The Bank of New York Mellon intends to securely hold the Bitcoin and Ether deposited under the trending Exchange Traded Funds (ETFs). This is the first bank officially allowed to bypass the SEC's controversial regulation and enter the profitable crypto custody sector on an equal basis with non-banking organizations, challenging Coinbase's dominance. This exemption might also be applied to other crypto-related ETPs.

What Makes Crypto Custody So Lucrative?

After the approval of Bitcoin and Ethereum ETFs, the crypto custody market has been growing rapidly. Currently, the total amount of assets under management (AUM) of Bitcoin ETFs is over $50 billion, and ETH ETFs AUM has surpassed $5 billion. The numbers are expected to grow. The business is especially lucrative, given that custody providers can charge higher fees for safeguarding risky crypto than traditional assets.

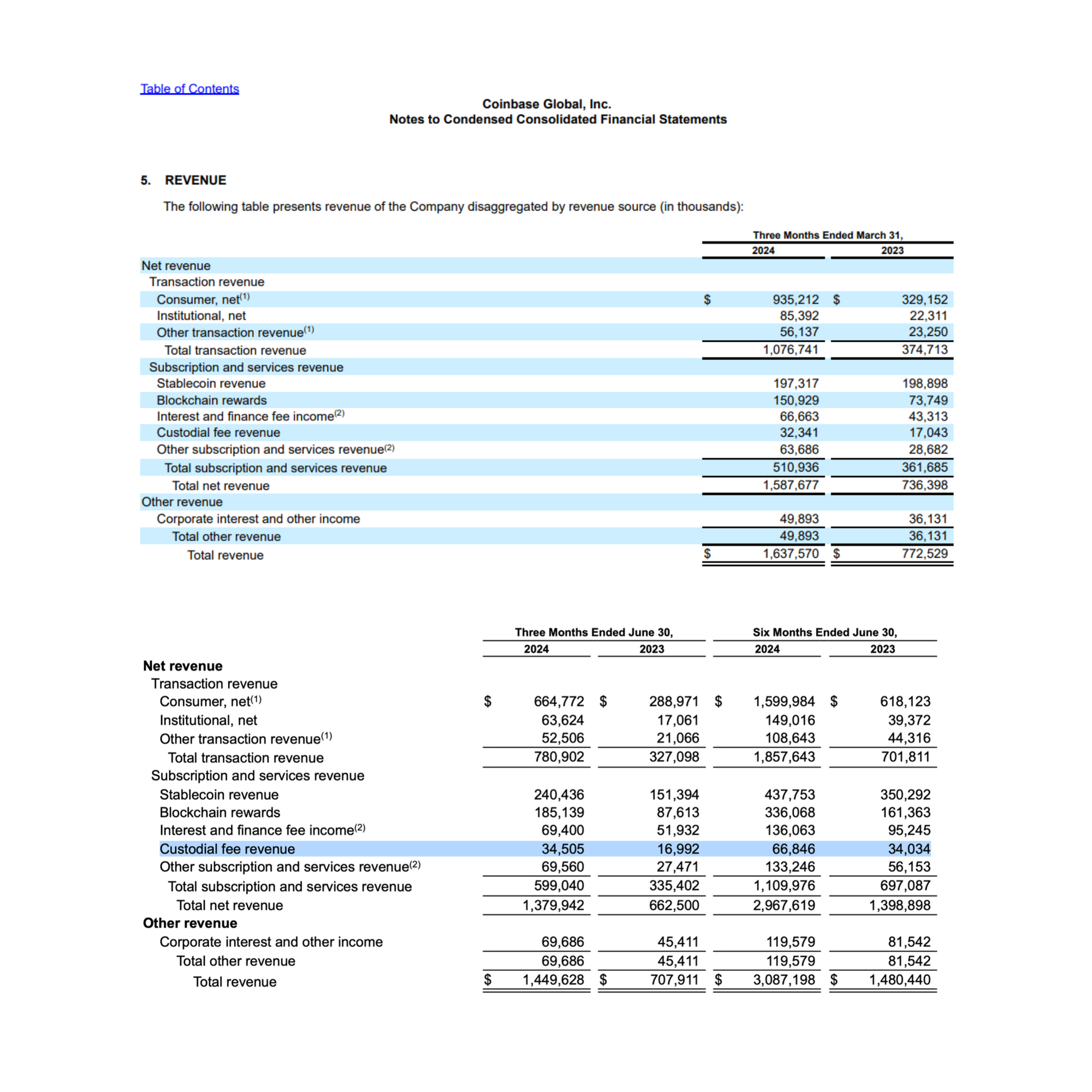

Now, the major U.S. ETF custodian is Coinbase Global Inc., which, according to its CEO, managed 90% of the Bitcoin ETF assets in Q4 2023 and apparently remains the leader. The company is gaining notable revenues from the custodial business, which doubled compared to last year.

What Kept U.S. Banks From Providing Crypto Custody Services?

The problem dates back to 2022, when the SEC issued Staff Accounting Bulletin 121, a statement that, despite its bland name, has huge ramifications for crypto custodians.

Normally, custodians do not reflect clients' assets under custody on their balance sheets because they legally belong to the customers, not the 'holder.' However, SAB 121 requires publicly listed custodians to list digital assets they hold for customers on their balance sheets to show potential risks and, in general, treat these cryptocurrencies as part of their own financial liabilities.

"As long as Entity A is responsible for safeguarding the crypto-assets held for its platform users, including maintaining the cryptographic key information necessary to access the crypto-assets, the staff believes that Entity A should present a liability on its balance sheet to reflect its obligation to safeguard the crypto-assets held for its platform users," - SAB 121.

If assets are held on the balance sheet, banking organizations are obliged under federal regulation to hold reserves to back risky assets and to cover potential losses in case of instability. That makes crypto asset custody unprofitable for the banks.

What Have Banks Been Doing To Overturn the Rule?

In February this year, the U.S. commercial banks requested that the SEC modify SAB 121. The request specifically outlined that various non-banking organizations have not suffered from this rule and continue providing custody services, avoiding the regulators' oversight. At the same time, banking organizations are prevented from (1) custodying Bitcoin ETPs and (2) engaging in DLT-based projects (even those focused on using DLT to record traditional financial assets).

The banks requested that the definition of “crypto-assets” be narrowed and that banking organizations be exempt from "on-balance sheet treatment," keeping only the requirement to disclose information to investors.

The banks succeeded in lobbying their claim, and two weeks later, the House Financial Services Committee passed a resolution to overturn the rule, even stating that SAB 121 is "one of the most glaring examples of the regulatory overreach that has defined Gary Gensler’s tenure at the SEC." The Senate followed, but President Joe Biden ignored bipartisan support and vetoed the resolution. The House of Representatives attempted to override the veto but failed despite the majority voting against the President's decision.

Although, reportedly, the regulator and the banking sector representatives discussed changing the accounting policy, nothing has changed since then.

How Did BNY Get An Exemption?

The bank has introduced a structure that involves using separate crypto wallets for each client, with each wallet linked to its own bank account, according to Gary Gensler's words. The assets in these wallets would be kept completely separate from the bank’s own assets, meaning the bank can’t mix them. Apparently, the structure could be applied to other products alongside Bitcoin and Ethereum ETFs – if other crypto-related ETFs are approved by U.S. regulators.

The SEC Office of the Chief Accountant agreed that BNY Mellon doesn't have to consider Bitcoin and Ethereum ETFs as part of its own balance sheet, notwithstanding SAB 121. Instead, it will just be responsible for safeguarding the assets for its clients without treating them as its own property or liability, thus reducing financial risk.

“Though the actual consultation related to two crypto assets, the structure itself was not dependent on what the crypto was. It didn’t matter what the crypto was,” - SEC Chair Gary Gensler told Bloomberg News.

Although the SEC agreed that BNY's specific situation with ETPs doesn’t require adding the assets to its balance sheet, the decision doesn’t solve the issue for all banks in all use cases. Gensler shared that several other institutions have discussed potential digital asset custody structures to avoid the bulletin's requirements. Since any other bank with the same idea could also get a 'non-objection', we suggest that others will soon follow BNY's path, making good use of the SEC's more collaborative mood ahead of the presidential election.

The BNY told Bloomberg that it plans to work with regulators on a case-by-case basis to potentially expand its crypto custody services. The bank still needs approval from other prudential regulators before it can offer services related to digital assets. Besides, it might need to request an exemption from New York’s BitLicense.

BNY Mellon, the world’s largest custodial bank by assets, first noted that their clients showed a high demand for digital assets a few years ago. In 2022, BNY Mellon launched its Digital Asset Custody platform and added Bitcoin and Ether to its custodial offerings to select institutional clients, but faced regulatory hurdles due to the SAB 121. Reportedly, the company planned to treat (and account for) crypto similarly to traditional assets. Since then, the company executives repeatedly stated that institutional investors have a strong interest in crypto and that the industry is here to stay.

If other banks follow suit, it seems likely to impact Coinbase's near monopoly. The question remains: can they respond to this new competitive threat?