The Fed published long expected guidelines that makes it theoretically possible to connect cryptobanks to the US banking system, no timing set.

The US’s only digital asset bank license, a.k.a. Wyoming Special Purpose Depositary Institution (SPDI) charter was created in 2019. The amendments to the state laws and regulations have been effective since July 2021 and, as of the end of 2021, four charters have been already issued. Among them are Kraken, Caitlin Long’s Custodia Bank, and less known Commercium financial and Wyoming Deposit and Transfer.

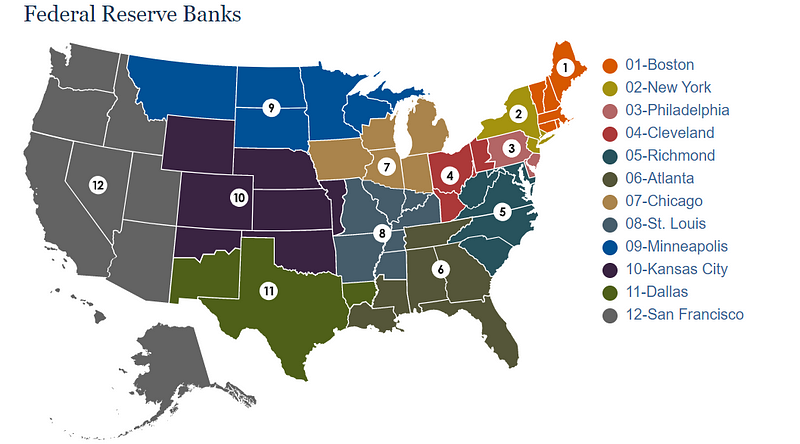

The charter allows the operation of digital assets along with fiat currencies, much like regular banks, but SPDI is not allowed to lend and is required to keep 100% reserves for assets under its custody. However, the latter exempts them from the Federal Deposit Insurance Corporation (FDIC) requirements. To connect with the US banking infrastructure, banks need a Routing number issued by ABA that in turn, requires a “Master account” with the Federal reserve bank. The Kansas City Fed, that covers Wyoming state, was delaying opening such accounts.

One of the SPDI, Custodia Bank, filled a complaint against the Fed and the Reserve Bank of Kansas City for “unlawful delays”. The issue was even raised on the reappointment of Chair Jerome Powel during a Senate hearing in January. Responding to Sen. Cynthia Lummis comments about unfair treatment of SPDI, he explained that they are taking their time because of precedential nature of this decision: “…we start granting these, there will be a couple hundred of them pretty quickly and we have to think about the broader safety and soundness implications,”

Nevertheless, Jerome Powel was reappointed for his second term in May 2022 and in the same month Fed issued guidelines that “establish a transparent, risk-based, and consistent set of factors for Reserve Banks to use in reviewing requests to access Federal Reserve accounts and payment services.”

The guidelines include a 3-tiered review process — the third, most stringent one is for “novel charter” applicants that have neither FDIC nor Federal level supervision. The only current example of such charter is SPDI.

The discussion part includes an interesting comment about “mix of banking and commercial activities” that, historically, were strictly separate in the United States. In 1999 the prohibitions were lifted for insurance and securities underwriting. Current fintech trends further blur the lines between the banking and commercial activities and this was considered as a “back door” for commercial companies to enter the banking system. Judging from the Board response to this comment, the applications will be reviewed from this specific perspective too.

Also importantly, the guidelines did not set any deadline or timeframe for review period of applications. Some expectations of accelerated review of SPDIs (sometimes pronounced “speedies”) were not realized. Let’s observe how long it will take the Fed to issue the first account access to them.