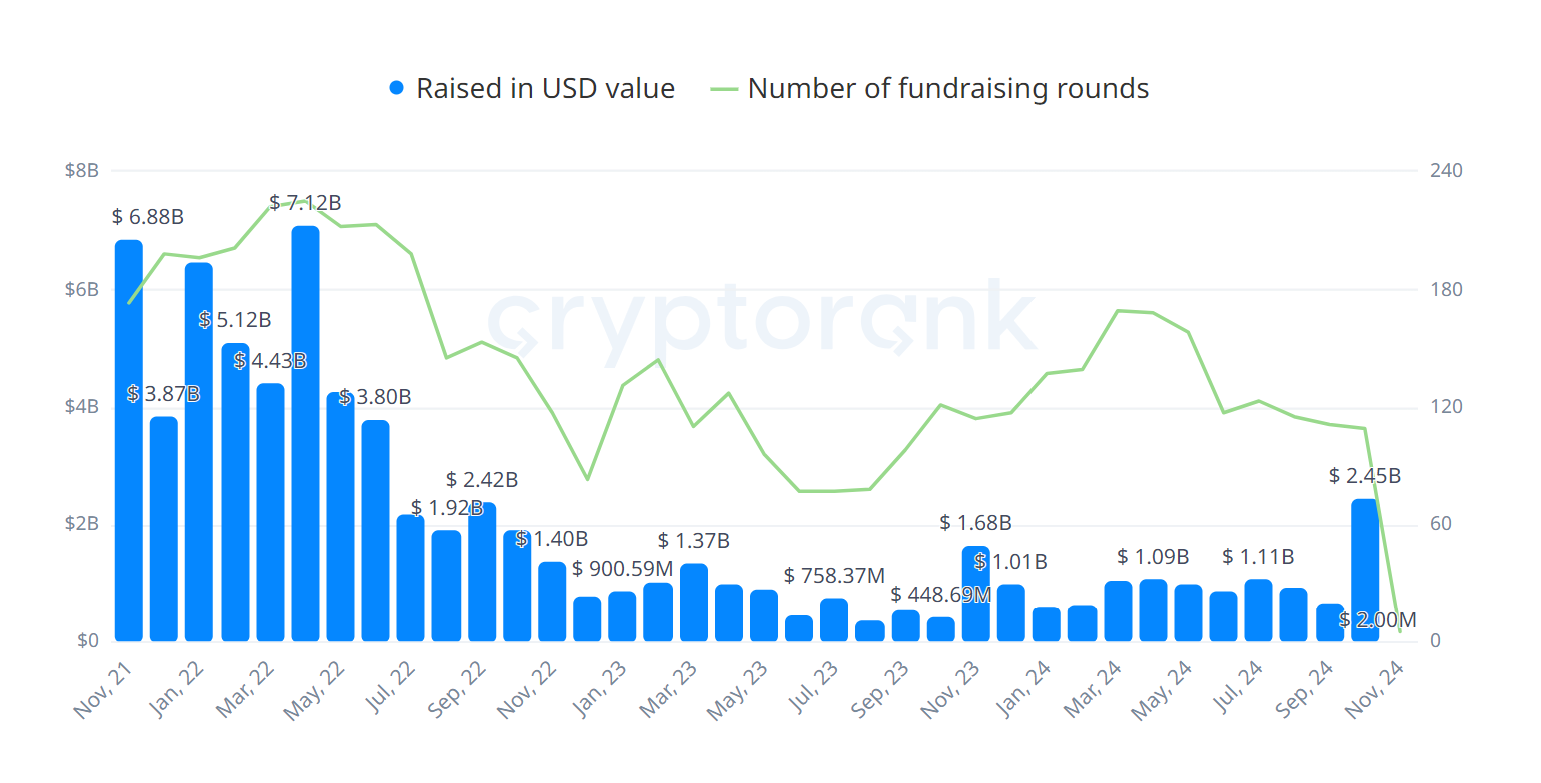

With the recent surge in Bitcoin prices, venture capital firms have accelerated their investments in cryptocurrency startups. Last month marked the highest level of crypto investments since September 2022, with VCs pouring over $2.5 billion into the sector—more than double the monthly average of around $1 billion seen over the past year.

In 2023 and the early part of 2024, startup funding plummeted dramatically compared to 2022. Until last month, there were no signs of recovery despite bullish Bitcoin prices, as funding trends appear to closely align with altcoin performance, which has lagged behind Bitcoin.

Some of the most active investors last month included Animoca Brands, CMS Holdings, Andreessen Horowitz (a16z), Hack VC, and HashKey Capital. Animoca Brands, in particular, completed 11 deals over the course of one month and has emerged as the most active investor this year, with nearly 100 deals. The company has billions to invest and seems to be employing a “spray and pray” investment strategy. Among its significant investments in October were zkPass, which aims to bring private data on-chain, and Gelato, a rollup-as-a-service platform.

It is important to remember that Animoca Brands was an early investor in several legendary crypto ventures, such as OpenSea, Dapper Labs, Yield Guild Games, Star Atlas, and Axie Infinity. So, the strategy seems to be working.

Interestingly, other large funds, such as Paradigm, were less active in October. Paradigm completed only two investments, one of which was in Ithaca, a Layer 2 solution that incorporates elements from the future of Ethereum's roadmap that no other team has built yet.

Regarding investment sectors, DeFi remains a popular choice. Although DeFi tokens have underperformed over the past several years, investors seem convinced that DeFi represents a vital use case for crypto.

Other favored categories include Blockchain Infrastructure and Blockchain Services, with investors continuing to pour money into these areas. Interestingly, blockchain gaming has been one of the least popular sectors, and the “play-to-earn” narrative seems to have lost its appeal among crypto investors.

Geographically, the US remains the hub for crypto startups, followed by Europe and Asia. This trend is also relevant for startups outside the crypto space.

Due to market stagnation, recent years have been challenging for crypto VCs. Finding suitable investment projects is difficult, valuations are high, exiting old projects poses challenges, and the secondary market for altcoins suffers from a lack of liquidity.

As altcoins underperform, new funds, particularly, face difficulties in raising additional rounds due to poor investment performance. For large funds, things are a bit less challenging, as they have more funds to deploy and fewer problems accessing capital. That is why giants like Animoca Brands and a16z continue to invest actively.

With Bitcoin hitting new all-time highs, there is hope that an altcoin rally might soon occur, spurring more investments in the crypto sector.