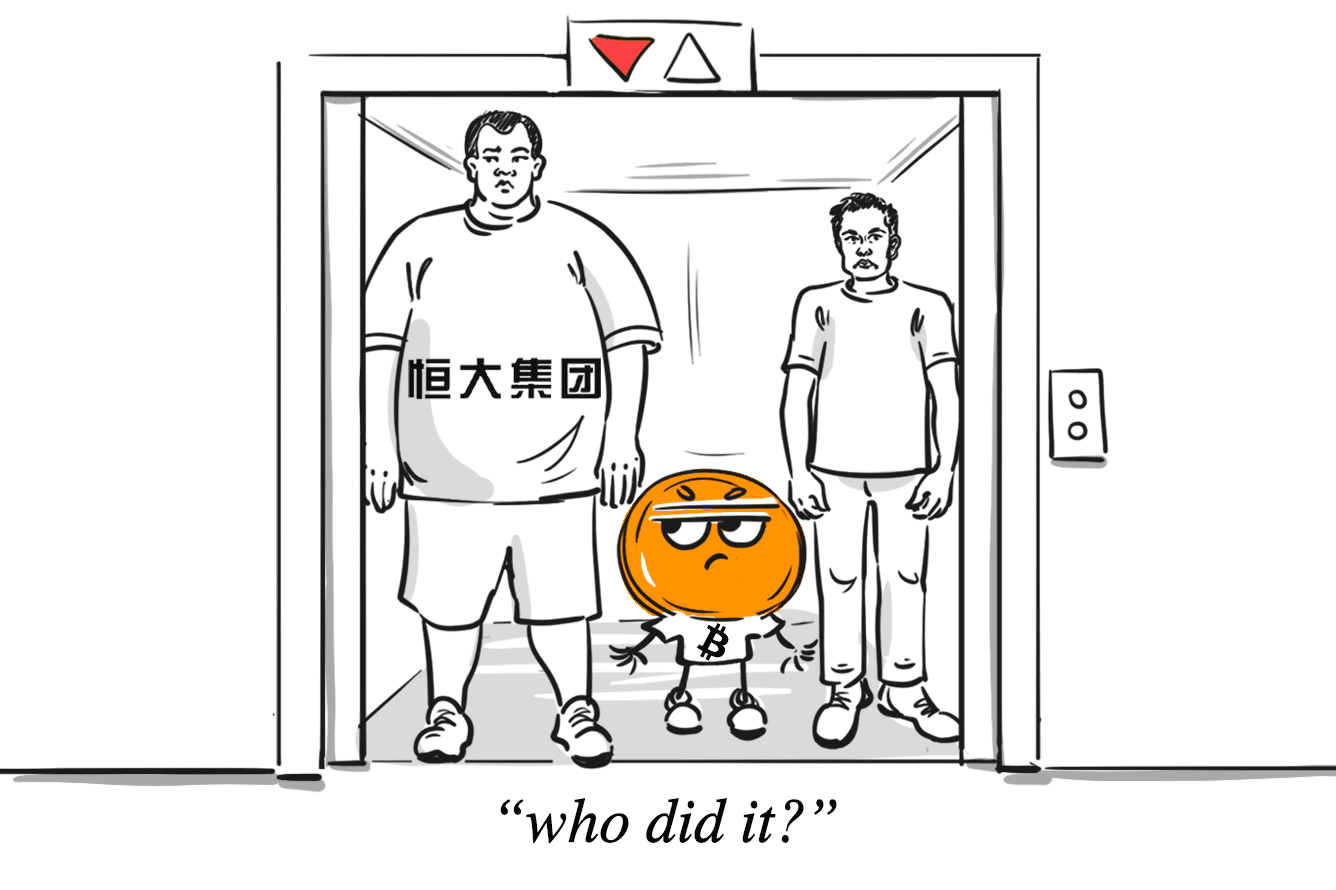

China’s Evergrande Group, the country’s second-largest property developer by sales, filed for U.S. bankruptcy protection on Friday, a move that some commentators have claimed precipitated a sudden crash of Bitcoin (BTC), which saw its biggest one-day fall since the collapse of crypto exchange FTX, as the broader cryptocurrency market recorded over US$1bn in liquidations in less than 24 hours.

Evergrande defaulted on its dollar-denominated debt in late 2021, leading to a liquidity crisis that has stunted China’s economic growth. The company has around US$19bn in overseas liabilities according to Bloomberg and had a debt load that reached US$340bn by the end of 2022. That is roughly 2% of China’s gross domestic product.

Other major cryptocurrencies saw similar falls, though not as large. Ethereum, for example, the second-biggest cryptocurrency by market cap, lost around 2 percent of its value. This means that the crypto market on the whole is down by 5.7 percent over the last 24 to 48 hours according to the tracking website CoinMarketCap.

The Evergrande bankruptcy is not just bad news for China’s economic growth prospects, but it is also seen by some as particularly problematic for the crypto market, with many analysts speculating that Tether’s USDT, the largest stablecoin by market cap, is heavily backed by the Chinese yuan. Even if this is untrue, Evergrande’s Chapter 15 bankruptcy filing still led to a move away from risk-on assets, which can have an impact on Bitcoin and cryptocurrencies in general.

Evergrande’s bankruptcy was not the only event that shook the crypto market this week. A Wall Street Journal article published on Thursday about SpaceX discussed the company’s finances in the context of Bitcoin:

"The documents also show SpaceX wrote down the value of bitcoin it owns by a total of $373 million last year and in 2021 and has sold the cryptocurrency.”

Market analysts were divided on what this meant. Did SpaceX simply write down its value? Did SpaceX sell it? Has Musk finished with Bitcoin altogether?

Other market analysts have said that it is not SpaceX and Evergrande that are to blame for this week’s events. Instead, they say, they have exacerbated problems that already existed in the market rather than instigated them, pointing instead to medium-term shifts in market behavior that are based on broader macroeconomic concerns.

In addition, according to one analyst who is the CEO of a venture capital firm specializing in Web3 and crypto, Bitcoin’s volume has been contracting naturally and there hasn’t been much new participation in the space. “If anything, this event seems to be largely driven by a flushing out of leveraged positions, which happens periodically with BTC and in a rather dramatic fashion,” he said.