When the Real World And DeFi Converge

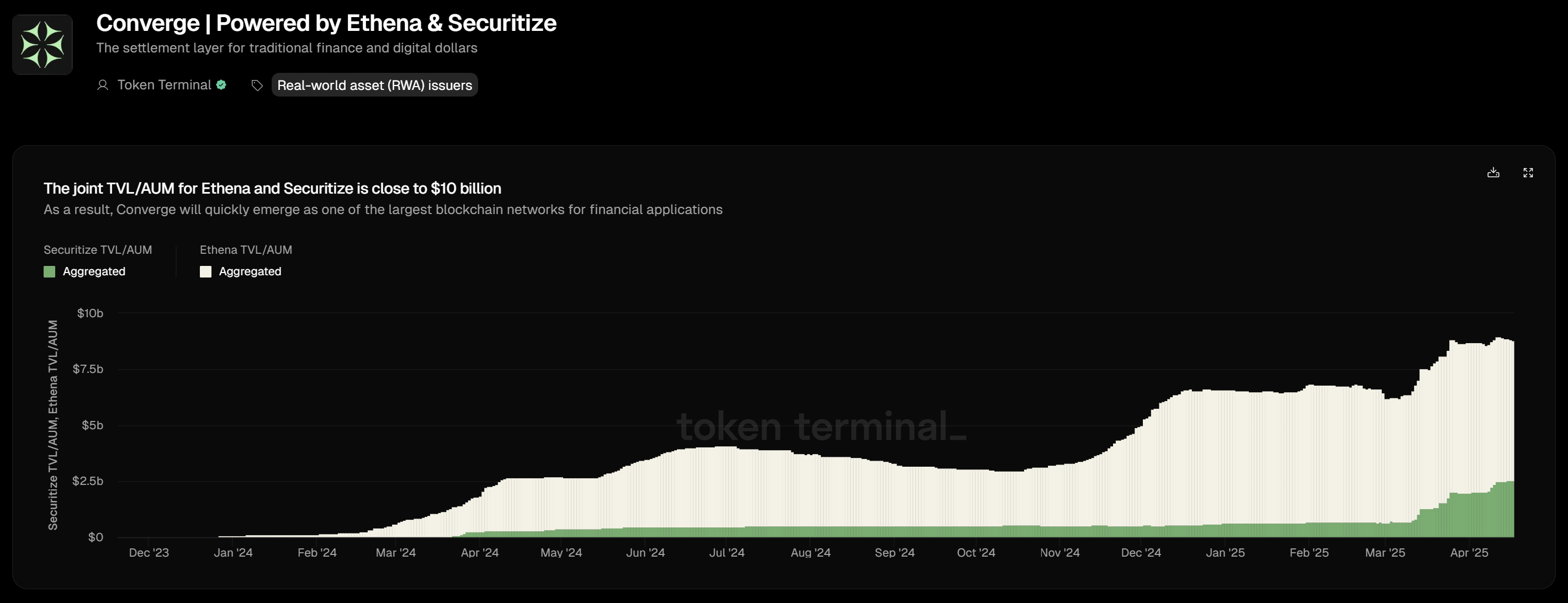

Ethena and Securitize unveil a new blockchain for Real-World Assets (RWA) and digital money. The new chain will be optimized for launching both permissionless and permissioned RWA applications, leveraging Arbitrum’s tech stack and Celestia for data availability.