Latest Articles

43 Articles

USD Coin (USDC) is a stablecoin that is pegged to the US dollar. USDC is classified as a centralized stablecoin, backed by U.S. dollars or dollar-denominated assets like U.S. Treasury securities. It is issued by Circle.

USD Coin (USDC) is a stablecoin that is pegged to the US dollar. USDC is classified as a centralized stablecoin, backed by U.S. dollars or dollar-denominated assets like U.S. Treasury securities. It is issued by Circle.

After the failure of three U.S. banks (with varying degrees of crypto exposure) in the space of a week last month, the sector seems to have settled back into relative calm, at least for the time being. So it would seem like the perfect opportunity for a recap.

Circle's partnership with cryptocurrency start-up Noble will bring the USDC natively to the Cosmos ecosystem.

On March 20, a vote was opened for the MakerDAO community to ‘normalize’ the parameters of the Price Stability Module (PSM). As a result, USDC remained the main reserve asset of PSM.

Alex Harutunian

On March 20, a vote was opened for the MakerDAO community to ‘normalize’ the parameters of the Price Stability Module (PSM). As a result, USDC remained the main reserve asset of PSM.

Alex Harutunian

After the failure of three U.S. banks (with varying degrees of crypto exposure) in the space of a week last month, the sector seems to have settled back into relative calm, at least for the time being. So it would seem like the perfect opportunity for a recap.

Jack Martin

Circle's partnership with cryptocurrency start-up Noble will bring the USDC natively to the Cosmos ecosystem.

Alex Harutunian

In a new report, Moody's analyzed the impact of the traditional banking system on stablecoins, as well as the possible tightening of regulation against the background of the recent banking crisis.

Alex Harutunian

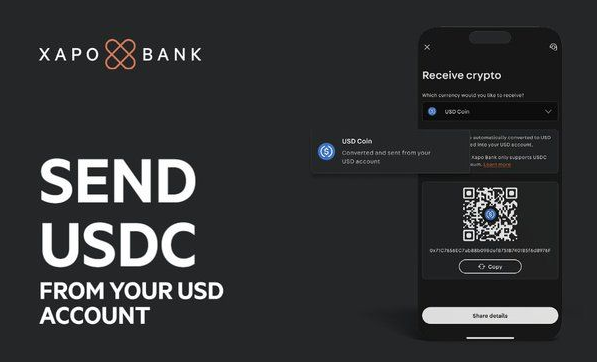

The move makes Gibraltar-based Xapo the first fully licensed bank in the world to offer USDC on-and off-ramps as a fast, free, 24/7 alternative to the expensive and slow SWIFT system used for international payments.

Jack Martin

USDC depeged from USD after US Silicon Valley Bank collapsed. Exchanges paused their conversion as users rushed into other assets. Now the stablecoin has got back to 1:1 ration, but what’s done is done…

Sasha Markevich

After Saturday saw the value of the USDC fall, trust in the stablecoin Tether (USDT) increased, driving its growth.

Alex Harutunian

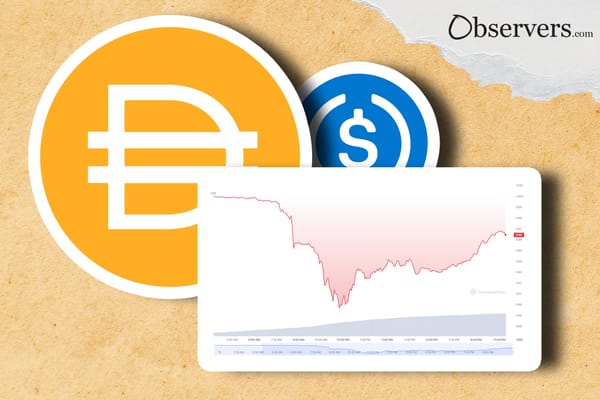

The collapse of Silicon Valley Bank (SVB) affected, among others, the USDC’s reserves and this “blue-chip” stablecoin has lost its peg to the dollar. Ironically, the only decentralized unicorn stablecoin project, MakerDAO is now in trouble due to its “reinforcing” USDC-backed component.

Alex Harutunian