe stablecoins—the private money of this century—are viable in the long term in the present form and supposes they need to be strictly regulated by the government and eventually replaced by an ‘official’ CBDC.

“In a similar manner to how privately-issued “wildcat” currencies were replaced by government-backed central currencies in the late-1800s, Central Bank Digital Currencies (CBDC) will likely need to replace stablecoins as the primary form of digital currency underpinning tokenised transactions,” - the report’s authors refer to “Taming Wildcat Stablecoins” by Gary Gorton.

We earlier observed that Fed members’ statements hint that stablecoins like USDT could serve as a de facto U.S. CBDC and that the launch of a separate CBDC project is questionable.

Whatever the departments call it—replacement, regulation, or nationalization—the question remains: Can the existing private stablecoins eventually transform into the digital form of U.S. sovereign money?