The stablecoin market was severely impacted on March 11 when the world’s second-most popular stablecoin, USDC, lost its peg to the dollar after it was discovered that the company behind it had reserves backing the coin at the now-defunct Silicon Valley Bank.

USDC’s primary competitor has always been USDT, the largest stablecoin in the world by market capitalization. Previously, the USDC was favored and viewed as more reliable by many members of the crypto community. However, this may no longer be the case.

In light of the USDC slump, USDT now exceeds the price of one dollar, and is actively trading in Curve pools and increasing its market capitalization. Let's explore this in more detail.

The price of USDT bypasses $1.

Consumers made the choice to begin transferring their assets to more secure locations after the USDC price fell below 90 cents on Saturday. As a result, users actively began exchanging their USDC for USDT, impacting the price of Tether.

According to СoinMarketСap data, Saturday saw the price of USDT rise to $1.0292. After this sudden increase, the price has steadily dropped. At the time of writing, the price of the USDT is at $1.0000.

The growth USDT’s market capitalization.

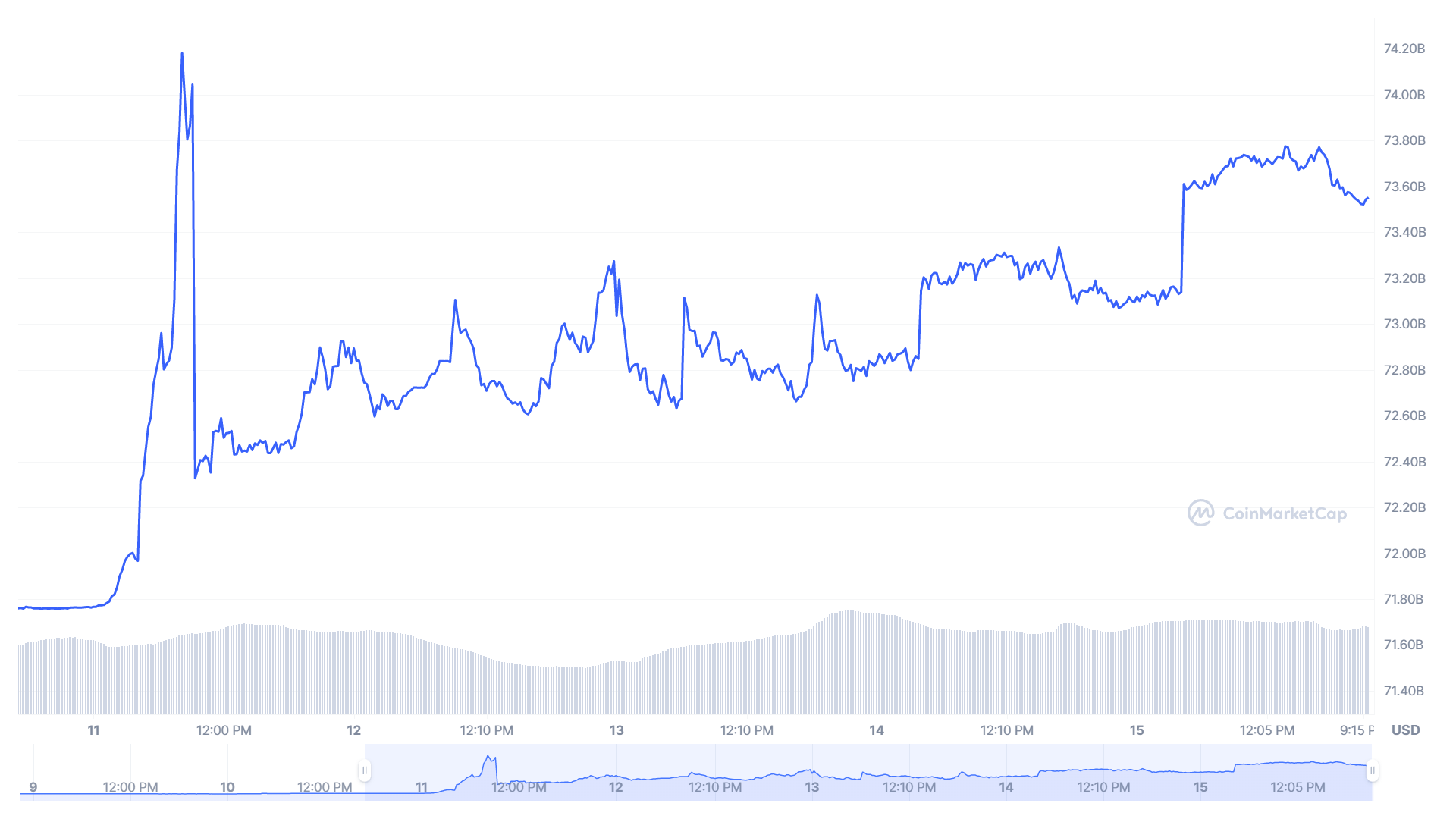

The previous days have seen the market capitalization of the USDT increase. According to CoinMarketCap, on Saturday March 11, USDT recorded a market capitalization of $74.18 billion, while just the previous day, the market capitalization of the stablecoin was at $71.76 billion. Thus, Saturday saw the market capitalization of USDT rise by $2.42 billion.

While the chart reveals that the USDT’s market capitalization gradually declined after Saturday’s sharp uptick, it remains higher than before. At the time of writing, it is $73.5 billion.

USDT and Curve pools.

After the fall of the USDC, a lot of interesting things happened in the Curve pools. On March 11, a Twitter user drew attention to the fact that in 3pool Curve - based on USDC, USDT and DAI stablecoins - users actively exchanged their USDC and DAI for Tether. Following this, the percentage of USDT in the pool decreased to 15%, despite the fact that 3pool should ideally contain all assets in equal proportions (approximately 33%). Tether's chief technology officer, Paolo Ardoino, called it a “flight to safety”, possibly hinting at the superiority of USDT over USDC and DAI.

Flight to safety https://t.co/4MYAhSXuQv

— Paolo Ardoino 🍐 (@paoloardoino) March 10, 2023

A few days later, on March 14, Curve Finance themselves pointed out interesting changes in another pool on their Twitter, remarking that the liquidity of the pool containing USDT, WBTC and ETH increased. Curve Finance assumed that this was due to USDT, which had won the trust of investors after Saturday’s events.

Maybe not many noticed, but looks like tricrypto liquidity increased after these weekend events. Possibly because USDT is now viewed by some as an option safer than USDC?https://t.co/GodIxjJ0hB

— Curve Finance (@CurveFinance) March 13, 2023

While Saturday’s revelations led to users actively exchanging their USDC to USDT, this is not the first time we have seen such a reaction. A similar situation occurred when Circle froze accounts associated with the Tornado Cash mixer, which led to users deciding to trust USDT, affecting the market capitalization of both stablecoins.

It turns out that despite the numerous criticism and FUD in the media, users still trust Tether, and sometimes prefer it to USDC, despite the latter previously enjoying a better reputation.

We will continue our observations of the world of stablecoins and keep you updated on all the latest news.