Wormhole is gearing up for its $W token launch, with a pre-market price around $1.5, setting it up to become the largest bridge in terms of market capitalization. With a planned circulating supply of 1.8 billion tokens, this would place Wormhole’s market cap at around $2.7 billion, and a fully diluted valuation (FDV) at $15 billion.

Despite its impressive financial metrics, Wormhole’s adoption rates trail behind several other bridge projects that also feature their own tokens, yet are valued much lower, some by more than ten times. This raises the question of Wormhole’s potential overvaluation.

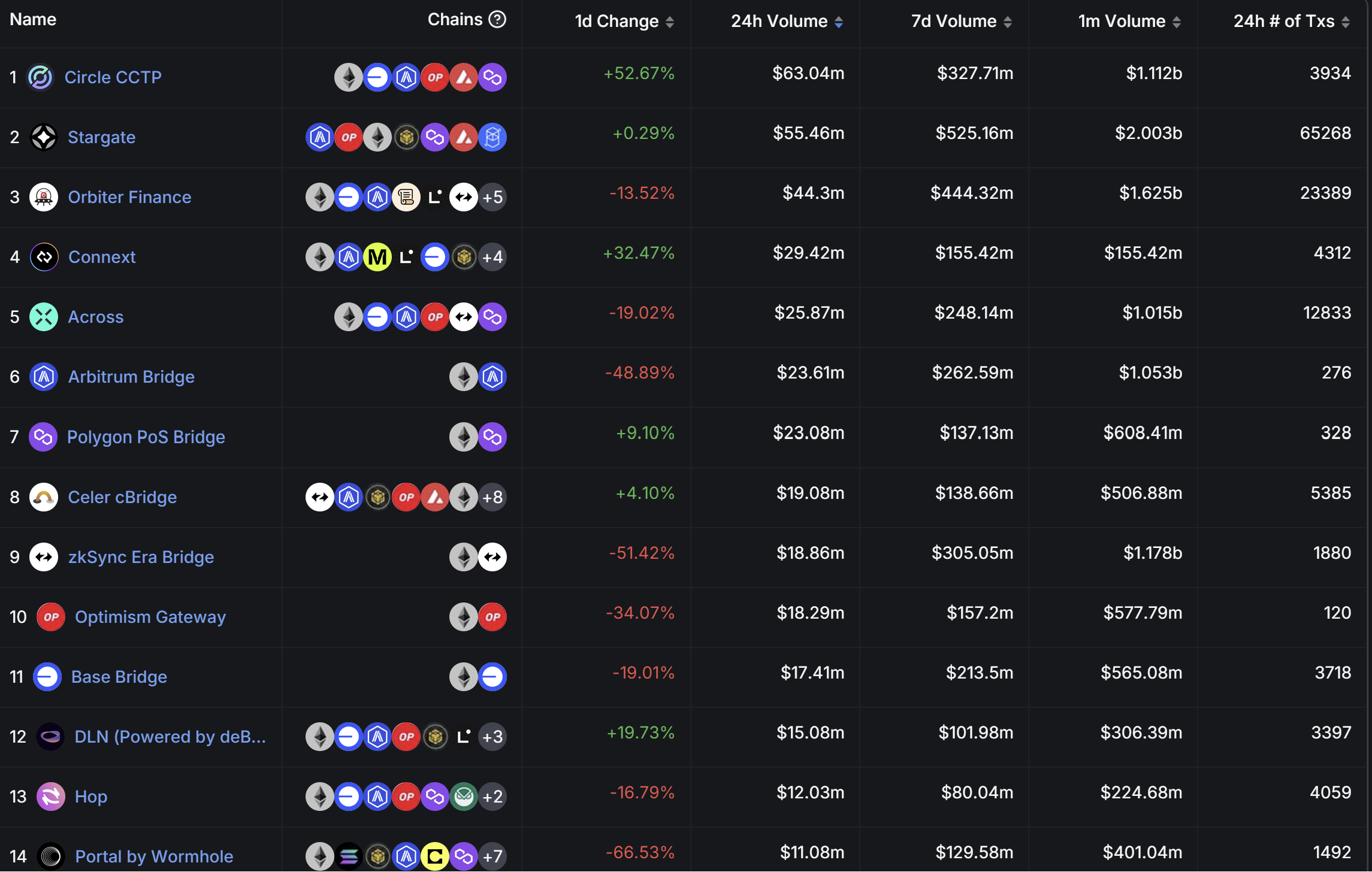

According to the latest data from Defillama, the 24-hour transaction volume across all bridges stands at approximately $444 million, with Wormhole contributing around $11 million or about 2% of this total. This doesn’t even place Wormhole in the top 10 by bridging volume.

In the table below, Defillama’s statistics includes bridges launched by Layer 2 networks such as Arbitrum, Polygon, and Optimism. However, our focus is on general-purpose bridges and their valuation compared to Wormhole.

Notable projects like Stargate Finance (market cap: $146 million), Connext (market cap: $25 million), Across Protocol ($92 million), and Celer ($168 million) all boast significantly higher daily volumes. However, they all trade at significantly lower valuations.

While this may sound irrational, given that it is a cryptocurrency market, it is not surprising at all.

This market often operates under its own unique rules, where traditional logic may not apply. Valuations can be more influenced by attention from influencers, investment funds, and others looking to profit, rather than fundamental factors. Wormhole has garnered significant attention at just the right time, especially as a key bridge for the Solana ecosystem, which is currently in the spotlight.

For Wormhole and its investors, now might appear to be the ideal moment to launch the token, as evidenced by the current valuation. In its latest funding round, the project raised $225 million, at a valuation of $2.5 billion, with contributions from Coinbase Ventures, and Multicoin Capital, among others. In rough estimates, the current valuation could potentially offer investors a minimum 6x return, based on the FDV, without considering the vesting schedule.

Yet, the necessity of the token within this ecosystem is up for debate. Currently, it offers governance functionalities—a feature common among many DeFi projects, such as Uniswap’s UNI and Aave’s AAVE tokens, which serve similar “governance” purposes.

However, having only governance features does not provide much utility, and since users won’t need the token to use the product, the token’s value capture will be quite small. However, this is not just a problem for Wormhole; it is a challenge shared by around 90% of other crypto projects in the space.

Still, when it comes to the future, we wouldn’t attempt to predict the price of the $W token. While it may seem overvalued, it is worth noting that the market can remain irrational for longer than one can stay solvent. We will continue to Observe.