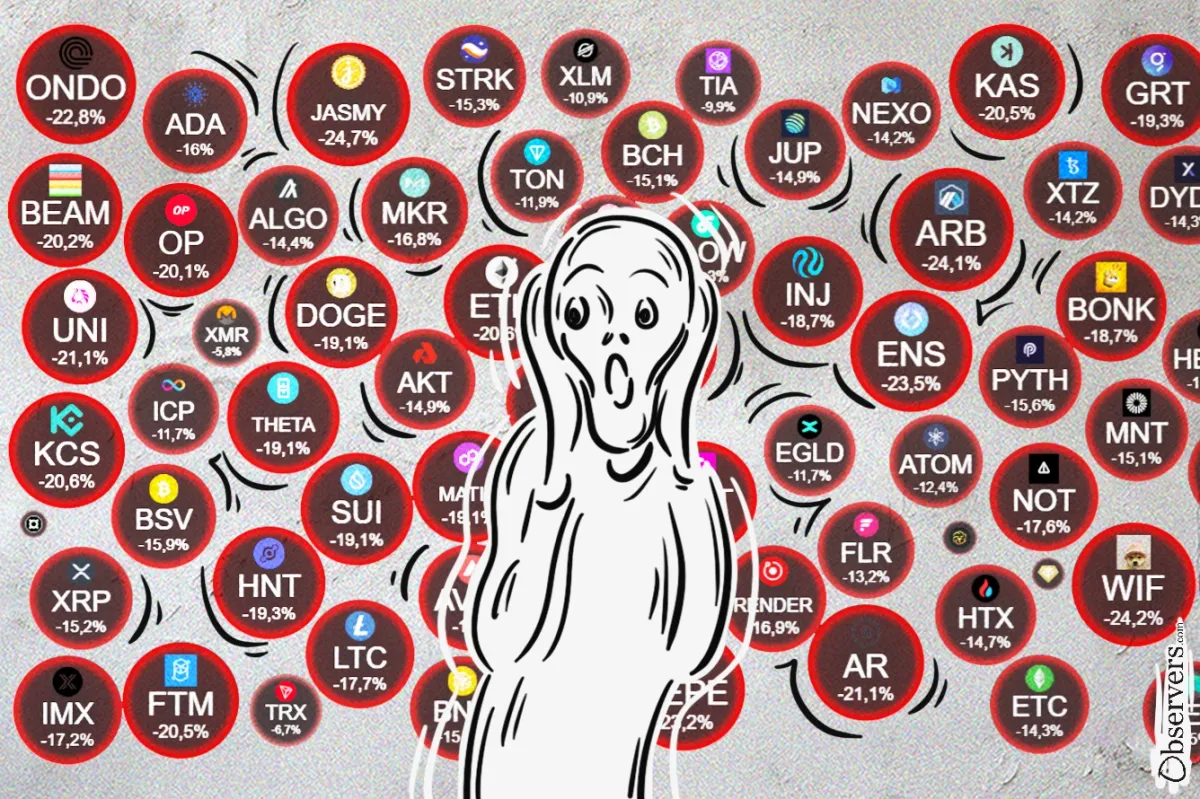

Bitcoin (BTC) and Ether (ETH) saw huge drops today, plummeting 10% and 18% respectively within two hours. As of publication, BTC and ETH are down 20% and 28% over the past week, while the entire crypto market has witnessed a significant sell-off, shedding up to $510 billion.

And it isn’t just the crypto industry that is falling. This decline parallels a 4.4% drop in the S&P 500 during the same period.

Over in Asia, Japan’s market has plunged almost 10% today; other markets in the region were down by less, although at one point, South Korea’s Kospi briefly halted trading. Japan’s recent rate hike in the benchmark interest rate news will likely have helped to feed the crypto slide. Kelvin Tay, regional chief investment officer at UBS Global Wealth, told CNBC that Going into the Japanese market at this moment is akin to catching “a falling knife" and warned everyone to expect the falls to continue.

So, what else is behind the sell-off?

Key factors contributing to the market's decline include weak U.S. employment data, sluggish growth in major tech stocks, and heightened recession fears along with the looming U.S. rate cut potentially coming in September. Meanwhile, the FBI has issued a major warning about crypto-scammers and the safety of user's funds.

Major companies like Microsoft and Intel have recently reported lower-than-expected Q2 results, and news that Buffet has gutted his Apple stocks has further rattled the tech industry.

Geo-politics is certainly stoking the market fear, with everyone awaiting the Iranian response to Israel, with some saying retaliatory attacks could begin as early as today.

Stability is not helped by the fact that the U.S. presidential election has turned into something of a "crypto election," with Trump coming out bullish on the industry and the potential Harris administration looking to stay the current regulatory-focussed course. It is interesting to note that Trump's personal crypto portfolio is down by around 80% as all the gifted meme-coins have plummeted in value.

There is, however, one positive amidst the chaos. Bitcoin's dominance in the crypto market surged to 58% during the fall, reaching its highest level in a year, as altcoins suffered more severe losses. Solana (SOL), a leading Layer-1 network, has been the most affected among the top 10 cryptocurrencies by market cap, falling 30.6% since July 30. Ethereum's decline has been particularly notable due to the impact on numerous other tokens and ecosystems built on its network.