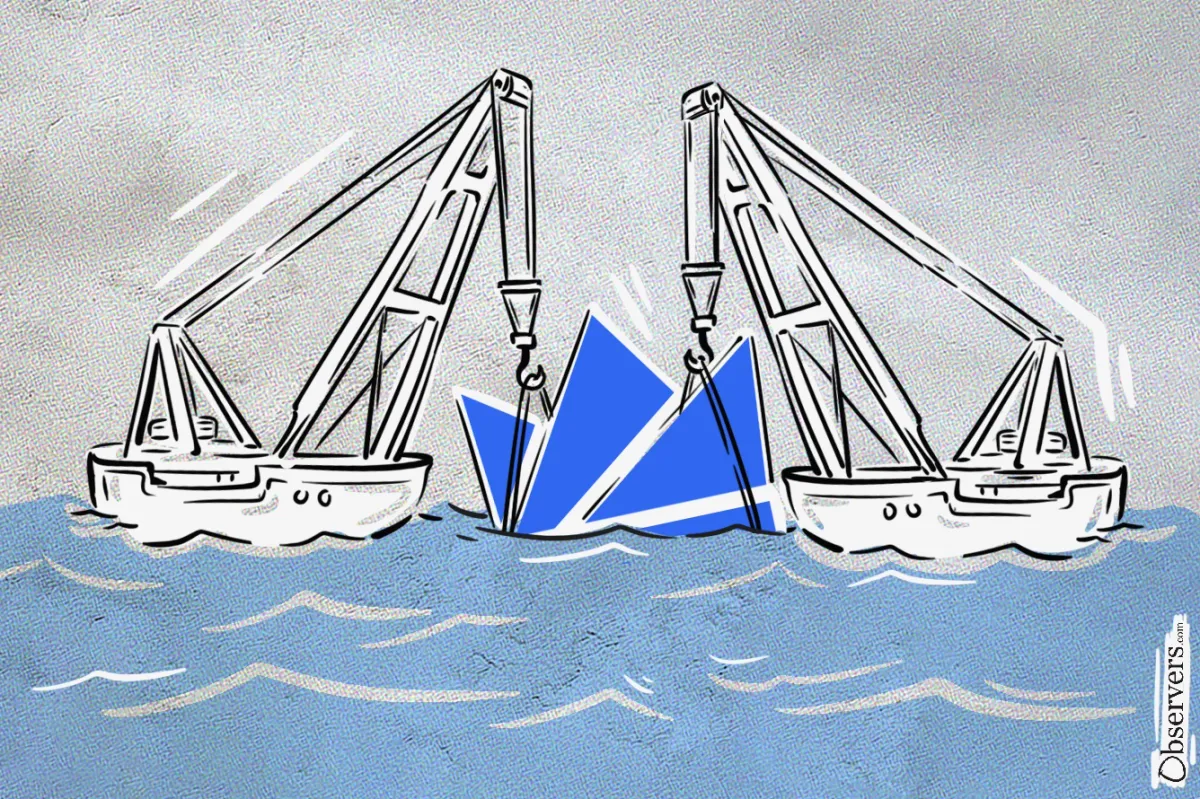

On July 18, 2024, WazirX suffered a major cyberattack, resulting in the loss of approximately $234.9 million in users' funds. Following the hack, the platform ceased operations, leaving thousands of users in limbo.

In a bid to recover, WazirX's parent company, Zettai Pte. Ltd., proposed a Scheme of Arrangement to repay users and restructure the business. The vote on this proposal took place in March 2025, showing overwhelming support from the claimants. The final court hearing to approve the outcome is scheduled for May 13, 2025, in Singapore.

The Rise and Fall of WazirX

Founded in 2017 by Nischal Shetty, Sameer Mhatre, and Siddharth Menon, WazirX quickly became India’s largest cryptocurrency exchange by trading volume. Shetty, who served as CEO, rose to prominence as a vocal advocate for crypto regulation in India.

In 2019, Binance announced the acquisition of WazirX to expand its foothold in the Indian market. However, in 2022, Binance CEO Changpeng Zhao (CZ) claimed that the acquisition was never completed—sparking confusion and a public dispute between the two companies. The situation escalated when India's Enforcement Directorate froze WazirX's assets amid a money laundering investigation. Binance distanced itself from the exchange, denying control over its operations.

The 2024 Hack and Its Fallout

The devastating hack in July 2024 was traced to North Korea’s Lazarus Group, which exploited vulnerabilities in WazirX’s multisignature wallet system. These wallets were jointly managed by WazirX and digital custody partner Liminal. Hackers reportedly created a fake WazirX account and manipulated the smart contract to gain full control of the funds.

At the time, WazirX held over $503.64 million in digital assets, meaning the attack wiped out more than 40% of its reserves. The breach triggered a collapse in operations and a wave of user distrust. Nischal Shetty faced significant criticism over the company’s delayed response and lack of transparent communication during the crisis.

Voting for Recovery: The Scheme of Arrangement

In January 2025, the Singapore High Court granted Zettai Pte. Ltd. permission to convene a vote among affected users to approve its recovery plan. The voting process was held online via the Kroll Issuer Services platform from March 19 to March 28, 2025.

Eligible participants, referred to as Scheme Creditors, were verified users with approved claims. While each creditor submitted a single vote, the scheme’s approval depended on the number of votes and value of claims. To avoid conflicts of interest, WazirX shareholders and their immediate families were barred from voting.

The results showed overwhelming support: 93.1% of creditors by number, representing 94.6% of total claims by value, voted in favor of the proposal. The outcome was reviewed and verified by Alvarez & Marsal, an independent restructuring advisory firm. However, the scheme will only become legally binding if the Singapore High Court approves it on May 13.

The Recovery Token Plan

Central to the recovery plan is the tokenization of creditor claims. WazirX will issue Recovery Tokens (RTs) equivalent to each user’s loss. Over a 36-month period, the exchange aims to buy back these tokens using a share of its net profits. If performance exceeds expectations, early redemptions may also occur.

Estimates suggest users could recover 75–80% of their original balances if the relaunch is successful.

This model is inspired by the precedent set by Bitfinex in 2016. Following a $72 million hack, Bitfinex issued BFX tokens to victims, redeeming them within eight months and even converting some into equity in its parent company, iFinex. The program’s success hinged on rapid action, transparent communication, and user trust—elements WazirX now hopes to replicate.

The upcoming Singapore High Court hearing on May 13, 2025, will determine whether the Scheme of Arrangement can move forward. If sanctioned, WazirX will resume operations and begin repaying users within 10 business days. If rejected, the company could face liquidation, with creditors potentially waiting until 2030 for any recovery due to unresolved legal claims and asset ownership disputes—particularly those involving Binance.