USDe, the "synthetic dollar" attempting to offer an alternative to major stablecoins, appears to have survived its first major stress test.

The crypto markets suffered a sharp decline on Saturday when Iran announced it had fired 300 drones and missiles toward Israel — with Bitcoin crashing from $67,100 to $61,700 in just 30 minutes.

But despite the dramatic drop, USDe largely held steady and only temporarily deviated from its peg to the dollar. Seraphim Czecker, the head of growth at Ethena Labs, posted on X:

So far so good: USDe passed its first stress test pic.twitter.com/tGg2ZFOQSs

— Seraphim (@MacroMate8) April 14, 2024

Ethena Labs has raised eyebrows because of the healthy yields offered to those who hold USDe, with critics claiming they would prove unsustainable during a bear market.

The project's lead, Guy Young, has also dismissed unfavorable comparisons to Do Kwon's doomed Terra ecosystem, which saw UST and LUNA spectacularly implode in May 2022 — wiping $40 billion from the crypto markets. Speaking to Laura Shin's Unchained podcast, he said likening USDe with UST was "really weak" because his asset is "fully backed and fully collateralized."

Young largely shrugged off the weekend's market turmoil by saying "there's no need to doompost" — and last week, set out ambitions for USDe to exceed its current market cap of $2.35 billion.

USDe is the fastest growing USD denominated asset in the history of crypto pic.twitter.com/xgiRJjf96t

— G | Ethena (@leptokurtic_) April 8, 2024

A key part of this strategy involves adding Bitcoin as collateral for USDe so the synthetic dollar can "scale significantly." (Incidentally, the Luna Foundation Guard had also amassed a war chest of 80,000 BTC to defend its peg to UST, which ultimately wasn't enough to prevent the algorithmic stablecoin's death spiral.)

Explaining the rationale behind the move, Ethena Labs wrote on X:

"In just 1 year, BTC open interest on major exchanges (exc. CME) has grown from $10bn to $25bn, while ETH OI has grown from $5 to $10bn. BTC derivative markets are growing at a faster pace than ETH and offer better scalability and liquidity for delta hedging."

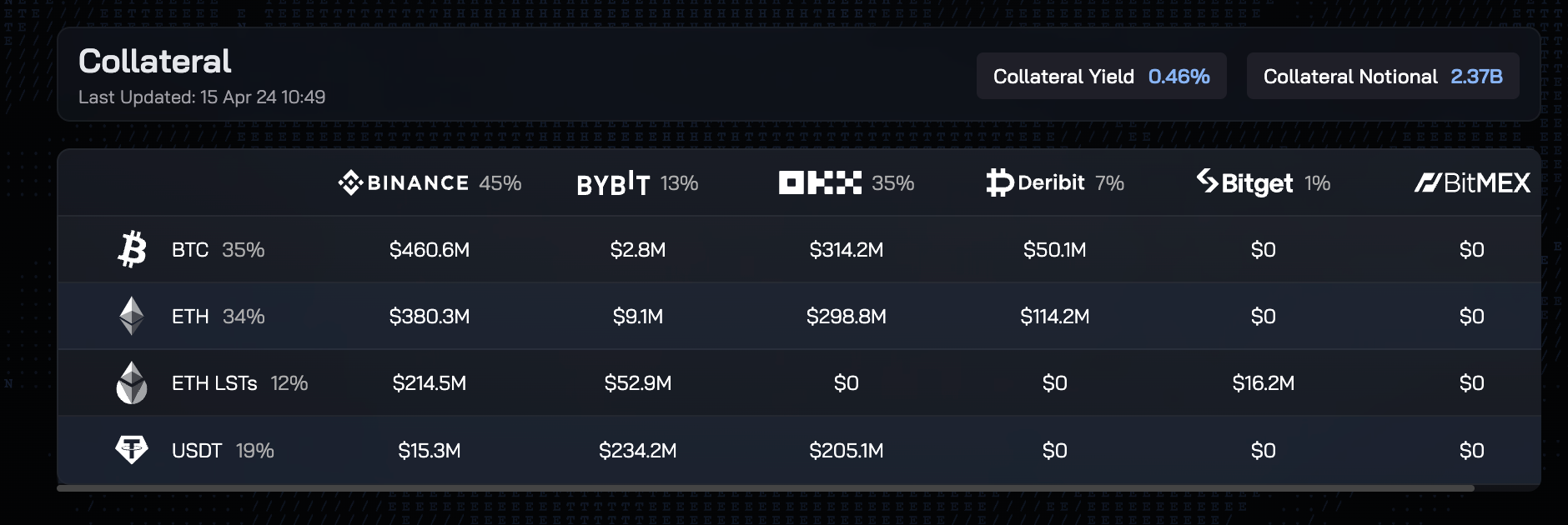

The current breakdown of USDe's collateral shows about 35% is held in Bitcoin, a further 34% in Ether, 12% in ETH liquid staking tokens, and 19% in USDT:

Earlier this month, Ethena Labs dropped its ENA governance token, which has quickly become the 55th-largest cryptocurrency in terms of market cap. While its price has surged 120% in the past fortnight, it has dropped 23% from all-time highs that were set on Thursday:

Arthur Hayes, who has also thrown his backing behind the project, appears to be championing an approach to transparency and risk that may have been missing in the Terra era.

Last Friday, he tweeted a link to an "Ethena Risk Radar" on IntoTheBlock that monitors key metrics related to the health of the project.