Governance attacks on DAOs are becoming more common, especially as whales increasingly use their weight to push decisions through community votes. We have already seen this happen in big DeFi projects like Compound and PancakeSwap.

In the past, most of these power plays happened behind closed doors—tight-knit groups with deep ties to projects negotiated deals in private, influencing votes without much visibility. But now, Lobby Finance is trying to take that same idea and turn it into an open business. Basically, it is formalized DAO lobbying—and it could take governance manipulation to a whole new level.

LobbyFi created a marketplace where governance token holders can rent out their voting power in exchange for money. It is simple: you delegate your votes to LobbyFi, and they put them up for sale. Buyers can either bid in auctions or go with a quick Instant Buy. After the vote, rewards are split based on how much voting power each person contributed.

Notably, the process is fully non-custodial. You never give up ownership of your tokens—they stay in your wallet. You are just delegating voting power, not transferring funds.

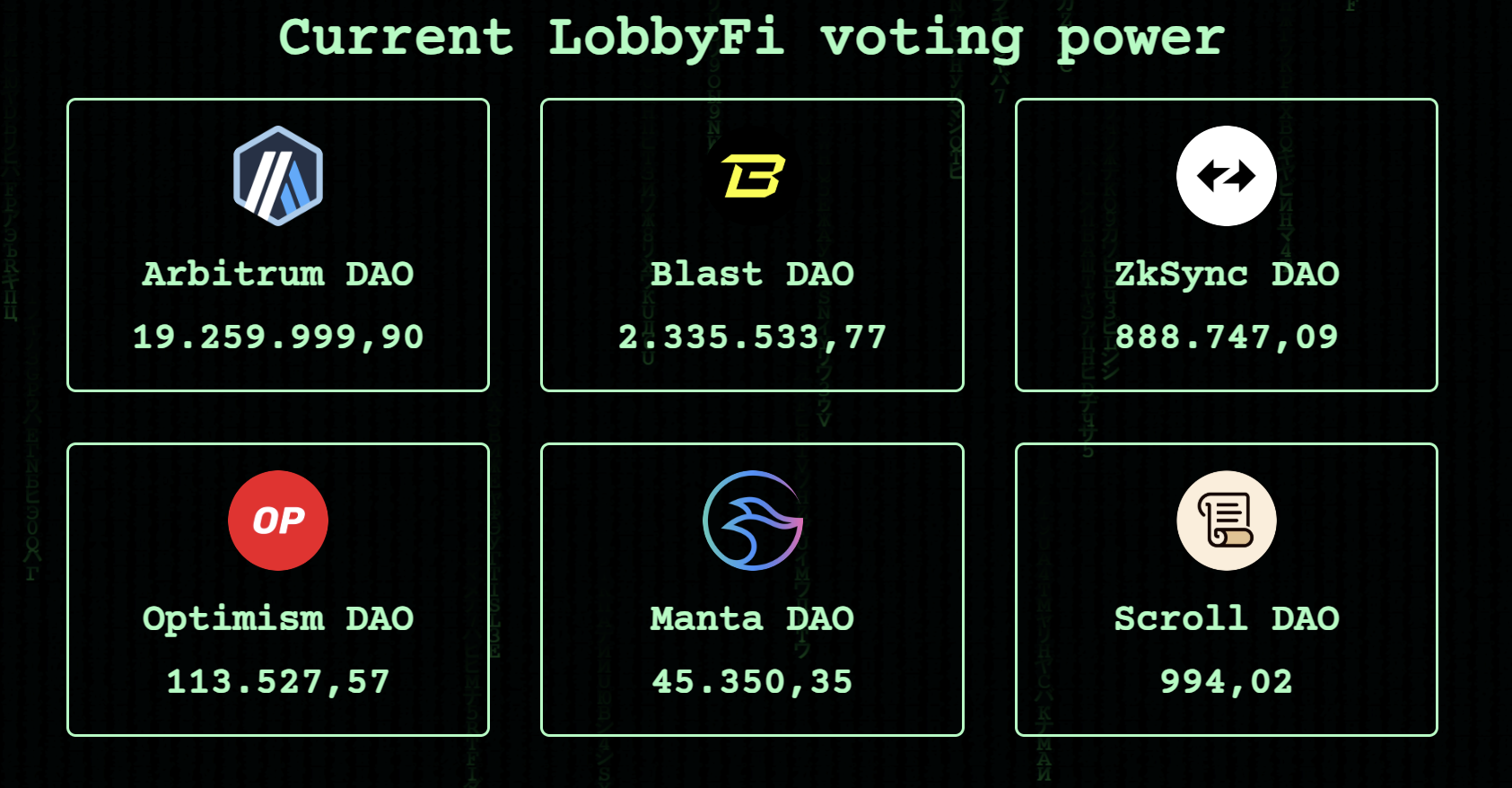

The protocol currently supports six EVM chains, and it has already made some waves. On certain chains, LobbyFi has helped buyers gain access to millions of dollars worth of voting power.

For example, on Arbitrum, someone managed to grab around 20.1 million votes (worth ~$5.8M) for just 0.0652 ETH (around 100 USD). In other cases, users picked up around 1 million ARB votes for less than $20. In fact, LobbyFi has sometimes outgunned major DAO delegates like Wintermute and L2Beat in terms of raw voting power.

Now the Arbitrum DAO is facing a real debate: Should vote-buying be banned, or is it just the new reality of DAO governance?

Yes, services like LobbyFi can lower the cost of governance attacks. But they also wake up dormant voting power—tokens that otherwise would not be used at all. That kind of activation might not be a bad thing.

Trying to censor vote-buying by deny-listing some votes, will only force these platforms into doing it in a much more obfuscated way, that will be way more difficult to track.

From Lobby Finance’s perspective, the goal is not to harm projects but to increase participation and transparency. The protocol has implemented safeguards to automatically disable participation in proposals that primarily benefit specific individuals or entities, rather than the broader community.

Example: A proposal aims to transfer a retrospective airdrop that benefits a single wallet. The auction is deactivated. The individual doesn't purchase enough votes via instant buy. LobbyFi automatically votes against the proposal.

In short, we are entering a new era of DAO governance—one shaped by difficult questions and complex trade-offs. As this landscape evolves, DAOs will be forced to decide: should they lean into full cypherpunk decentralization, or adopt stricter controls that limit how users can vote in order to protect the system?