While Trump's inauguration pushed Bitcoin's price above the $100,000 psychological mark, its position is fragile.

Crypto's number one token has had a disappointing performance during holidays, which has pushed many small and short-term traders away from the market while attracting institutional investors to buy the dip.

But, who was the most optimistic or well-informed, and who could not follow the HODL mantra?

The changes in the supply side of Bitcoin are a by-product of its increasing adoption by traditional investors, which kicked off when Bitcoin spot exchange-traded funds were approved in the United States one year ago and accelerated following Donald Trump's ( “the first Bitcoin president”) victory in the country’s national elections on November 5.

The shift in the composition of Bitcoin buyers led to a sinking of Bitcoin reserves on exchanges and daily trading volume, which prevented the asset’s price from breaking through the resistance and support levels until January 17.

Who Was NOT Buying The Dip?

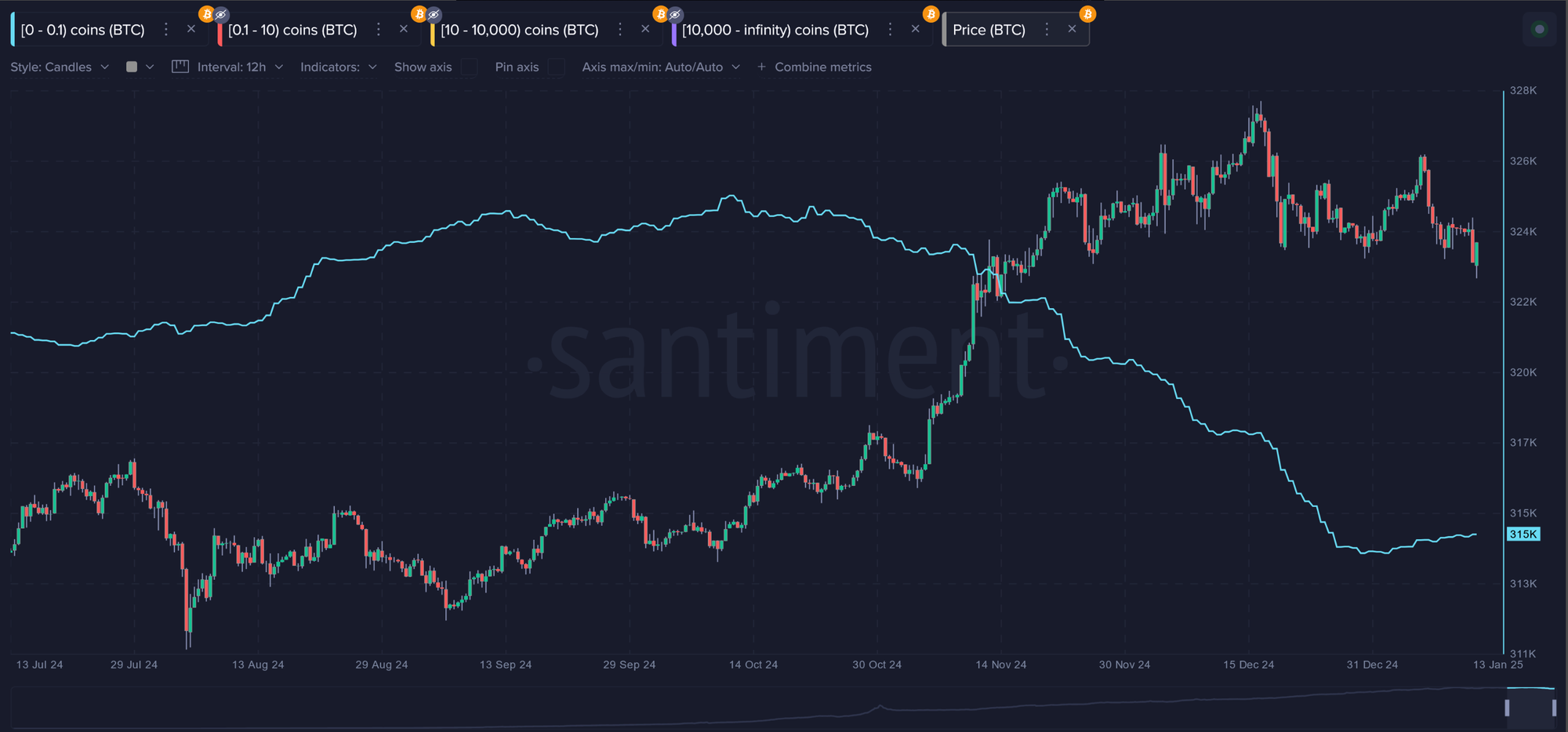

"There has been some small effort to buy the dip,” read a report on Bitcoin's supply distribution by Sentiment regarding the recent behavior of small Bitcoin holders (wallets with 0 to 0.1 BTC) before continuing.

The situation with the wallets holding from 0.1 to 1 has been similar.

These two groups have sold their assets “in the heat of the rally” to bigger fish and have been slow in retrieving them due to the asset's discouraging price performance during the holiday season.

According to the intelligence firm, “the main beneficiaries of the last bull rally were these 10 - 10,000 BTC wallets,” which kept accumulating while the smaller players panicked and sold.

While their purchases have slowed down slightly since the start of the year, “their confidence is pointing in the right direction.”

Analyzing the time periods for holding Bitcoin, market intelligence platform Into The Block concluded that short-term traders were holding the least amount of BTC since the post-election price rush, suggesting a decrease in speculative investment alongside fewer market newcomers.

Who Was Buying The Dip?

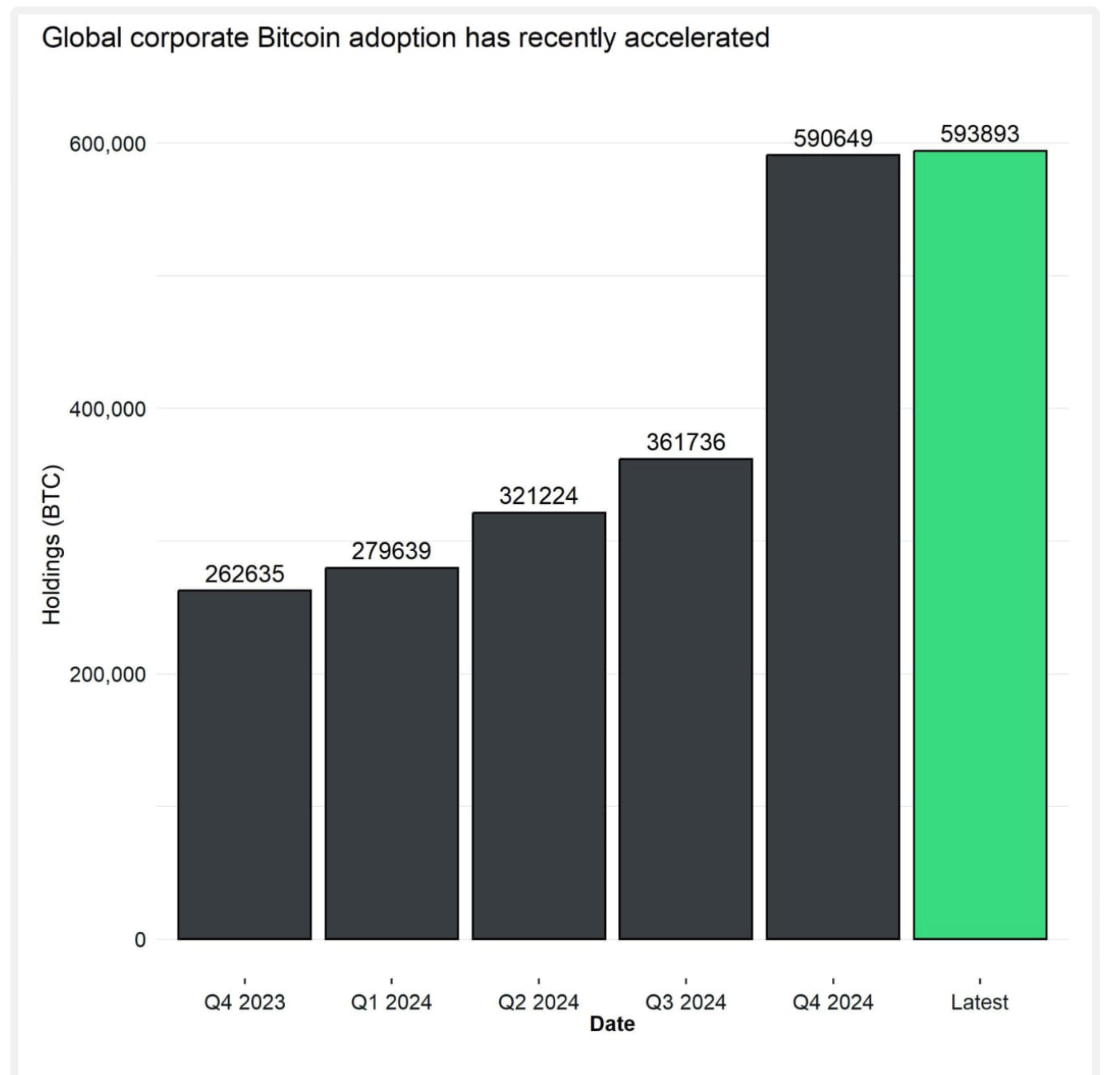

A January 14th report by crypto fund manager Bitwise, authored by its Head of Research in Europe, André Dragosch, shows that public and private companies have been “acquiring Bitcoin as a store-of-value quite aggressively.”

While institutions joined the party later, they came in full force: in 2024, corporations bought more than 50% of Bitcoin that was mined.

So far this year, the high institutional demand continues.

While holdings of all companies together account for only 4% of all BTC, “they are one of the fastest growing entities with respect to overall Bitcoin holdings.”

On January 12, Michael Saylor announced that his company Microstrategy, by far the most notable corporative holder of Bitcoin, acquired $243 million worth of BTC at an average price of $95,972.

Several other Wall Street companies were also buying the dip. On January 13, for example, Medical technology company Semler Scientific informed the public that it had purchased 237 bitcoins for $23.3 million, bringing its total BTC reverses to 2,321.

Besides corporations, hedge funds and traditional finance companies were also buying Bitcoin, as are asset managers who offer BTC exchange-traded products increase and have to have enough BTC to cover demand.

BLACKROCK BOUGHT BTC

— Arkham (@arkham) January 15, 2025

MICROSTRATEGY BOUGHT BTC

LARGEST BANK IN ITALY BOUGHT BTC

Did you sell them your coins? pic.twitter.com/D81KSw0wIG

To Buy Or Not To Buy?

Frank Corva, a veteran Bitcoin trader, wrote in Bitcoin Maganize advising fellow individual investors not to buy the dip: “ I like to buy bitcoin when it’s truly selling at a discount, not just when it appears to be selling at one.”

According to him, while for those used to traditional finance, an asset trading at less than 10% of its ATH might be considered at a discount, for Bitcoin holders, this is just “hardly more than a daily fluctuation.”

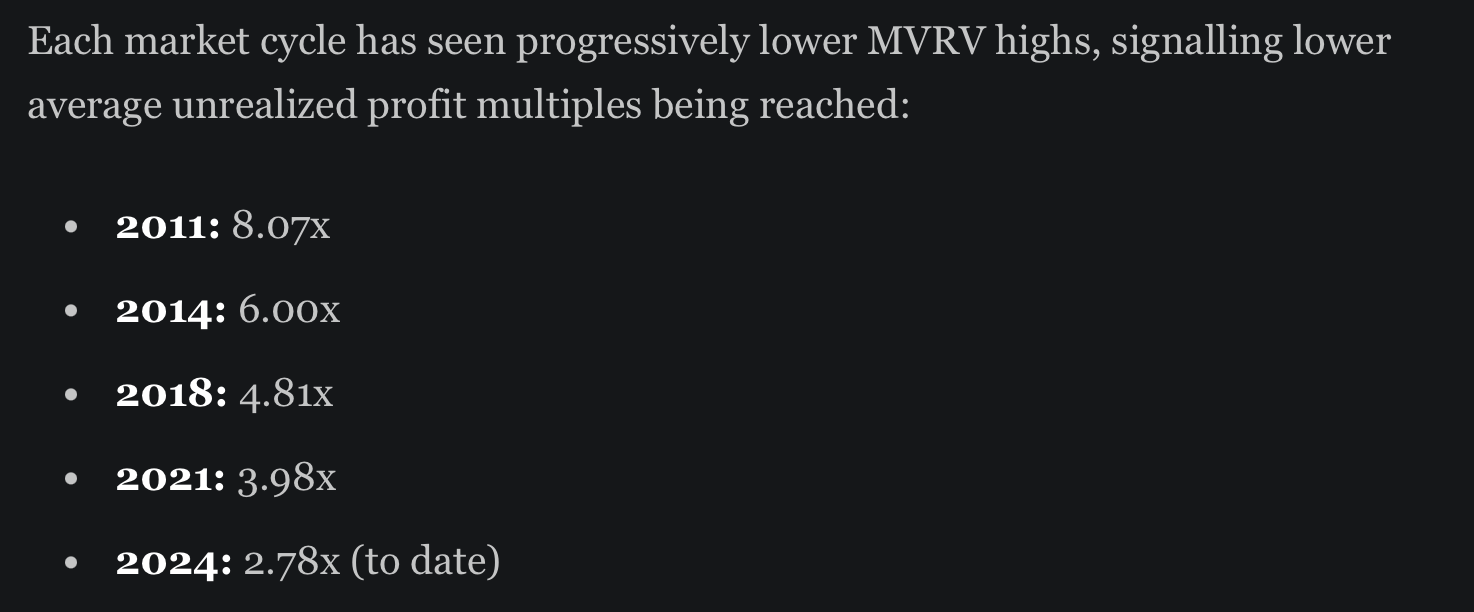

Data from the blockchain data company Glassnode contradicts Corva.

A report published by the analysts showed that stress levels were much more modest than they were during previous dips.

Bitcoin MVRV Ratio is the ratio between the spot price and the realized price - the weighted average price of the bitcoins at their last transaction date. It has been decreasing throughout the years according to data from Glassnode.

This “gradual reduction in volatility and speculative intensity” is a sign of market maturity and increased efficiency, which is unlikely to go away now that institutional investors have started purchasing the asset for keeps.