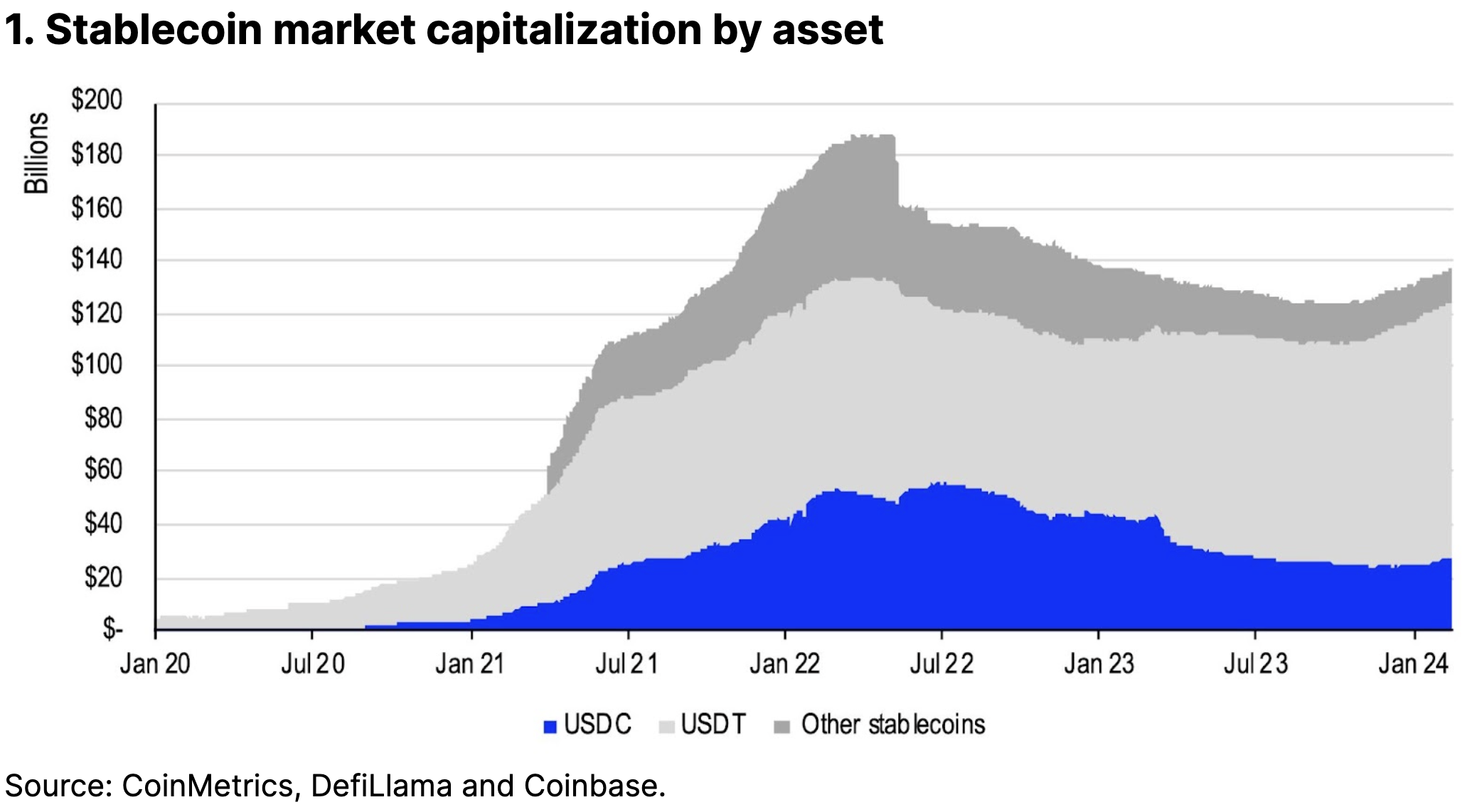

Tether's digital dollar, USDT, has been the clear winner among stablecoins so far, holding a significant lead with around 70% of the total market cap. However, Circle's USD Coin (USDC) appears to be experiencing something of a comeback, regaining investor confidence after a period of relative stagnation. A report by crypto exchange Coinbase titled The Resurgence in USDC, highlights increasing global liquidity, surging supply, and growing international adoption as key drivers for the revival of the second-largest stablecoin. It should be noted that Coinbase initially co-managed USDC with Circle, although a deal last August saw Circle assume full control of the stablecoin, while Coinbase took an equity interest in Circle.

The stablecoin's recent market cap increase was partly due to BUSD's shutdown, the Paxos-issued Binance coin, dropping from over $16 billion to under $100 million by early 2024.

Coinbase analysts David Duong and Li Liu believe that the recent approval of spot Bitcoin ETFs in the U.S. may have triggered an influx of fresh capital into the crypto market, with a portion flowing into USDC due to its perceived stability and regulatory clarity. USDC is also seeing more investor interest in non-US markets, likely driven by increasing global awareness of blockchain and cryptocurrency, and integration with decentralized finance (DeFi) platforms. USDC's stronger presence in international markets has boosted its share of activity in both spot and derivatives trading, which has multiplied nearly fivefold. However, it still represents a modest 4% of the total global stablecoin volume on centralized exchanges.

The report reveals a 14.3% (over $3.5 billion) increase in USDC supply since the beginning of December 2023, surpassing the growth observed in main competitor, Tether (USDT), which only saw an 8.7% increase during the same period. This surge in USDC's market cap, now at $28 billion, suggests a potential shift in investor preference towards Circle's stablecoin.

USDT has reached a new all-time high of $98 billion, with an addition of roughly $2 billion over the past month, according to CoinGecko data. USDC grew by nearly $2.5 billion over the same period, although Tether's token still dominates the stablecoin market with a 71% share, up from 49% in January 2023.

The report suggests that some of this lost market share over the last year was due to MakerDAO, the issuer of the stablecoin DAI, making plans to reduce its reliance on USDC reserves in its peg stability module (PSM) back in October 2022.

"We believe those plans were accelerated after the U.S. regional banking crisis in March 2023, which both led to a brief secondary market dislocation for USDC but also drew greater attention to the sharp rise in U.S. interest rates."

This, combined with the growing lure of real-world assets like U.S. Treasury bills, prompted MakerDAO to convert a significant portion of its USDC holdings into T-bills, mirroring a similar trend observed in many retail investors seeking refuge in money market funds during the same period. MakerDAO aimed to potentially mitigate risks associated with relying on a single stablecoin and capitalize on the rising yields offered by real-world assets.

David Shuttleworth, a research partner at Anagram, has also noted USDC's significant contribution to overall stablecoin growth in the past months, with its supply expanding by almost 10% in the past month alone, accounting for more than half of the total stablecoin growth.

Shuttleworth further noted that with increasing liquidity and a growing user base, USDC is gradually reclaiming its market share, indicating a positive trend for the stablecoin's future prospects.