South Korea's rightwing President Yoon Suk Yeol's shocking decision to declare martial law late Tuesday night triggered a massive sell-off of approximately $33 billion in cryptocurrencies.

The rigid regulatory restrictions on the crypto market meant that there was not enough liquidity to satisfy the massive number of panic selling requests, which meant investors ended up letting go of their assets at a huge loss.

While the political order was reversed after six hours of tumultuous opposition, and with it, the calm in the markets was restored, the event highlighted the shortcomings of overtly protective crypto laws.

Post Mortem Of A Martial Law That Didn't Make It To The Morning

For ltrd, last night was "one of the most spectacular trading events" he has witnessed in his trading career.

On South Korea's largest crypto exchange, Upbit, the price of Bitcoin dropped to $62,300, marking a $30 thousand difference between BTC price in South Korea and the rest of the world.

The imposition of martial law led to a 24-hour record trading volume on the country's exchanges: Together, Upbit and Bithumb saw over $33 billion in crypto sales and purchases.

The selling pressure generated by the troubling news "would not have been so brutal" under normal circumstances, but South Korean crypto markets are very different from all others.

Due to strict travel rules and Know Your Customer (KYC) and anti-money laundering (AML) regulations, it is extremely difficult to enter the market, meaning just a handful of players are available to provide liquidity and arbitrage.

This regulatory framework on the bid side often creates a Kimchi Premium—a gap between the price of cryptocurrencies in the country and the rest of the world, where prices in the former are higher than in the latter.

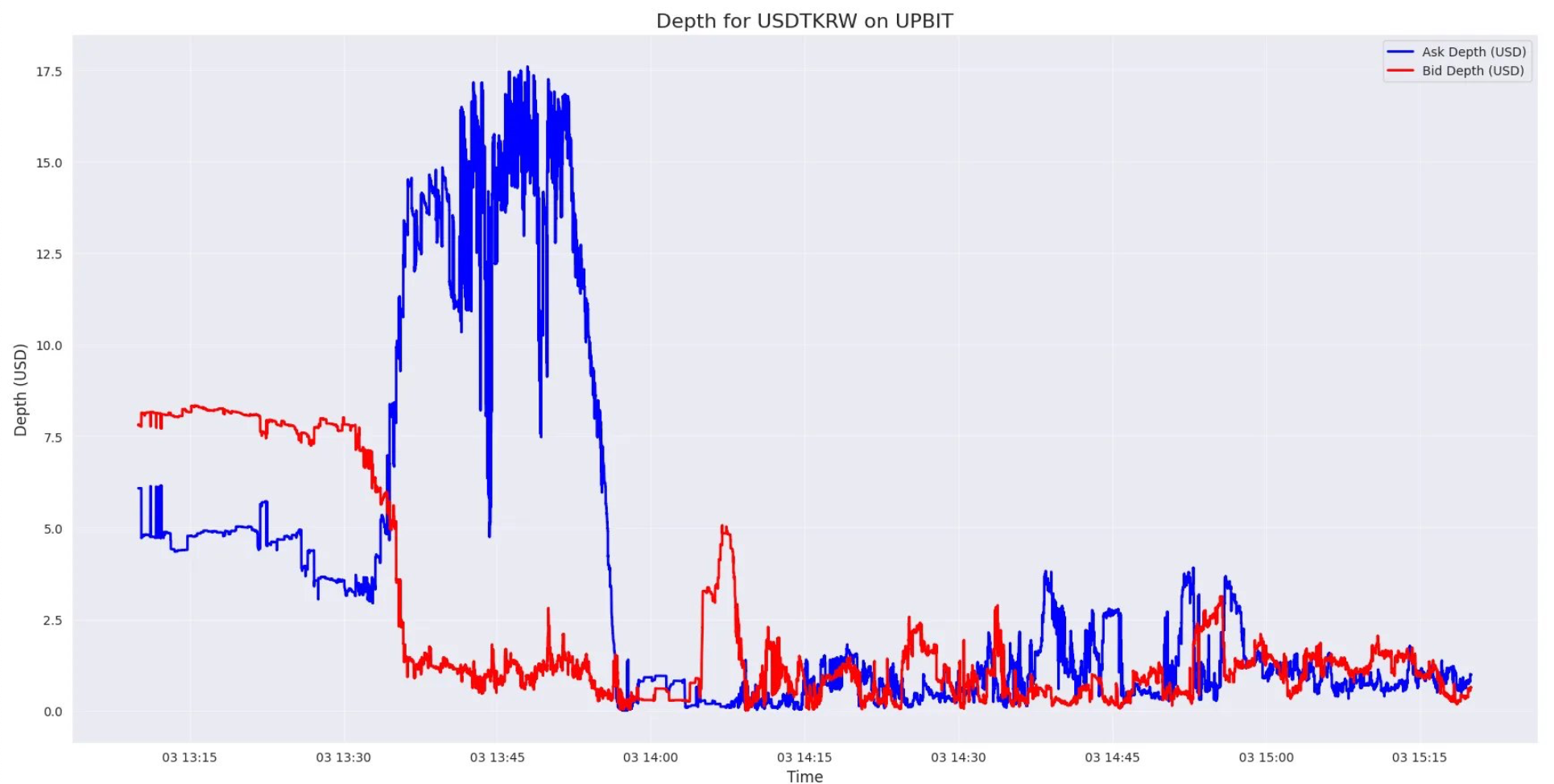

Last night, it was the opposite. "You see that liquidity just disappeared," noted ltrd.

The situation was so extreme that, at one moment, there was 200 times more liquidity on the ask side than on the bid.

When You Try So Hard But You Don't Succeed

South Korea's government is aware of the enormous opportunity that the blockchain technology industry represents amongst its tech-savvy population.

To stimulate innovation in the sector, the country's authorities have announced this week that they would postpone enacting crypto legislation until 2027.

However, these pro-crypto policies are counterbalanced by legislation that, because it is overtly protective of citizens, has several downsides.

For one, it discourages investment; then it makes it extremely difficult for foreign companies to operate in the country, which means citizens are blocked from some of the most interesting opportunities and solutions that the industry provides and, as we saw on Tuesday night, it limits the market's capacity to respond to shocks.