As Bitcoin’s price hovers around its all-time high, the Crypto Twitter community is discussing possible long-term problems the network might face if it continues on its current path. It has become apparent that Bitcoin’s current development trajectory may not make its long-term sustainability plan realistic.

For those unfamiliar with Bitcoin’s security model, it largely depends on miners who validate transactions and add blocks to the blockchain, receiving rewards in return. Currently, miners earn 3.125 BTC per mined block, which comes from supply inflation. Additionally, they receive transaction fees from the transactions included in the block.

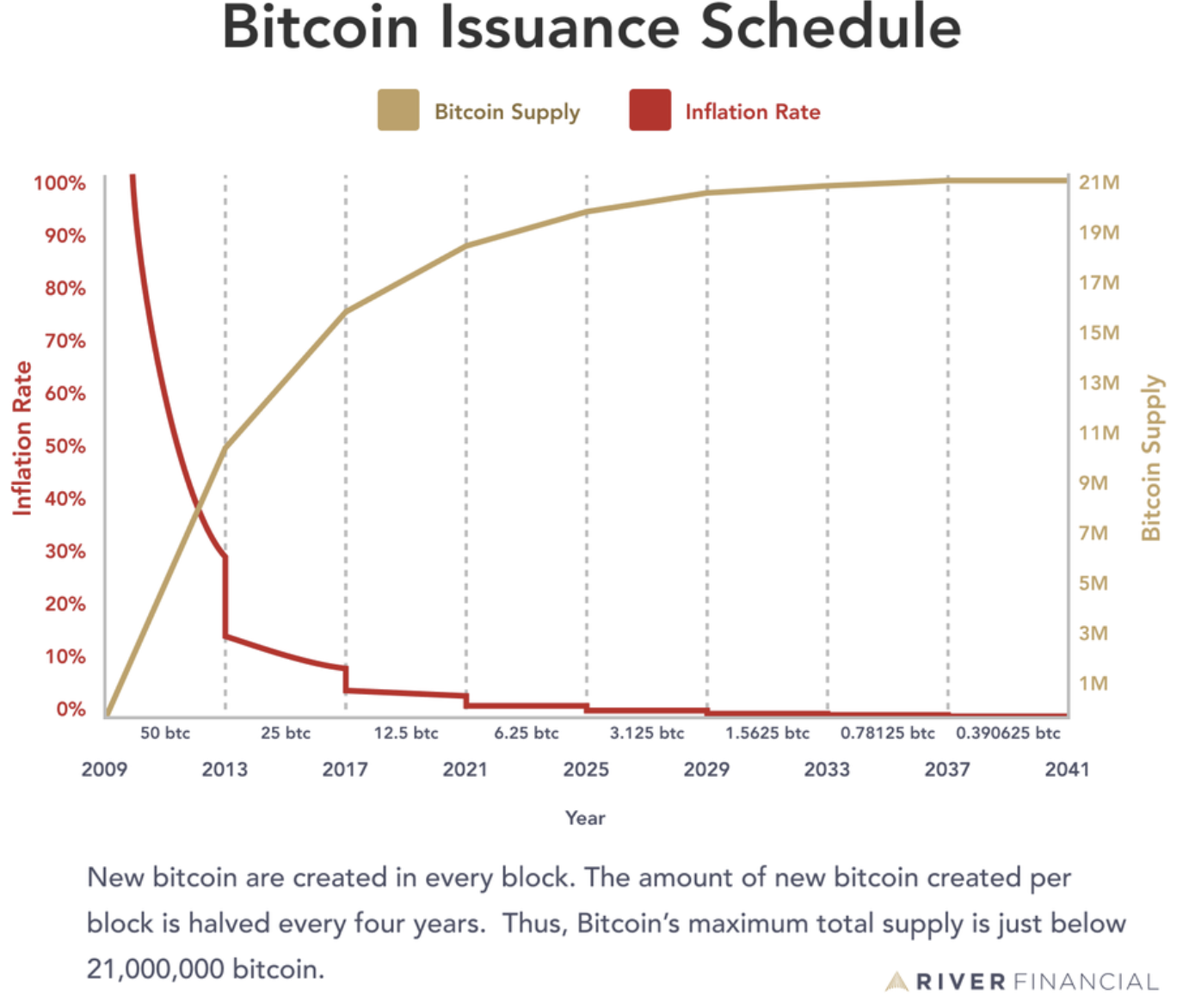

However, the Bitcoin protocol includes a “halving” mechanism where block rewards are halved approximately every four years. The latest halving occurred in 2024, and the next is expected in 2028. For example, the 2024 halving reduced the block reward from 6.25 BTC to 3.125 BTC per block.

Further, according to the Bitcoin whitepaper, the final halving, which is expected to occur around 2140, will stop further issue of the coins. The number of Bitcoins in circulation will reach its maximum supply of 21 million and miners will receive no more reward from closing the block.

So, if the rewards in Bitcoins are decreasing, how will miners be incentivized? Satoshi’s vision was that as block rewards diminish, Bitcoin transaction fees would take over as the primary incentive, and miners would be motivated by the fees generated by the network.

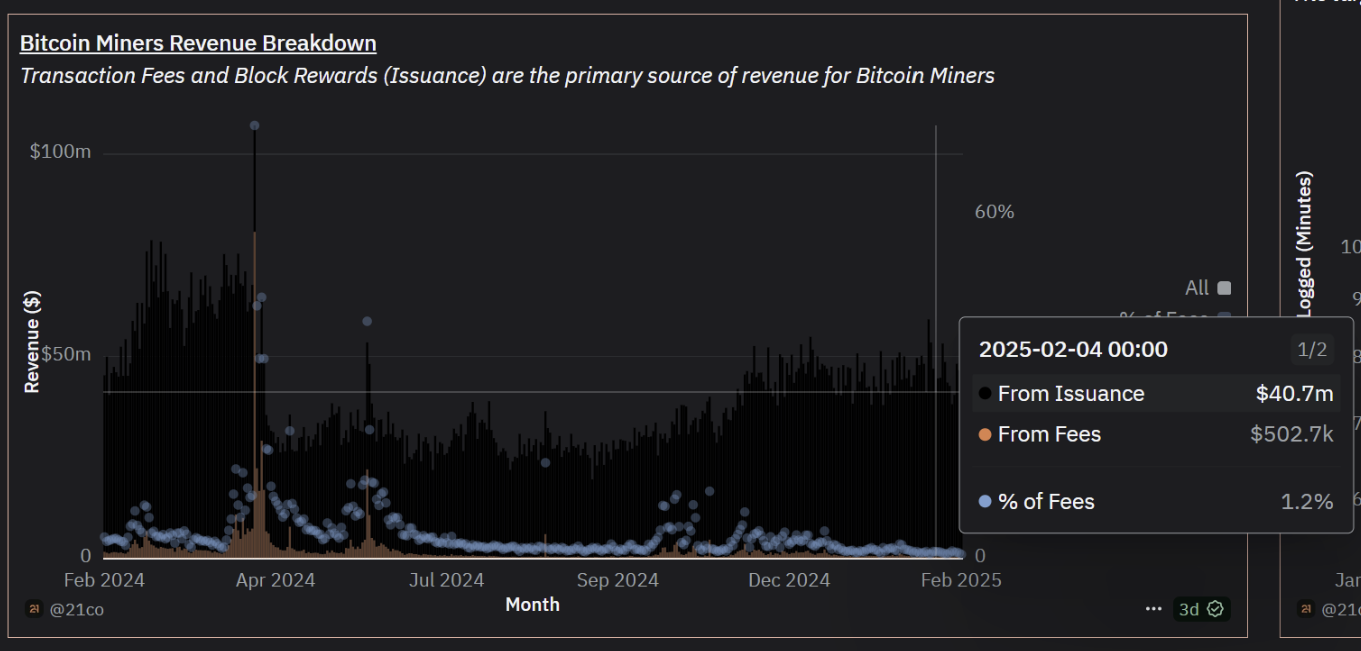

However, this is where the problem lies. It appears that people are not using Bitcoin extensively for transactions, and at the current stage of Bitcoin’s development, network transactions alone may not be sufficient to cover miners’ expenses to secure the network.

Bitcoin blocks are often not fully utilized; we are not seeing a high volume of on-chain transactions anymore.

Here we go again. Close to empty blocks on the Bitcoin Blockchain. 👀 pic.twitter.com/czESWOLGq5

— freedom🇨🇦 (@freedom19462) February 8, 2025

According to Dune Analytics, on an average day right now, transaction fees comprise only around 1% of miners’ revenue. Imagine what would happen if we removed all the block rewards—the mining industry could collapse and might not be able to sustain the security of the network.

Why Are There Less Transactions On Bitcoin Blockchain?

There are several reasons behind this, one of the main ones being the shift in Bitcoin’s original vision of peer-to-peer electronic cash to its current use as a speculative trading asset.

Users around the world are actively trading Bitcoin, yet BTC doesn't necessarily change hands. Most of the trades happen in centralized crypto exchanges, where BTC moves only during deposits and withdrawals.

With the emergence of ETFs, trading volumes in the institutional segment have increased. However, here too, the coins are stored in custody and not actively moved while the derivative instruments are being traded. Without derivatives, trading physical BTC at the same scale as it is now would be impractical.

Given the Bitcoin network's limited throughput, its current positioning is quite logical. With the emergence of large smart contract networks, Bitcoin has lost some of its competitive edge in the money transfer niche to other chains. For everyday transactions, we often choose to use stablecoins like USDT or USDC on various much faster and cheaper chains rather than Bitcoin.

Many teams are currently attempting to solve Bitcoin’s network throughput issues with various constructs, such as the Lighting Network and other Layer 2 chains. However, many of these sidechains have a parasitic rather than a symbiotic relationship with Bitcoin. They drain liquidity from the network without providing much in return.

Does Bitcoin Need A Change?

The community and experts discuss various theoretical scenarios to address the issue. Those range from a complete rewriting of the Bitcoin concepts, such as the introduction of perpetual inflation (mining more bitcoin for rewards) and fixed nodes (centralization), to less radical ideas, such as higher transaction fees.

Bitcoin maximalists suggest adding more use cases, such as Bitcoin-based NFTs and stablecoins, increasing network activity and fees. These people likely overestimate the power of their community and underestimate the competition and market preferences.

Economic simulations also vary: some predict that the decrease in quantity will continue to be compensated by the increase in the price of BTC. It means that price of BTC needs to at least double every 4 years (hello, HODLers). Others argue that the bitcoin price can't go up indefinitely and the mining economy will shrink, decreasing the security and decentralization of the network.

What we observe now is the natural outcome of an experimental solution such as bitcoin blockchain facing real-world problems. The only encouraging factor is that we still have some time before those become critical. Hopefully, the Bitcoin community will come up with a solution by then.